Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

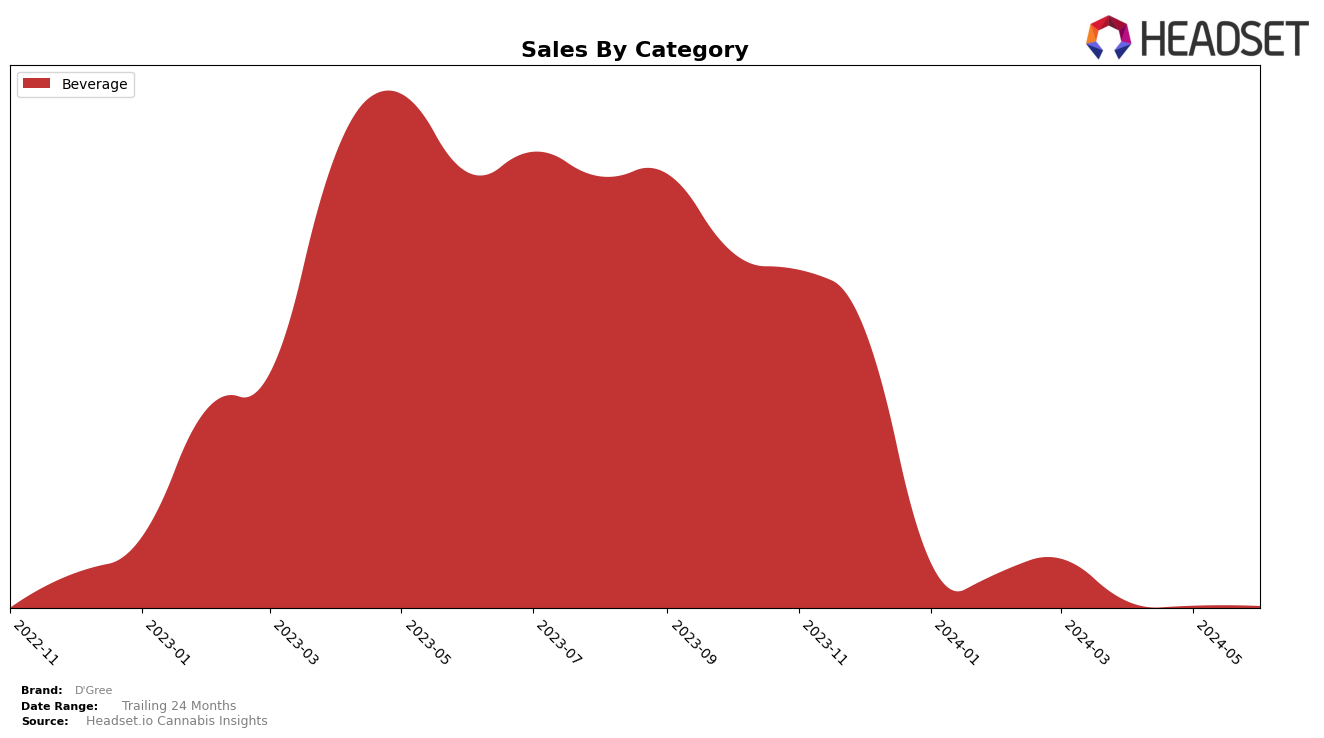

D'Gree's performance across various states and categories has shown significant variability, highlighting both strengths and areas for improvement. In Ontario, the brand has struggled to break into the top 30 in the Beverage category, with a rank of 32 in March 2024. This indicates that while D'Gree has a presence in the market, it is not yet competitive enough to secure a top spot. The absence of rankings in subsequent months suggests that the brand's performance did not improve, potentially indicating a need for strategic adjustments in marketing or product offerings to better capture consumer interest in Ontario's competitive landscape.

In contrast, D'Gree has shown more promising trends in other regions and categories, although specific ranking details are not provided. This mixed performance across different markets suggests that the brand may be more successful in certain niches or geographic areas. For instance, if D'Gree were to focus on markets where it has shown upward momentum, it could capitalize on existing strengths and potentially replicate successful strategies in underperforming regions like Ontario. Monitoring these trends will be crucial for D'Gree as it seeks to establish a more robust presence across diverse markets and product categories.

Competitive Landscape

In the competitive landscape of the beverage category in Ontario, D'Gree has faced significant challenges in maintaining its rank and sales. Notably, D'Gree was ranked 32nd in March 2024 but did not appear in the top 20 in subsequent months, indicating a struggle to sustain its market position. In contrast, Tweed consistently held a higher rank, moving from 9th in March 2024 to 11th in May 2024, before dropping out of the top 20 in June 2024. This suggests that while Tweed experienced a slight decline, it still maintained a stronger presence compared to D'Gree. Additionally, Proper Cannabis Company showed fluctuating ranks, being 31st in March 2024, dropping out in May 2024, and reappearing at 32nd in June 2024. These trends highlight the competitive volatility in the Ontario beverage market, with D'Gree needing to strategize effectively to improve its rank and sales amidst strong competition.

Notable Products

In June 2024, the top-performing product from D'Gree was Iconic-C Classic Tomato Sparkling Beverage (10mg THC, 355ml) in the Beverage category, which climbed to the number one spot with sales of 196 units. Blood Orange Creamsicle Soda (10mg THC, 355ml) dropped to the second position, a notable decline from its consistent first-place rank in the previous three months. The shift indicates a significant change in consumer preference within the Beverage category. Iconic-C Classic Tomato Sparkling Beverage's rise to the top contrasts with its steady second-place ranking from March to May 2024. This change highlights the dynamic nature of product popularity and suggests a potential seasonal or marketing influence.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.