Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

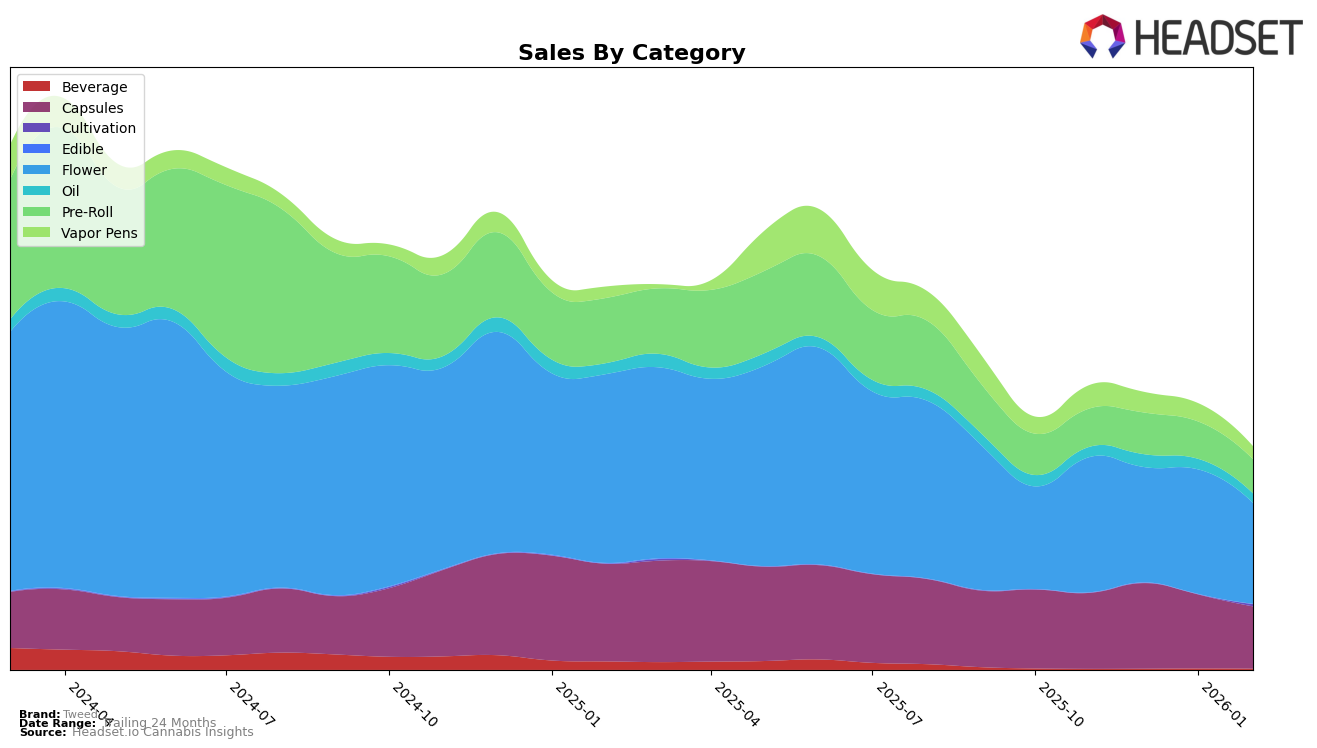

In Alberta, Tweed has shown remarkable consistency in the Capsules category, maintaining the top position from November 2025 through February 2026. This stability is indicative of a strong product offering and customer loyalty in that segment. However, in the Flower category, Tweed experienced some fluctuation, initially ranked at 21st in November 2025, improving to 13th in January 2026, only to drop slightly to 15th by February 2026. This movement suggests a competitive landscape where Tweed is making strides but still faces challenges to secure a top-tier position consistently. The Pre-Roll category saw an upward trend, where Tweed moved from 41st in November 2025 to 29th by February 2026, indicating a positive reception in this product line.

In British Columbia, Tweed's performance in the Flower category has been relatively stable, though slightly declining, moving from 19th in November 2025 to 23rd by February 2026. This indicates a need for strategic efforts to regain momentum. The Pre-Roll and Vapor Pens categories, however, reveal a more challenging scenario. Tweed did not make it into the top 30 in Pre-Rolls after December 2025, and similarly, the Vapor Pens category saw a drop-off in visibility after January 2026. These gaps highlight areas where Tweed could focus on improving market penetration or product differentiation to enhance their competitive standing in British Columbia.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Tweed has experienced a downward trend in its rankings, moving from 28th in November 2025 to 34th by February 2026. This decline in rank is mirrored by a consistent decrease in sales over the same period. In contrast, Pistol and Paris has shown a slight improvement, climbing from 39th to 35th, with sales showing a modest upward trend. Meanwhile, Catch Me Outside and Tuck Shop have maintained relatively stable positions, although their sales figures suggest some fluctuations. Notably, South Point was not in the top 20 in November 2025 but has since entered the rankings, indicating a potential emerging competitor. This competitive environment suggests that Tweed may need to reassess its strategies to regain its footing in the Ontario Flower market.

Notable Products

In February 2026, the top-performing product for Tweed was the Mega Packs THC Softgels 100-Pack (1000mg) in the Capsules category, maintaining its number one rank from previous months despite a sales decrease to 5747 units. The Quickies - Chemsicle Pre-Roll 10-Pack (3.5g) held steady in second place, showing consistent performance across the months. Chemsicle (14g) in the Flower category remained third, having climbed from fifth place in November 2025. A notable new entrant to the top ranks is the Sour Sucker Mints Pre-Roll 10-Pack (3.5g), debuting in February 2026 at fourth place. Quickie's- Blood Orange Kush Pre-Roll 10-Pack (3.5g) stayed at fifth, maintaining its position from January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.