Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

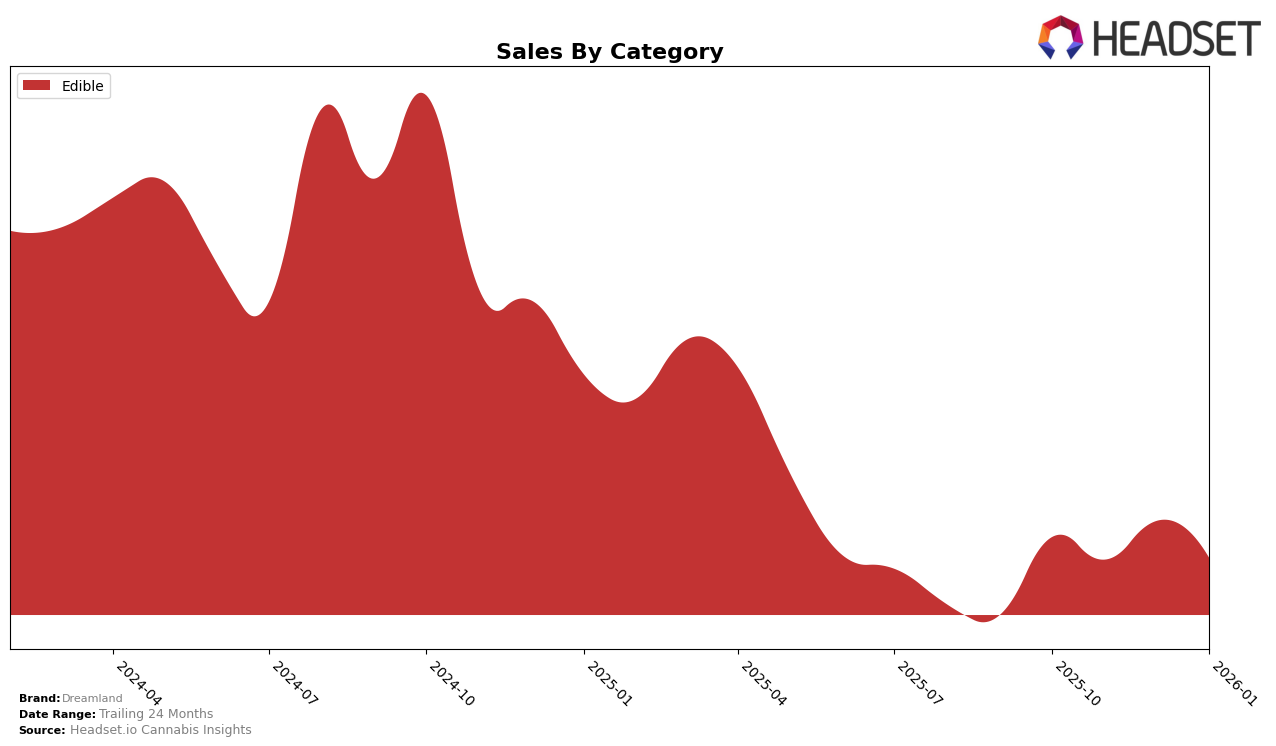

Dreamland has shown consistent performance in the Nevada market, particularly in the Edible category. Over the span from October 2025 to January 2026, the brand maintained a steady ranking, fluctuating slightly between 13th and 14th positions. This stability in ranking suggests a loyal customer base and consistent demand for their products. However, it's notable that Dreamland did not break into the top 10 during this period, which could indicate strong competition in the Nevada Edible market or a potential area for growth and strategic improvement for the brand.

While Dreamland's rankings remained relatively stable in Nevada, the brand's sales figures saw some fluctuations. For instance, sales in December 2025 peaked compared to other months, suggesting a possible seasonal boost or successful promotional activities during that time. Conversely, the slight dip in sales during November and January could be indicative of market saturation or external factors affecting consumer purchasing behavior. The absence of Dreamland in the top 30 rankings in other states or provinces highlights a potential limitation in market reach or distribution strategy, which could be a focal point for future expansion efforts.

Competitive Landscape

In the competitive landscape of the Nevada edible cannabis market, Dreamland has experienced a relatively stable but challenging position. Over the months from October 2025 to January 2026, Dreamland consistently ranked 14th, except for a brief improvement to 13th in November. This stability contrasts with the fluctuations seen in competitors like Tyson 2.0, which dropped from 12th to 15th, and Beboe, which saw a dip in December before recovering. Notably, Smokiez Edibles maintained a strong 10th position, indicating a significant lead over Dreamland. Despite these challenges, Dreamland's sales figures remained relatively stable, suggesting a loyal customer base, but the brand may need to innovate or enhance its offerings to climb the ranks and compete more effectively with higher-ranking brands.

Notable Products

In January 2026, Dreamland's top-performing product was the Peanut Butter Milk Chocolate Cubes 4-Pack (40mg) in the Edible category, maintaining its first-place ranking from previous months with sales of 1693 units. The Mystical Milk Chocolate Bar (100mg) rose to the second position, showing an improvement from its fourth-place ranking in December 2025, with sales increasing to 1229 units. The Peppermint Dark Chocolate Bar 10-Pack (100mg) held steady in third place, despite a slight drop in sales to 1003 units. The Milk Chocolate Salted Toffee Bar 10-Pack (100mg) experienced a decline, dropping from second to fourth place as its sales fell to 853 units. Lastly, the Banana Milk Chocolate Bar 10-Pack (100mg) remained in fifth place, with sales decreasing to 717 units compared to the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.