Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

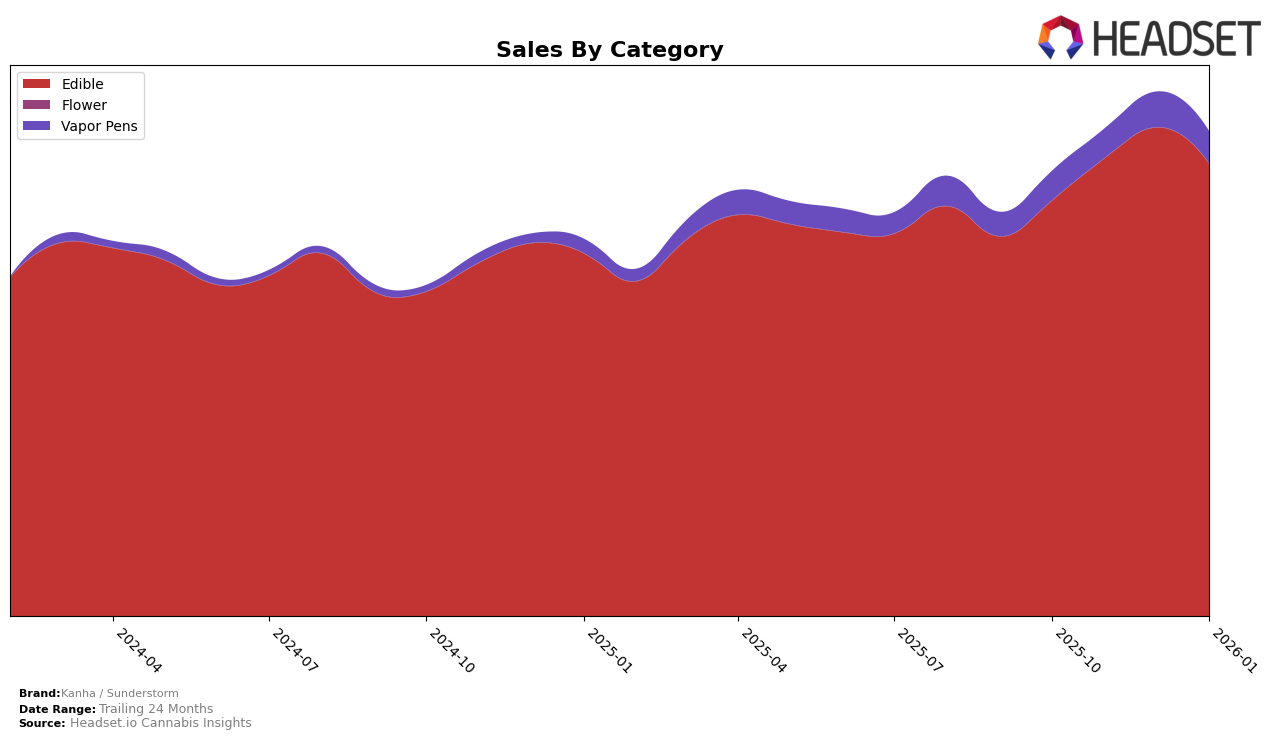

Kanha / Sunderstorm has demonstrated a consistent performance in the California edibles market, maintaining a steady third-place ranking from October 2025 through January 2026. This stability in one of the largest cannabis markets is indicative of their strong brand presence and consumer loyalty. In Massachusetts, the brand has dominated the edibles category, holding the top spot throughout the same period. This leadership position in Massachusetts highlights Kanha / Sunderstorm's ability to capture and maintain market share in different regions with varying consumer preferences.

In the Illinois market, Kanha / Sunderstorm has shown positive movement in the edibles category, improving from eighth to seventh place before slightly dropping to ninth in January 2026. Meanwhile, their vapor pen category has seen a steady climb, advancing from 24th to 20th place over the four-month period, indicating a growing acceptance of their products in this segment. In Nevada, the brand has experienced upward momentum in edibles, moving from ninth to fifth place by January 2026, suggesting an increasing demand for their offerings. However, it is notable that in some regions and categories, Kanha / Sunderstorm has not made it to the top 30, which could be seen as an area for potential growth or a challenge in those markets.

Competitive Landscape

In the competitive landscape of the California edible cannabis market, Kanha / Sunderstorm consistently maintained its position as the third-ranked brand from October 2025 to January 2026. This stability in rank is notable, especially when compared to the top-performing brand, Wyld, which held the number one spot throughout this period. Despite the fierce competition, Kanha / Sunderstorm's sales figures showed a healthy upward trend from October to December 2025, before experiencing a slight dip in January 2026. This trend indicates a robust market presence, although it still trails behind Camino, which consistently ranked second. Meanwhile, Lost Farm and Good Tide maintained their positions at fourth and fifth, respectively, suggesting a stable competitive environment where Kanha / Sunderstorm continues to be a key player.

Notable Products

In January 2026, Kanha / Sunderstorm's top-performing product remained the CBN/CBD/THC 3:1:2 Sleep Marionberry Plum Gummies 10-Pack, consistently holding the number one rank with a sales figure of 45,463. The CBD/THC/CBN 1:1:1 Blue Raspberry Tranquility Gummies also maintained their second-place position, demonstrating steady sales performance. Nano - Indica Galactic Grape Gummies reclaimed the third spot after a brief absence from the rankings in December 2025. The Restore - CBG/THC 2:1 Harmony Acai Blueberry Gummies debuted impressively in fourth place, indicating a strong market entry. Meanwhile, the Classic - Sativa Cherry Gummies saw a slight improvement, moving up to fifth place after previously being unranked in November and December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.