Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

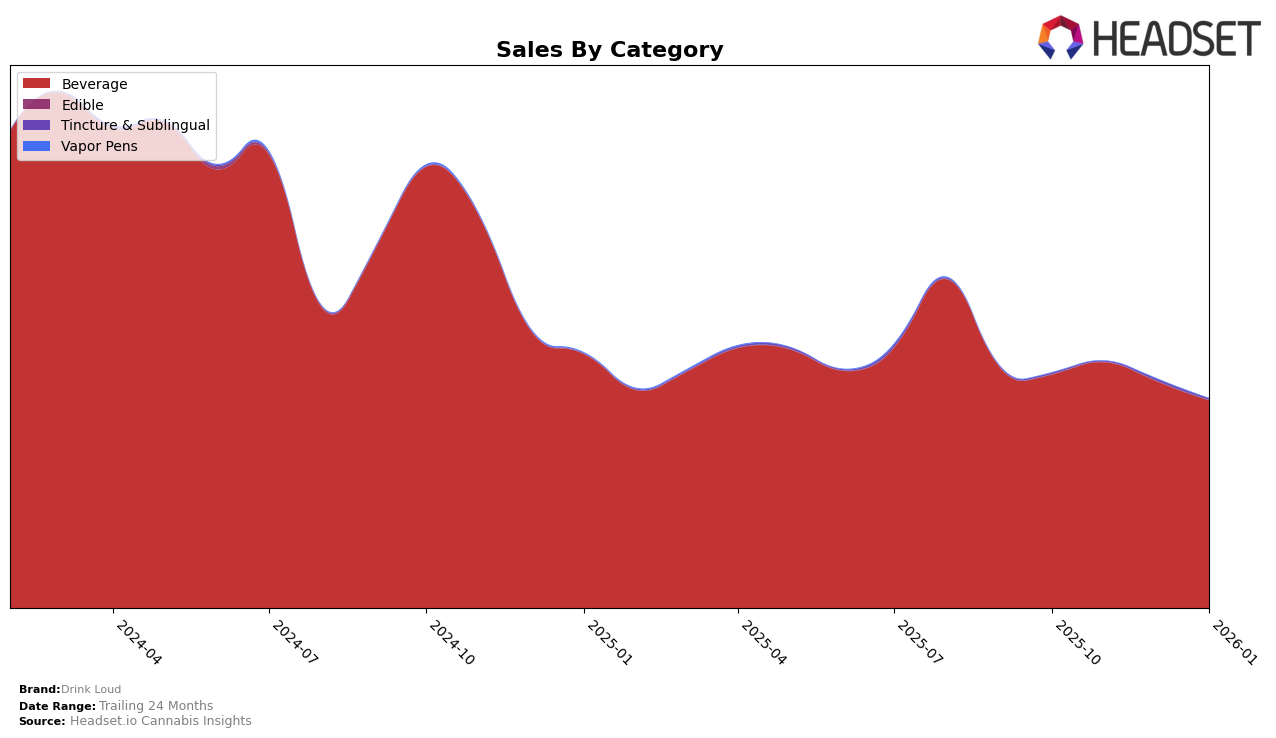

Drink Loud has demonstrated varied performance across different states, with notable stability and some shifts in its category rankings. In Illinois, the brand maintained its position at 11th in the Beverage category for two consecutive months before slipping to 12th in December and January. This decline coincided with a consistent decrease in sales figures, suggesting a potential challenge in maintaining market share. Meanwhile, in Massachusetts, Drink Loud held steady at 13th place throughout the observed period, though the sales figures showed a significant drop in January, which could indicate seasonal fluctuations or increased competition.

In contrast, Nevada has been a strong market for Drink Loud, with the brand securing a solid 4th place in the Beverage category for three consecutive months, following a brief stint at 5th in October. This upward trend in rankings is mirrored by a general increase in sales, especially notable in November. The brand's ability to maintain a top-five position in Nevada suggests a strong consumer base and effective market strategies. However, the absence of Drink Loud from the top 30 in other states could indicate untapped potential or areas needing strategic adjustments.

Competitive Landscape

In the competitive landscape of the Nevada cannabis beverage market, Drink Loud has shown a consistent upward trajectory in its rankings over the past few months. Starting from the 5th position in October 2025, Drink Loud climbed to the 4th position by November and maintained this rank through January 2026. This improvement in rank is notable given the consistent performance of top competitors like Keef Cola and HaHa, which have held steady at the 2nd and 3rd positions respectively. Despite Uncle Arnie's experiencing a drop from 4th to 5th place, Drink Loud's ability to surpass them and maintain its position indicates a positive trend in sales and brand recognition. This upward movement in rank suggests that Drink Loud is effectively capturing market share and resonating with consumers, positioning itself as a formidable player in the Nevada cannabis beverage category.

Notable Products

In January 2026, Maui Blast Potion Shot (100mg THC, 50ml) maintained its top position as the best-selling product for Drink Loud, with sales reaching 2,999 units. Pink Lemonade Live Rosin Potion Shot (100mg THC, 2oz) climbed to the second spot, showing a slight increase from its third position in December 2025. Chill - THC/CBN 10:1 Kush Berry Shot (100mg THC, 10mg CBN, 50ml) slipped to third place, continuing its downward trend from the previous months. Cucumber Haze Potion Live Rosin Fast Acting Nano Shot (100mgTHC, 50ml) remained consistently at the fourth position since October 2025. Sleep - CBN/THC 1:2 Grape Crash Shot (50mg CBN, 100mg THC) held steady in fifth place, with sales figures gradually declining over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.