Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

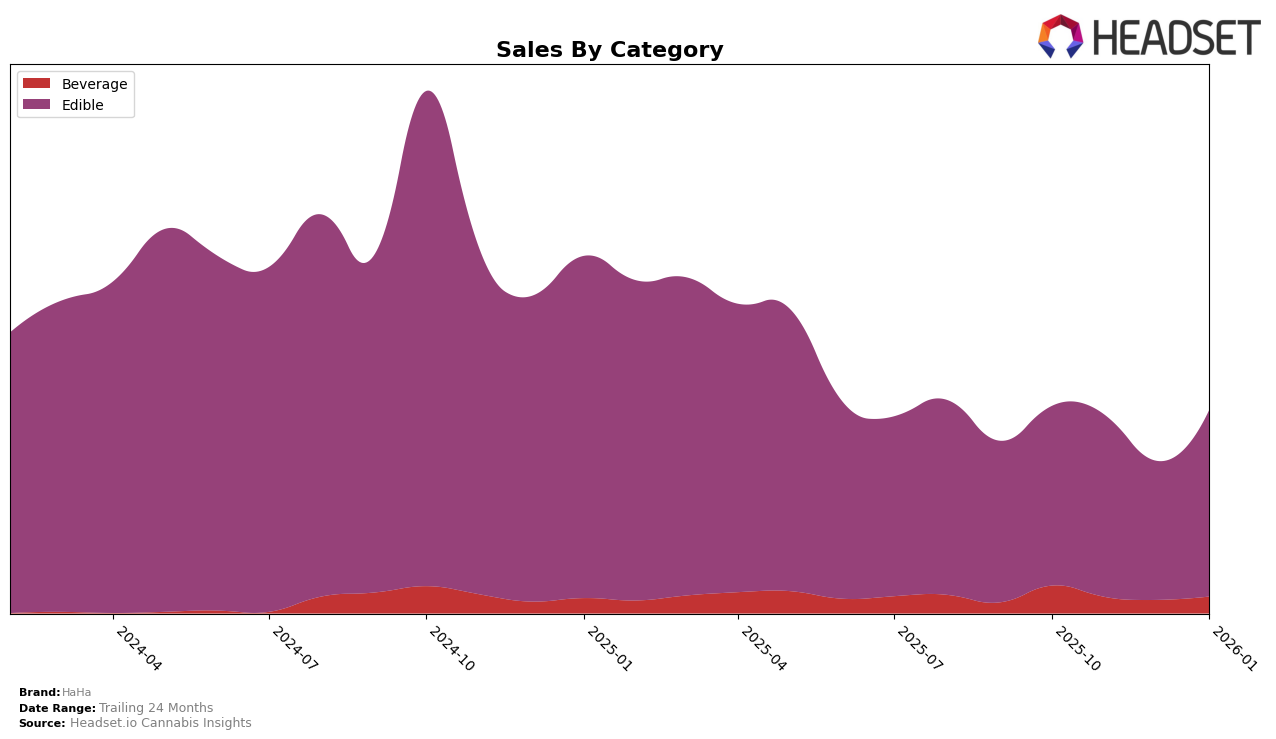

HaHa has demonstrated varied performance across different categories and states, particularly in the Nevada market. In the Beverage category, HaHa has maintained a consistent third-place ranking from October 2025 through January 2026, which indicates a stable presence and possibly a strong consumer base in this category. Despite a decrease in sales from October to December, there was a slight recovery in January, suggesting potential seasonal influences or promotional efforts. In the Edible category, HaHa also held a steady third-place ranking throughout the same period, with sales showing a significant dip in December but rebounding in January. This consistency in rankings highlights HaHa's solid positioning in Nevada's cannabis market, especially within these two key product categories.

In contrast, HaHa's performance in California presents a different narrative. The brand did not make it into the top 30 rankings for the Edible category from October 2025 to January 2026, which could indicate challenges in market penetration or competition in this highly competitive state. Despite this, there was a slight improvement in their ranking from 68th in December to 63rd in January, which might suggest some positive movement or strategic adjustments being made. This absence from the top rankings in California highlights the competitive pressure and the need for strategic initiatives to boost brand visibility and sales in this key market.

Competitive Landscape

In the Nevada edible market, HaHa has consistently maintained its position as the third-ranked brand from October 2025 through January 2026. Despite stable rankings, HaHa's sales experienced a notable dip in December 2025, though they rebounded by January 2026. This suggests that while HaHa is a strong contender, it faces significant competition from leading brands such as Wyld and Incredibles, which have consistently held the first and second ranks, respectively. Wyld's sales are significantly higher, indicating a dominant market presence. Meanwhile, Kanha / Sunderstorm has shown a positive trend, climbing from ninth to fifth place, suggesting a potential threat to HaHa's position if this upward trajectory continues. The data highlights the competitive nature of the Nevada edible market and underscores the importance for HaHa to strategize effectively to maintain or improve its rank amidst dynamic market shifts.

Notable Products

In January 2026, the CBG/THC 3:1 Mighty Mango Gummies 10-Pack maintained its top position from previous months, leading the sales for HaHa with a notable figure of 6606 units sold. The Strawberry Lemonade Gummies 10-Pack ranked second, showing an improvement from its fourth-place position in November 2025. Wicked Watermelon Gummies 10-Pack consistently held the third spot, reflecting steady performance in the Edible category. The CBD/THC 2:1 Blue Raspberry Gummies 10-Pack remained in fourth place, experiencing a slight increase in sales compared to December. Nano Grape Soda entered the rankings for the first time, securing the fifth position in the Beverage category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.