Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

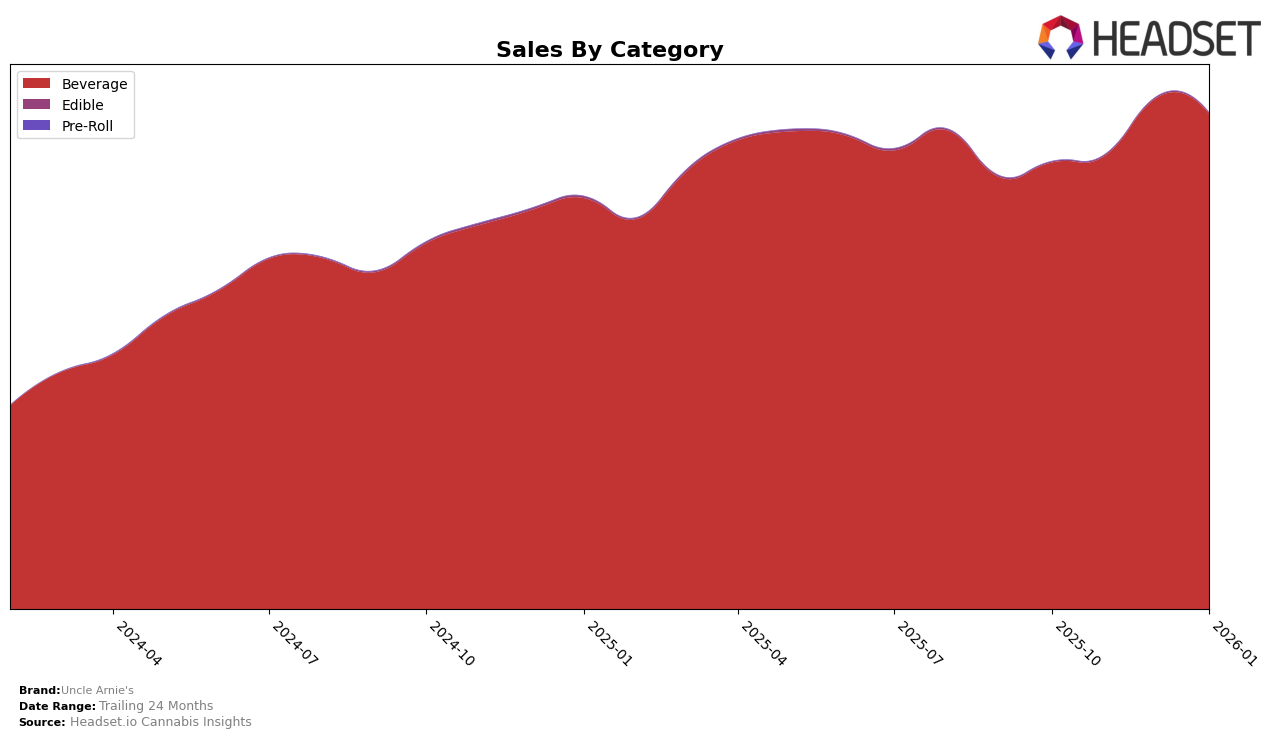

Uncle Arnie's has demonstrated consistent performance in the Beverage category across various states. In Arizona, the brand maintained a steady position, ranking third in both December 2025 and January 2026, indicating a positive trend with sales increasing from $98,927 to $108,413. Meanwhile, in California, Uncle Arnie's held a strong second place consistently from October 2025 to January 2026. Despite a slight dip in sales in January 2026 compared to December 2025, the brand's position remained unchanged, suggesting a stable market presence.

In Illinois, Uncle Arnie's dominance is evident as it retained the top spot in the Beverage category throughout the four-month period. However, the sales figures reflect some volatility, with a peak in December 2025 and a subsequent decline in January 2026. On the other hand, the brand's performance in Nevada saw a slight drop in ranking from fourth to fifth place in November 2025, where it remained through January 2026. Despite this, sales showed a recovery in January 2026, hinting at potential growth opportunities. The absence of Uncle Arnie's from the top 30 in other states could indicate areas for strategic expansion or improvement.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Uncle Arnie's consistently holds the second rank from October 2025 to January 2026, demonstrating a stable position in the market. Despite its steady rank, Uncle Arnie's faces stiff competition from St Ides, which maintains the top position throughout this period. While Uncle Arnie's sales show a positive growth trajectory, increasing from October to January, they remain significantly lower than those of St Ides. Meanwhile, Not Your Father's Root Beer and Pabst Labs consistently rank third and fourth, respectively, with sales figures that are considerably lower than Uncle Arnie's. This indicates that while Uncle Arnie's is securely positioned as a strong contender, there is a substantial gap to close with the market leader, St Ides, to capture the top spot.

Notable Products

In January 2026, Uncle Arnie's top-performing product was the Strawberry Kiwi Shot 100mg THC 2oz, maintaining its first-place ranking consistently since October 2025, with sales reaching 28,550 units. The Sunrise Orange With Caffeine Shot 100mg THC 2oz climbed to the second position, improving from its third-place standing in previous months. The Magic Mango Shot 100mg THC 2oz, which had held the second spot, slipped to third place in January. The CBN/THC 1:4 Blueberry Nightcap Shot 25mg CBN, 100mg THC 2oz remained in fourth place, showing steady sales. Notably, the Watermelon Wave Soda 100mg THC 8oz entered the rankings in fifth place, marking its debut in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.