Sep-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

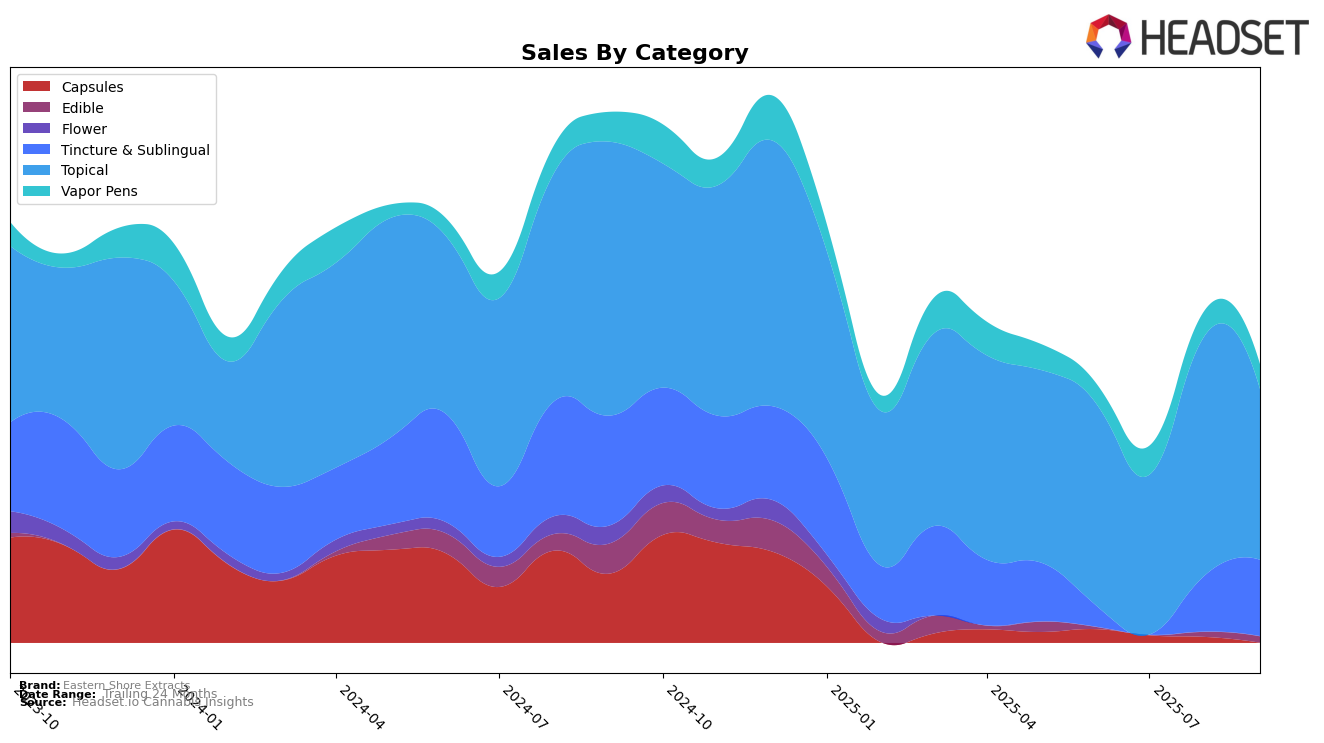

Eastern Shore Extracts has shown a notable emergence in the Maryland market, particularly in the Topical category. As of September 2025, the brand secured the 5th position in this category, marking a significant entry as it was not present in the top 30 rankings in the preceding months. This sudden rise suggests a strategic move or introduction of a product that resonated well with consumers, leading to a tangible impact on their market presence. The absence of ranking data for June, July, and August indicates that the brand was either not performing at a top level or was focusing on establishing its product line before making a significant push in September.

While Eastern Shore Extracts has made strides in Maryland, the lack of data from other states or categories suggests that their current focus might be concentrated on capturing and expanding their market share within the Topical category in Maryland. This localized success could be a part of a broader strategy to first dominate in a familiar market before expanding into other states or categories. The brand's performance in Maryland could serve as a case study for their potential in other markets, should they choose to expand their footprint across state lines. For more insights on Maryland's cannabis market, you can explore Maryland.

Competitive Landscape

In the Maryland topical cannabis market, Eastern Shore Extracts has shown a notable entry by securing the 5th position in September 2025, despite not being ranked in the top 20 in the preceding months. This suggests a significant upward trajectory in their market presence. In contrast, Avexia has maintained a stronghold at the top, consistently ranking 1st in June and July, before slightly dropping to 2nd place in August and September. Meanwhile, Cosmec Healing has demonstrated steady performance, climbing from 4th in July to 3rd in both August and September. The rise of Eastern Shore Extracts into the top 5 indicates a growing consumer interest and potential for increased sales, positioning them as a brand to watch in this competitive landscape.

Notable Products

In September 2025, the top-performing product for Eastern Shore Extracts was the CBD/CBN/CBG Ultra Pain Relief Lotion (900mg CBD, 450mg CBN, 450mg CBG) in the Topical category, maintaining its rank of 1 since June 2025 with sales of 183 units. The CBD Marionberry Distillate Cartridge (1g) in the Vapor Pens category held steady at the second position, showing consistent demand over the past months. The CBD/CBN 3:1 Blueberry Drip Gummies 10-Pack (150mg CBD, 50mg CBN) ranked third, climbing from fifth place in June, indicating a significant increase in popularity. The CBD Unflavored Full Spectrum Tincture Drops (1000mg CBD, 30ml) and the CBD/CBG 1:1 Unflavored Tincture (750mg CBD, 750mg CBG) both secured the fourth position, with the former showing a notable improvement from August. Overall, the rankings highlight a strong performance in both topical and edible categories for Eastern Shore Extracts in September.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.