Apr-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

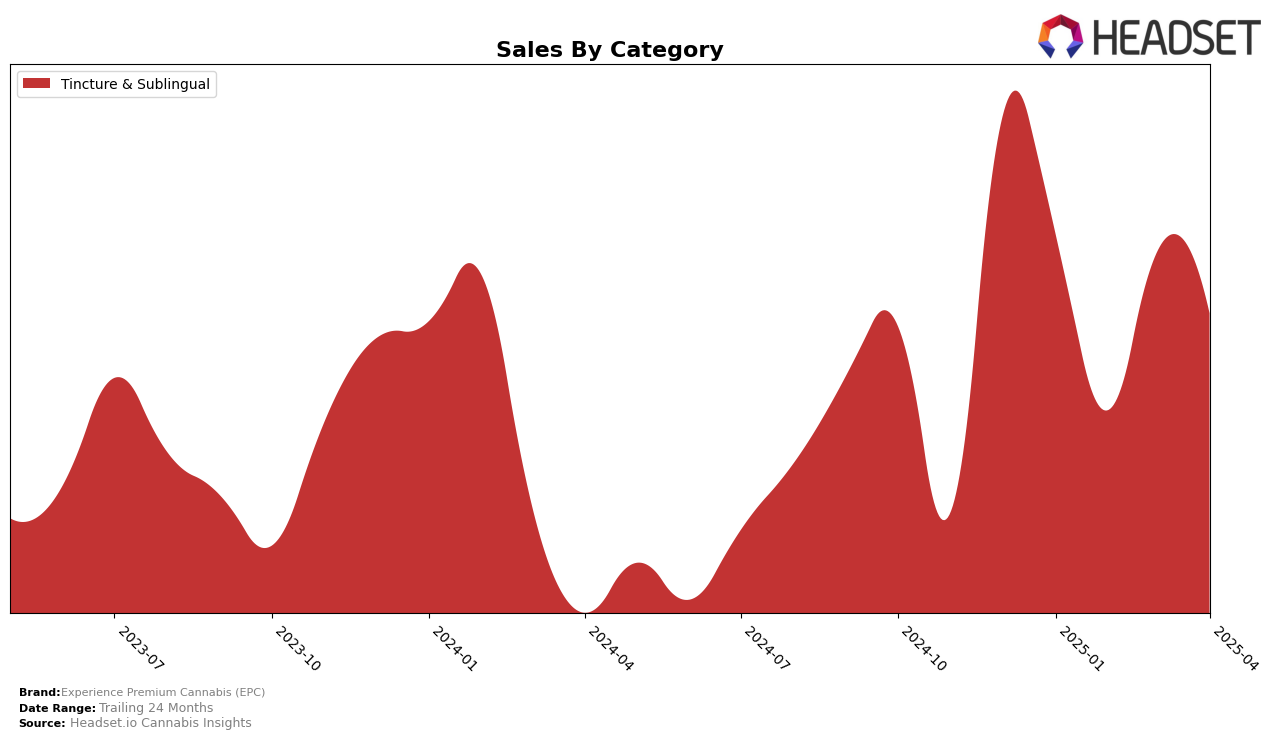

Experience Premium Cannabis (EPC) has demonstrated a fluctuating presence in the Tincture & Sublingual category within the Nevada market. In January 2025, EPC achieved a commendable 5th place ranking, indicating strong consumer interest and competitive performance. However, the absence of rankings in February and April suggests that the brand did not maintain its top 30 status in these months, which could be a point of concern for stakeholders monitoring their market consistency. Despite these fluctuations, EPC managed to secure a 7th place ranking in March, showcasing a potential rebound or strategic adjustment that allowed them to regain traction.

Sales figures for EPC in the Nevada market reflect these ranking shifts, with a notable sales number in January that set a high benchmark for the quarter. However, the absence of sales data for February and April could imply challenges such as increased competition or market saturation affecting their standing. The drop from January to March, despite maintaining a top 10 position, suggests potential volatility in consumer preferences or supply chain dynamics. These insights into EPC’s performance across months and categories offer a glimpse into the challenges and opportunities faced by cannabis brands in a competitive landscape like Nevada.

Competitive Landscape

In the Nevada Tincture & Sublingual category, Experience Premium Cannabis (EPC) has faced fluctuating rankings, indicating a competitive landscape. In January 2025, EPC held a solid 5th position, but by March, it slipped to 7th, with its rank missing in February and April, suggesting it fell out of the top 20 during these months. This volatility contrasts with the consistent performance of competitors like Doctor Solomon's, which maintained the top spot throughout the period, and Spiked Flamingo, which consistently ranked 2nd. City Trees also showed resilience, ranking 4th in February and 5th in March. These dynamics highlight the need for EPC to strategize effectively to regain and sustain its competitive edge in a market where top brands are showing stable or increasing sales trajectories.

Notable Products

In April 2025, the CBN Good Night Tincture (500mg CBN, 14ml) from Experience Premium Cannabis (EPC) maintained its position as the top-performing product in the Tincture & Sublingual category, consistently holding the number one rank since January. Notably, this product achieved sales of 140 units, showcasing its sustained popularity. The CBD/THC 1:1 Golden Mylk Tincture (100mg CBD, 100mg THC) also retained its second-place ranking throughout the first four months of the year. Meanwhile, the CBD/THC 8:1 Cannabis Tincture (270mg CBD, 30mg THC) experienced a slight drop, moving from second place in March to third in April. Lastly, the CBD/THC 20:1 Breath Easy Tincture (400mg CBD, 20mg THC, 14ml) remained in fourth position, showing a steady performance since February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.