Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

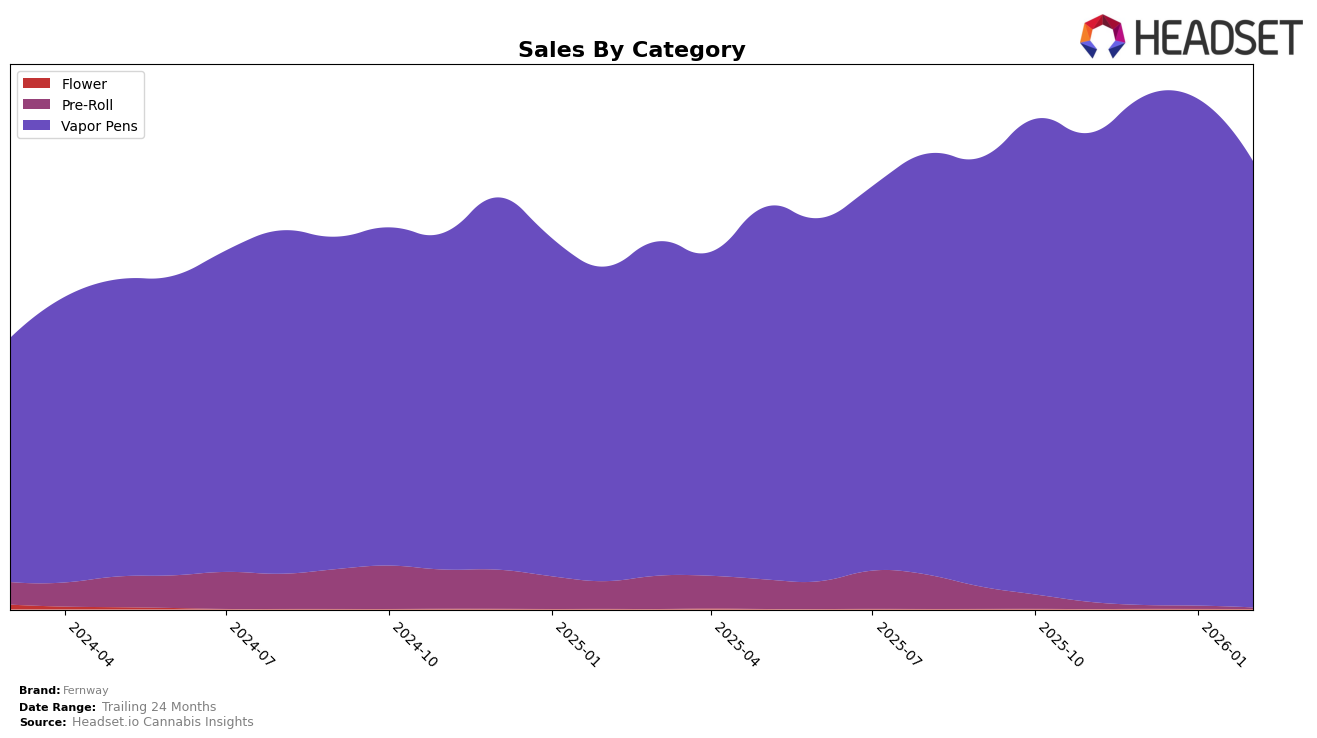

Fernway's performance in the Vapor Pens category showcases its strong market presence, particularly in the northeastern United States. In Massachusetts, Fernway consistently held the top spot from November 2025 through February 2026, indicating a stable and leading position in the market. Similarly, in New Jersey, Fernway maintained its number one ranking throughout the same period, further underscoring its dominance in these regions. However, the brand's performance in New York remained steady at the third position, suggesting room for growth compared to its leading positions in Massachusetts and New Jersey.

In contrast, Fernway's performance in Illinois showed notable improvement in the Vapor Pens category. The brand moved up from the 11th position in November 2025 to the 8th position by February 2026, indicating a positive trajectory in this market. The absence of Fernway from the top 30 rankings in other states or categories suggests that its current focus may be more regionally concentrated, particularly in the Northeast. This regional strength could be leveraged for further expansion, but the lack of presence in other markets could also highlight potential areas for strategic development.

Competitive Landscape

In the competitive landscape of vapor pens in Massachusetts, Fernway has consistently maintained its leading position from November 2025 through February 2026, showcasing its dominance in the market. Despite a slight dip in sales from January to February 2026, Fernway's sales figures remain robust, significantly outpacing its competitors. Select, holding steady at the second rank, has experienced a gradual decline in sales over the same period, indicating potential challenges in maintaining its market share. Meanwhile, Rove has shown a slight improvement in rank, moving from fourth to third place by February 2026, although its sales have decreased, suggesting a competitive pressure to sustain its upward trajectory. Fernway's ability to retain the top spot amidst these shifts underscores its strong brand presence and customer loyalty in the Massachusetts vapor pen market.

Notable Products

In February 2026, Fernway's top-performing product was the Traveler - Alpine Strawberry Distillate Pro Disposable (2g) in the Vapor Pens category, reclaiming the top rank with sales of 14,182 units. The Elderflower Distillate Cartridge (1g) made a significant leap to the second position from fifth in January, indicating a strong surge in popularity. Space Queen Distillate Cartridge (1g) maintained its steady performance, holding the third spot for two consecutive months. White Widow Distillate Cartridge (1g), which was previously a top contender, dropped to fourth place, reflecting a decline in sales. Notably, the Mandarin Orange Distillate Cartridge (1g) entered the rankings at fifth place, showing promising potential in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.