Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

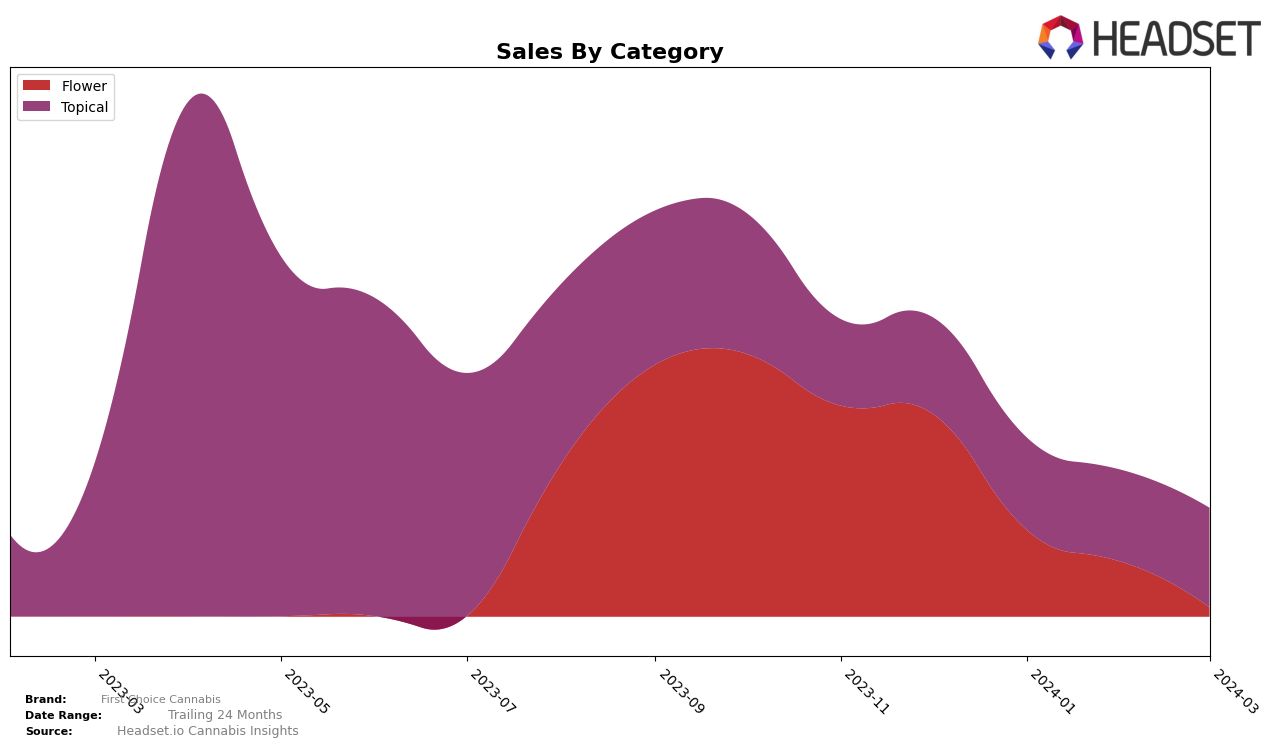

In the competitive cannabis market of British Columbia, First Choice Cannabis has shown a consistent performance across the Topical category. Starting from December 2023, the brand was ranked 11th, showing a positive trajectory as it improved its position steadily over the following months. By March 2024, First Choice Cannabis climbed two spots up to rank 9th, indicating a growing preference among consumers. This upward movement is particularly impressive considering the brand was not only able to maintain its position but also enhance it in a highly saturated market. The sales figures reflect this positive trend as well, with an increase from 1782 units in December 2023 to 1834 units by March 2024. The consistent rank improvement, despite the slight fluctuation in sales figures in the intervening months, underscores the brand's resilience and growing appeal in the Topical category within British Columbia.

However, the data provided does not cover the performance of First Choice Cannabis across other states or provinces, nor does it delve into other product categories. This limitation restricts a comprehensive analysis of the brand's overall market performance. The absence of rankings outside the Topical category or beyond British Columbia could suggest a focused or limited market presence, which might be strategic or indicative of areas for expansion. The consistent ranking within the top 10 for the Topical category in British Columbia from December 2023 to March 2024, nonetheless, signals a strong brand presence and consumer loyalty in that segment. Without additional context or comparisons, it's challenging to gauge the full scope of First Choice Cannabis's market dynamics, including how it stacks up against competitors or its performance in broader or more diverse markets.

Competitive Landscape

In the competitive landscape of the topical cannabis category in British Columbia, First Choice Cannabis has shown a notable upward trajectory in its market position from December 2023 to March 2024, moving from 11th to 9th rank. This improvement in rank is indicative of its resilience and growing preference among consumers, despite the fierce competition. Notably, Even Cannabis Company has maintained a higher rank but experienced a gradual decline, moving from 6th to 8th place, suggesting a potential opportunity for First Choice Cannabis to capture a larger market share. Meanwhile, Hulit Botanicals made a significant leap from 10th to 7th place, showing the most substantial rank improvement and sales increase in the same period, which positions them as a strong competitor. Other brands like Transit and Forty Acre Blends have shown fluctuations in their rankings and sales, indicating a dynamic and competitive market. First Choice Cannabis's steady climb in rank, despite not having the highest sales growth, suggests a solidifying position in the market that could be leveraged to challenge higher-ranked competitors with targeted marketing strategies.

Notable Products

In March 2024, First Choice Cannabis saw CBD/THC Real Relief THC Topical (50mg CBD, 225mg THC, 60ml) maintain its position as the top-selling product, with sales reaching 72 units. Following closely behind was Vanilla Ice (1g) in the flower category, which climbed to the second spot from its previous position in February. Notably, Vanilla Ice (3.5g) had been a strong contender in earlier months, ranking first in December 2023 and second in January 2024, but it did not make the list in March. The shift in rankings indicates a changing consumer preference, with a noticeable increase in demand for topical solutions over traditional flower products. This analysis underscores the dynamic nature of product popularity within First Choice Cannabis, highlighting the importance of adaptability in inventory management.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.