Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

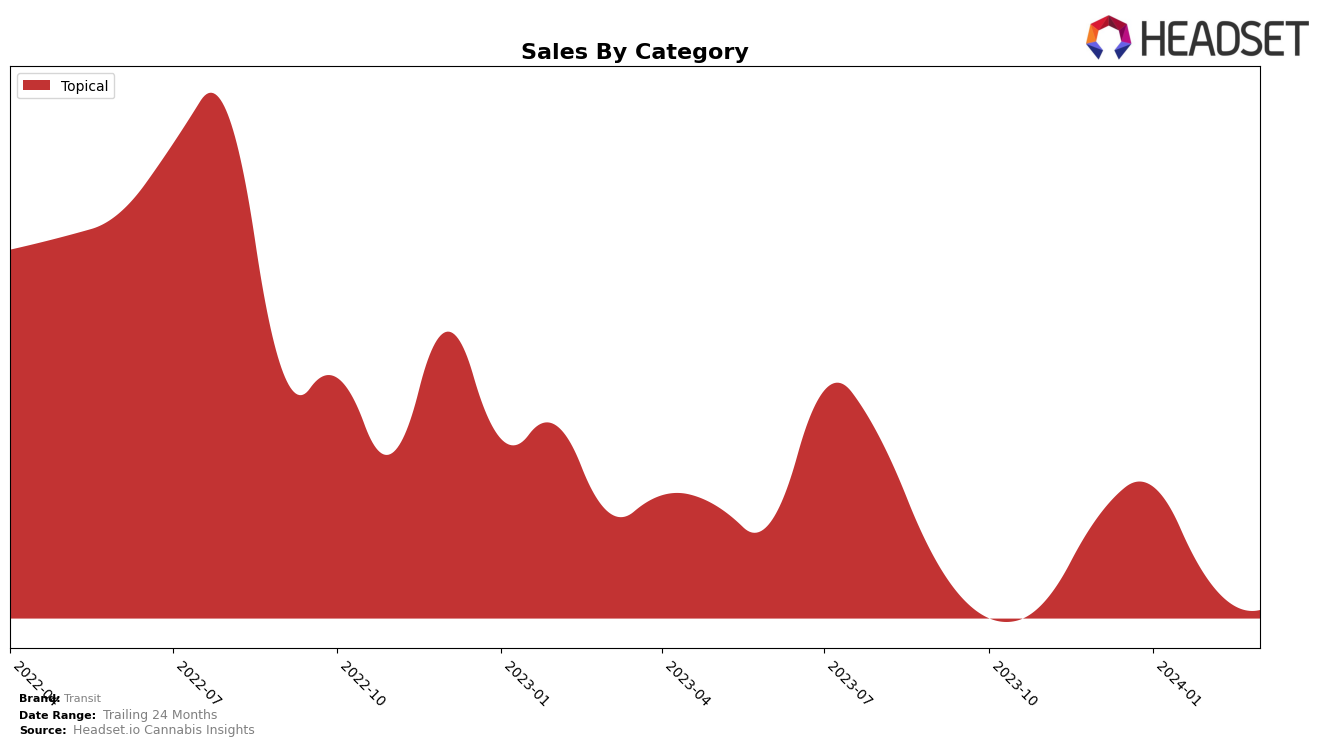

In the topical category, Transit has shown a mixed performance across different provinces in Canada. In British Columbia, Transit maintained a strong presence within the top 10 brands from December 2023 to February 2024, but experienced a slight drop to the 10th position by March 2024. This fluctuation is notable, considering their sales peaked in January 2024 with $5132.0 before declining in the following months. The brand's ability to stay within the top 10, despite the drop in sales, indicates a resilient market position in British Columbia. However, the situation was different in Ontario, where Transit faced challenges in maintaining a consistent ranking. After being ranked 23rd in December 2023, the brand disappeared from the top 30 in January 2024, only to reappear at the 30th position in February 2024, which highlights a struggle to maintain a strong market presence in Ontario's competitive landscape.

Meanwhile, in Saskatchewan, Transit's performance in the topical category remained stable, securing the 15th rank in both December 2023 and January 2024, although specific rankings for February and March 2024 are not provided. This stability in ranking, despite the lack of data for the latter months, suggests that Transit has carved out a niche for itself within Saskatchewan's market. The absence of data for February and March could indicate either a strategic withdrawal from the rankings or simply a temporary dip in performance. Overall, Transit's journey across these provinces showcases a brand navigating through the complexities of the cannabis market, with significant achievements in certain areas and challenges in others. The brand's ability to maintain relevance in British Columbia and Saskatchewan, contrasted with its fluctuating presence in Ontario, provides valuable insights into the regional dynamics of the cannabis industry.

Competitive Landscape

In the competitive landscape of the topical cannabis market in British Columbia, Transit has experienced fluctuations in rank and sales that highlight its dynamic position among rivals. Starting from December 2023 to March 2024, Transit's rank slightly deteriorated from 8th to 10th, despite a notable peak in sales in January 2024. This fluctuation is indicative of the intense competition within the category, especially from brands like Even Cannabis Company which consistently ranked higher than Transit throughout the period, albeit with a declining sales trend. Conversely, First Choice Cannabis showed an upward trajectory in both rank and sales, overtaking Transit in March 2024. Other competitors such as Tidal and Forty Acre Blends (formerly Backforty Blends) also displayed varied performance, with Tidal making a significant leap in rank in March 2024. These movements underscore the volatile nature of the market and suggest that Transit's position is challenged by both consistent top performers and rapidly improving brands, emphasizing the need for strategic adjustments to maintain or improve its market stance.

Notable Products

In March 2024, the top-performing product for Transit was CBD:THC High Potency Alleviating Massage Oil (300mg THC, 400mg CBD, 60ml) within the Topical category, maintaining its number one rank from the previous months. This product has shown consistent dominance in its category, with sales peaking at 36 units in March. Notably, its sales figures have fluctuated over the months, with a significant peak in January at 156 units. The consistency in ranking despite the varying sales figures highlights its strong market presence and consumer preference. Unfortunately, without more data on other products, it's challenging to provide a comparative analysis or insights into how other rankings have changed over time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.