Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

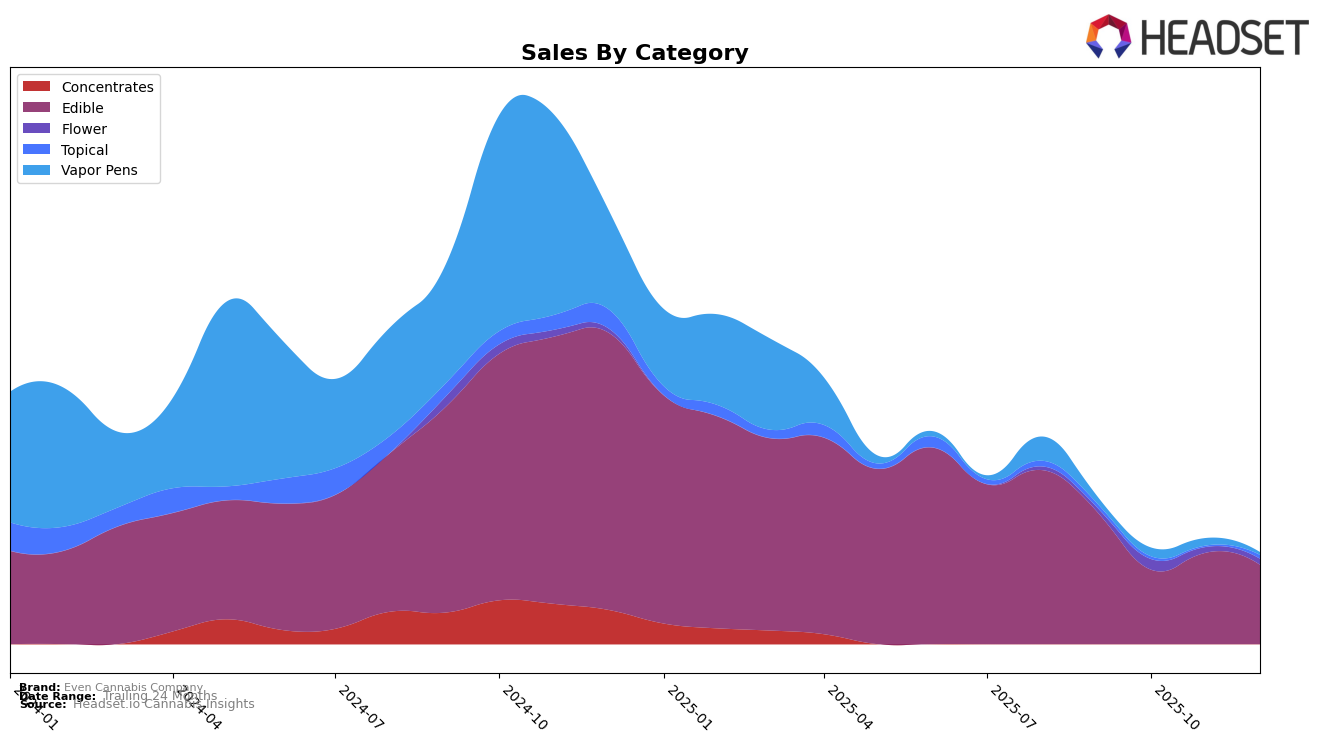

Even Cannabis Company has shown varied performance across different states and categories. In British Columbia, their ranking in the Edible category fluctuated between 15th and 18th place from September to December 2025. Despite this movement, they maintained a presence within the top 20, indicating a stable yet competitive positioning in this market. However, the sales figures suggest a decrease from September to October, followed by a recovery in November, only to dip again in December. This inconsistency may point to challenges in sustaining momentum in the British Columbia edible market.

In contrast, the performance in Ontario paints a different picture. Even Cannabis Company consistently ranked at the lower end of the top 30 in the Edible category, with their position dropping to 30th place in both November and December 2025. This suggests that while they are managing to stay within the top 30, they are struggling to rise higher in the rankings. The sales data reflects a downward trend from September to November, with a slight increase in December. This could indicate that while they face stiff competition, there might be potential for growth if they can capitalize on the slight uptick seen at the end of the year.

Competitive Landscape

In the competitive landscape of the edible category in British Columbia, Even Cannabis Company has experienced fluctuating rankings over the last few months of 2025. Despite a strong start in September with a rank of 16th, Even Cannabis Company saw a dip to 18th by December. This shift is notable when compared to competitors like Edison Cannabis Co, which maintained a relatively stable position, ending December at 17th, and Olli, which improved its rank from 17th in November to 16th in December. The sales performance of Even Cannabis Company also reflects this volatility, with a significant drop in October before rebounding in November, only to decrease again in December. This suggests a need for strategic adjustments to regain and sustain a higher market position amidst strong competition from brands like Wildflower and The Hazy Camper, both of which have shown resilience in maintaining or improving their rankings.

Notable Products

In December 2025, Even Cannabis Company's top-performing product was the CBD/CBG/THC 4:4:1 Biggies Orange Creamsicle Gummies 4-Pack, maintaining its number one rank with impressive sales of 3428 units. The Biggies CBD/THC 10:1 Ginger Ale Lemonade Soft Chews 4-Pack consistently held the second position, showing a significant increase in sales compared to previous months. The CBD Mango Lemonade Gummies 30-Pack remained steady in third place, while the CBD Blue Raspberry Lemonade Fast Acting Gummies 50-Pack climbed to fourth, despite not being ranked in the previous months. The Biggies Cherry Cola Live Resin Soft Chews 4-Pack entered the top five for the first time, indicating a growing interest in this product. Overall, December saw a strong performance from Even Cannabis Company's edible category, with notable shifts and improvements in product rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.