Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

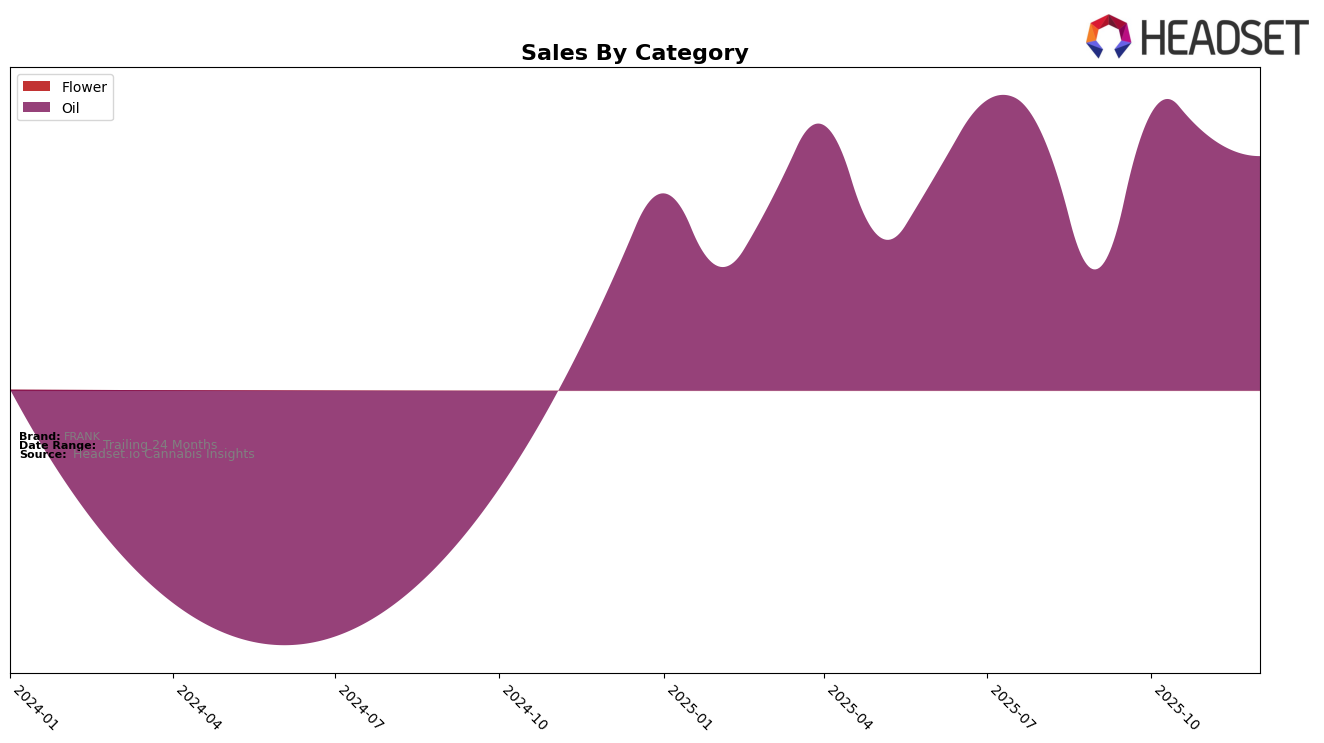

FRANK has shown a consistent presence in the Alberta market within the Oil category, maintaining its position at rank 9 from October to December 2025. This stability suggests a solid footing in the market, likely due to a loyal customer base or effective product offerings. The brand's ability to climb from rank 12 in September to 9 in October and maintain this position indicates a positive trend and potential growth in consumer preference or market strategy. However, the absence of FRANK in the top 30 rankings in other states and categories could imply a need for strategic adjustments to broaden its market reach or enhance its competitive edge outside Alberta.

In terms of sales, FRANK experienced a significant leap from September to October, with sales figures rising from 11,381 to 36,444, indicating a strong performance boost, possibly due to seasonal promotions or new product launches. However, sales saw a decline in November and December, which could be attributed to market saturation or increased competition. The consistent ranking in Alberta's Oil category despite fluctuating sales suggests that while FRANK may face challenges in sustaining its sales momentum, its brand recognition or customer loyalty remains intact. Observing these trends can provide valuable insights into FRANK's strategic positioning and potential areas for growth or improvement.

Competitive Landscape

In the Alberta oil category, FRANK has shown a notable improvement in its rank from September to December 2025, moving from 12th to a consistent 9th place. This upward trend in rank is accompanied by a significant increase in sales, particularly evident in October 2025, where sales more than tripled compared to September. Despite this growth, FRANK remains behind competitors like Divvy, which consistently ranks higher, peaking at 6th place in November, and Dosecann, which maintains a steady 8th place ranking throughout the period. These competitors have higher sales figures, indicating a strong market presence. Meanwhile, Twd. and DayDay are close competitors, fluctuating around FRANK's rank, with DayDay showing a similar upward trend, ending December in 10th place. This competitive landscape suggests that while FRANK is gaining traction, there is still room for growth to catch up with the leading brands in Alberta's oil category.

Notable Products

In December 2025, CBD Ultra 250 Oil Drops (30ml) from FRANK maintained its position as the top-performing product, continuing its streak from previous months. This product has consistently held the number one rank since September 2025, showcasing its strong market presence. Notably, its sales in December reached 724 units, indicating a slight decrease from the previous month. The unwavering top rank suggests a loyal customer base and effective marketing strategies. The product's dominance in the oil category remains unchallenged, emphasizing its popularity and consistent demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.