Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

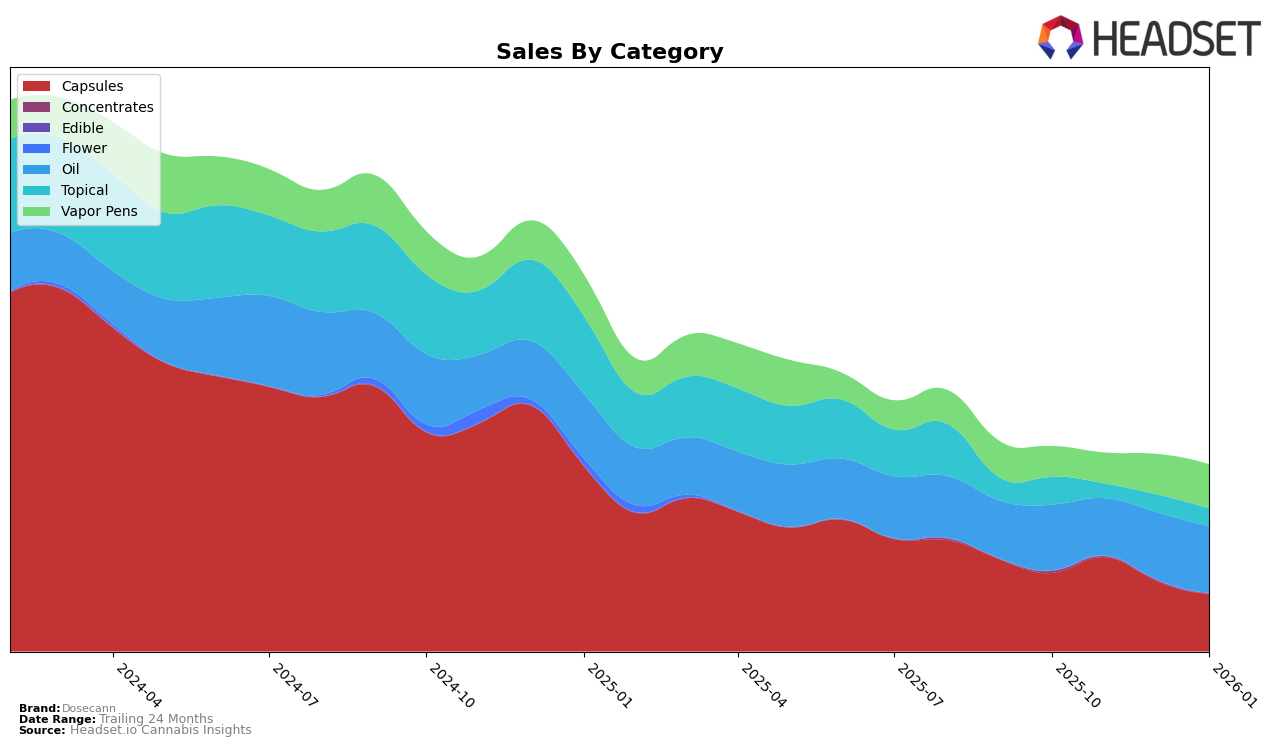

In the province of Alberta, Dosecann maintained a consistent presence in the Oil category, holding steady at the 8th rank from October 2025 through January 2026. This stability suggests a strong foothold in this particular segment, with sales figures showing a notable increase in December 2025 compared to November. However, in the Capsules category, Dosecann was not ranked in December and January, indicating a potential area for improvement or a shift in market dynamics. This absence from the top 30 could be seen as a gap in their market penetration or a strategic choice to focus on other categories.

Meanwhile, in British Columbia, Dosecann saw a positive trajectory in the Capsules category, climbing from an unranked position in October to the 7th spot in November 2025. Although there was a slight drop to 9th in December, the brand regained ground by moving up to 8th in January 2026. This upward movement suggests a strengthening brand presence and possibly an increase in consumer demand. In Ontario, the brand's performance in the Vapor Pens category showed a consistent improvement from 95th in October to 78th by January, reflecting a positive trend in consumer acceptance and market strategy. However, the Capsules category in Ontario saw a decline in rankings, from 11th in October to 13th in January, which might indicate a need for strategic adjustments to regain its standing.

Competitive Landscape

In the competitive landscape of the oil category in Alberta, Dosecann consistently held the 8th rank from October 2025 to January 2026. Despite maintaining its position, Dosecann faces significant competition from brands like Divvy, which has consistently ranked higher, moving between 6th and 7th place, and Frank, which has maintained a stable 5th position. The sales figures for Divvy and Frank are notably higher than Dosecann's, indicating a stronger market presence. Meanwhile, FRANK has consistently ranked 9th, just below Dosecann, while DayDay has shown an upward trend, moving from 12th to 10th place over the same period. This competitive environment suggests that while Dosecann has a stable position, there is pressure from both above and below in the rankings, highlighting the need for strategic marketing efforts to enhance its market share in Alberta's oil category.

Notable Products

In January 2026, Dosecann's top-performing product was CBD Oil 30ml, maintaining its consistent first-place ranking from previous months with sales of 1610 units. Following closely, CBD 50 Capsules 30-Pack 1500mg CBD held its second-place position, although sales slightly dipped to 877 units. The Indica Blackberry Cream Distillate Disposable Pen 0.3g continued its streak in third place, showing a gradual increase in sales to 680 units. Notably, the Super Lemon Haze Distillate Cartridge 1g emerged in fourth place, marking its debut in the rankings. Meanwhile, CBD/THC Daily Relief Cream 1200mg CBD, 40mg THC, 60ml, previously unranked in December, climbed to fifth place, despite a drop in sales to 272 units.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.