Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

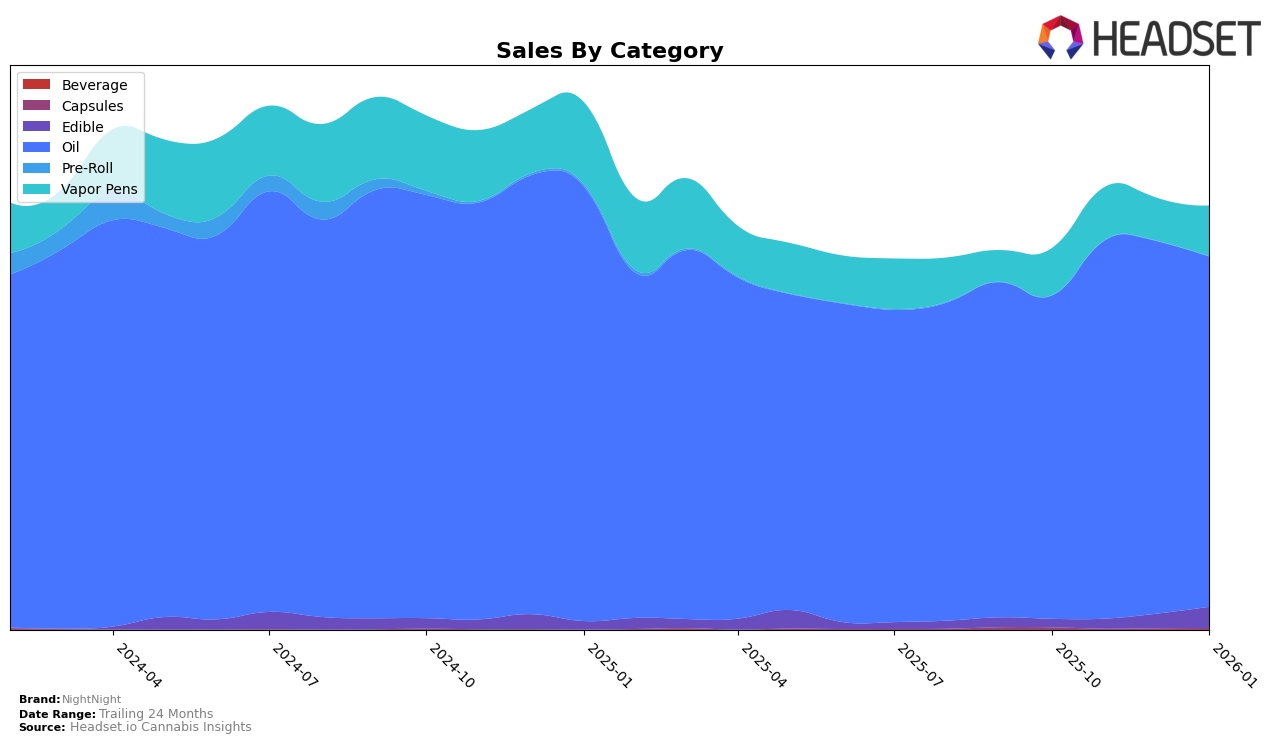

NightNight has shown notable performance in the oil category across several Canadian provinces. In Alberta, the brand has consistently held a spot within the top 10, with a promising upward trend as it moved from 6th place in October 2025 to 4th by January 2026. Similarly, in British Columbia, NightNight maintained a strong presence, peaking at 4th place in January 2026 after a brief dip in December. This consistent ranking indicates a strong foothold in the oil market within these provinces, reflecting a stable consumer base and possibly effective marketing strategies.

In Ontario, NightNight's performance varies across categories. The oil category is particularly strong, with the brand consistently ranking 4th over the months analyzed. However, the edible category tells a different story, as NightNight was not in the top 30 until December 2025, when it emerged in 35th place, improving to 27th in January 2026. This suggests some growth potential in the edibles market, albeit from a lower starting position. Meanwhile, in the vapor pens category, NightNight remains outside the top 30, indicating either a competitive market or a need for strategic adjustments to gain traction in this segment.

Competitive Landscape

In the competitive landscape of the oil category in Ontario, NightNight consistently holds the fourth rank from October 2025 to January 2026. Despite maintaining its position, NightNight faces stiff competition from brands like MediPharm Labs and Mod, which rank third and second, respectively, throughout the same period. Notably, NightNight's sales figures show a downward trend from October to January, contrasting with the steadier sales of MediPharm Labs and the significant sales peak of Mod in December. Meanwhile, Glacial Gold consistently ranks fifth, with sales figures that are generally lower than NightNight's, suggesting that while NightNight maintains a competitive edge over lower-ranked brands, there is a clear opportunity to strategize for growth against the top-tier competitors.

Notable Products

In January 2026, NightNight's top-performing product was the CBN:CBD 1:3 Full Spectrum Oil (30ml) in the Oil category, maintaining its number one rank consistently from October 2025 with sales of 5,137 units. The CBD/CBN/Delta 8 THC 3:2:1 K.O Oil (30ml) also retained its second-place position throughout these months. The CBN+CBD Full Spectrum Cartridge (1g) in the Vapor Pens category held steady at third place, showing consistent performance. Notably, the CBD/CBN 1:3 Goodnight Grapes Gummies 20-Pack experienced a significant sales increase, moving from fifth to fourth place in November 2025 and maintaining that position into January 2026. The K.O. - CBD:CBN:THC 3:2:1 Blue Widow Distillate Cartridge (1g) remained stable in fifth place, showing consistent demand despite a brief absence in November 2025 rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.