Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

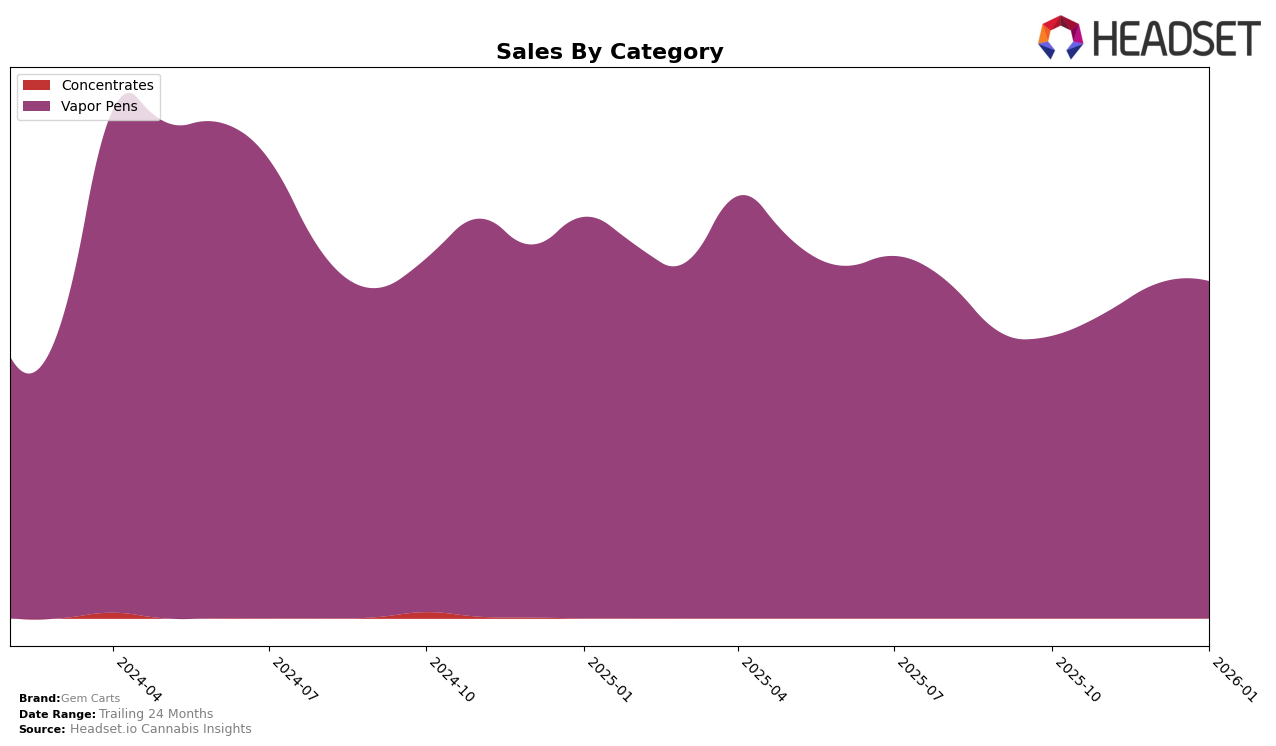

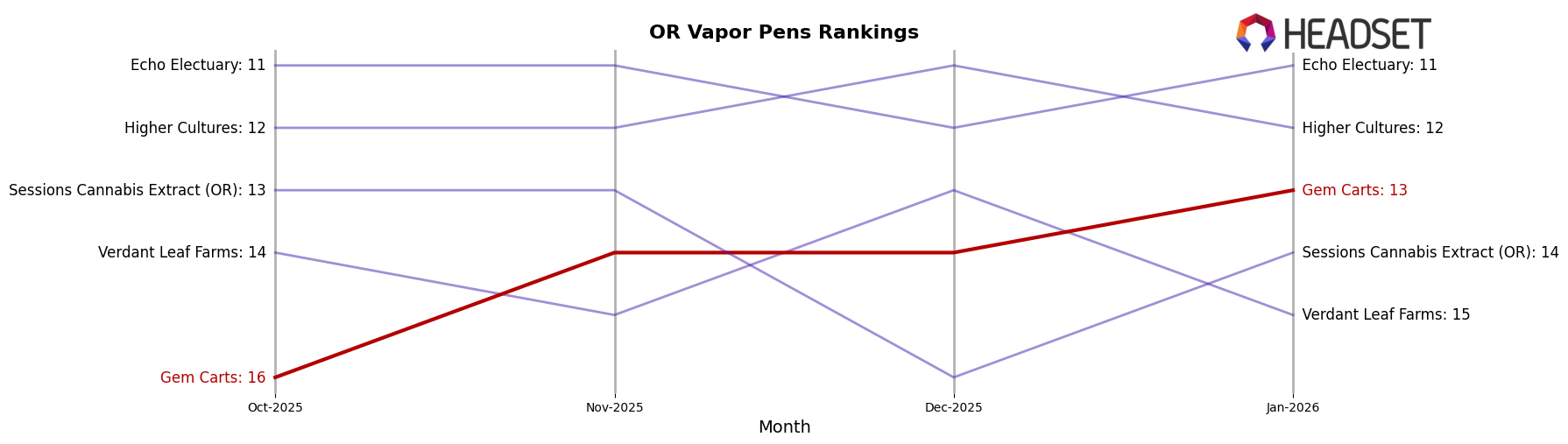

Gem Carts has demonstrated a consistent upward trajectory in the vapor pens category within Oregon. The brand improved its ranking from 16th in October 2025 to 13th by January 2026, indicating a steady gain in market presence. This rise in ranking is accompanied by a notable increase in sales, reflecting a growing consumer preference for Gem Carts' offerings. However, the absence of rankings in other states suggests that the brand is currently not within the top 30 in those markets, which could be a potential area for expansion or improvement.

While Gem Carts shows promise in Oregon, its performance in other states remains to be seen, as their absence from the top 30 rankings in those areas may indicate either a lack of market penetration or a more competitive landscape. Interestingly, the vapor pens category in Oregon seems to be a stronghold for Gem Carts, with sales figures consistently climbing over the observed months. This trend suggests that the brand is effectively capturing market share in this category, which could serve as a blueprint for strategic growth in other regions. Further analysis would be required to understand the dynamics in states where Gem Carts is not currently ranked.

Competitive Landscape

In the competitive landscape of vapor pens in Oregon, Gem Carts has shown a promising upward trajectory in rankings over the last few months, moving from 16th in October 2025 to 13th by January 2026. This improvement in rank is indicative of a positive trend in sales, as Gem Carts has consistently increased its sales figures month over month. In contrast, Echo Electuary has maintained a stable position around the 11th rank, with sales showing slight fluctuations. Meanwhile, Verdant Leaf Farms experienced a dip in rank from 14th to 15th, which aligns with their sales decrease in the same period. Higher Cultures and Sessions Cannabis Extract (OR) have also seen some variability in their rankings, with Higher Cultures maintaining a relatively stable position while Sessions Cannabis Extract dropped to 16th in December before recovering to 14th in January. This competitive environment suggests that while Gem Carts is gaining momentum, it must continue to innovate and capture market share to surpass its competitors and climb higher in the rankings.

```

Notable Products

In January 2026, the top-performing product for Gem Carts was the Sour Grape x Jack Herer Cured Resin Cartridge (1g) in the Vapor Pens category, achieving the number one rank with sales of 1703 units. Following closely was the Mango Sapphire Cured Resin Cartridge (1g), which rose to the second position from its previous rank of fourth in November 2025. The Blue Dream Cured Resin Cartridge (1g) maintained a steady presence, ranking third in both December 2025 and January 2026, although its sales decreased from 2042 units in December to 1409 units in January. The Sour Cherry Jackmosa Cured Resin Cartridge (1g) entered the top five for the first time, securing the fourth spot. Finally, the Fortyphoria Cured Resin Cartridge (1g) rounded out the top five, maintaining its position from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.