Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

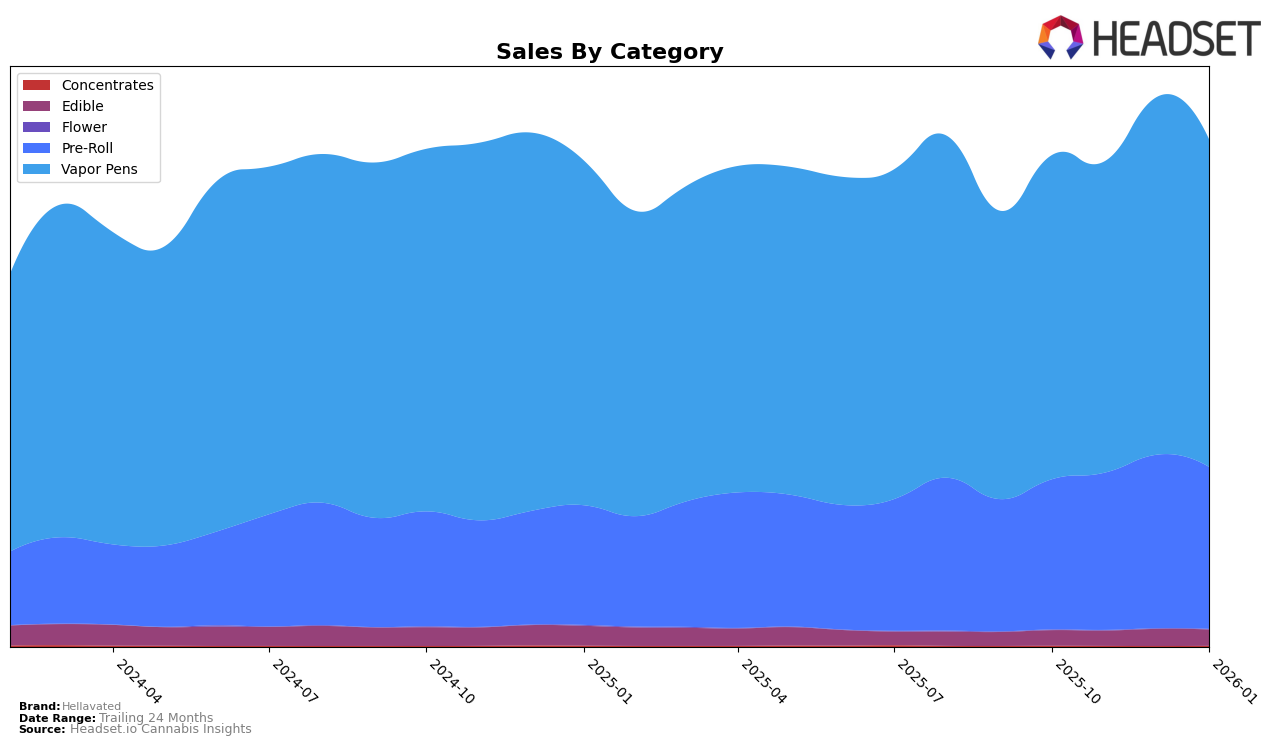

In examining the performance of Hellavated across different states and categories, noteworthy trends emerge, particularly in the pre-roll and vapor pen segments. In Massachusetts, Hellavated's pre-roll category experienced fluctuations in its rankings, moving from 18th in October 2025 to 15th by January 2026, highlighting a slight recovery after peaking at 11th in December. However, in the vapor pen category, the brand showed consistent improvement, reaching the 10th position in January 2026, up from 12th in October, indicating a strengthening position in this market. Meanwhile, in Maryland, Hellavated's pre-rolls climbed steadily to 7th place by January 2026, while their vapor pens maintained an impressive 2nd position from December onwards, showcasing strong consumer preference and market presence.

In Oregon, Hellavated's performance in the pre-roll category remained stable at 2nd place across the examined months, demonstrating a solid foothold in this segment. The vapor pen category saw a slight dip from 3rd to 4th place in January 2026, suggesting a need for strategic adjustments to regain their previous position. The edible category remained consistently ranked at 8th place, indicating steady performance but with room for growth. In contrast, in Washington, Hellavated's pre-rolls improved to 7th place by January 2026, but their vapor pen category did not rank in the top 30 after November, suggesting challenges in maintaining competitiveness in this segment. These movements across states and categories highlight Hellavated's varied performance and potential areas for strategic focus.

Competitive Landscape

In the Maryland vapor pens market, Hellavated has shown a notable upward trajectory in its competitive positioning, moving from a consistent third place in October and November 2025 to securing the second spot in December 2025 and January 2026. This shift in rank highlights Hellavated's growing appeal and market penetration, especially as it surpassed RYTHM, which fluctuated between second and fourth place during the same period. Despite Select maintaining a stronghold on the top position, Hellavated's ability to overtake &Shine—which dropped from second to fourth place—demonstrates its competitive edge. This positive trend in rank suggests an increase in consumer preference and brand strength, positioning Hellavated as a formidable contender in the Maryland vapor pens category.

Notable Products

In January 2026, Hellavated's top-performing product was Juicy Stickz - Blueberry Dream Infused Pre-Roll (0.75g), maintaining its number one rank with sales of 23,876 units. The Grape Stomper Infused Pre-Roll held steady at the second position, while the Bomb Popz Infused Pre-Roll remained third, both showing consistent rankings since December 2025. The Strawberry Haze Infused Pre-Roll consistently ranked fourth over the past months, indicating stable performance. The Variety Infused Pre-Roll 5-Pack, which debuted in December 2025, held its fifth-place position into January 2026. Overall, the rankings for Hellavated's top products showed remarkable stability from the previous months, reflecting steady consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.