Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

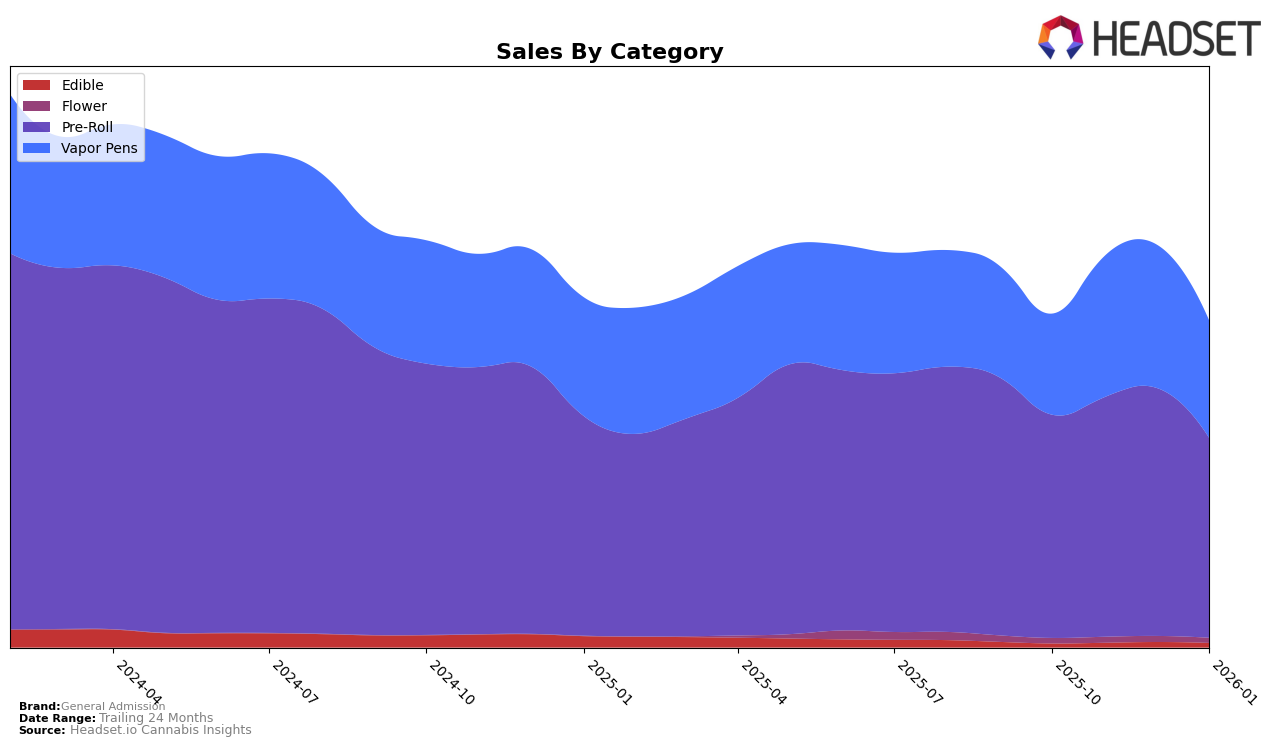

General Admission has demonstrated a robust performance in the Alberta market, particularly in the Pre-Roll category, where it consistently held the top rank from October 2025 to January 2026. Despite a decline in sales from November to January, the brand maintained its leadership position, indicating strong consumer loyalty or effective market strategies. In the Vapor Pens category, General Admission experienced a slight fluctuation, peaking at rank 3 in November but settling at rank 4 in January. This suggests a competitive landscape in the vapor pen market, although General Admission's consistent presence in the top ranks reflects a stable market share.

In British Columbia, General Admission's performance in the Pre-Roll category showed a remarkable improvement, climbing to the top rank by November 2025 and maintaining it through January 2026. This upward trajectory highlights the brand's growing influence and consumer preference in this region. Conversely, in the Vapor Pens category, the brand moved from rank 2 to rank 3 by January 2026, indicating a slight dip in its competitive position. Meanwhile, in Ontario, the brand's Pre-Roll category saw a slight drop from rank 1 to 2 by January, while it consistently held the 4th position in Vapor Pens throughout the observed period. Notably, in Saskatchewan, General Admission appeared in the top 30 for both Pre-Rolls and Vapor Pens only in January 2026, suggesting a late but emerging presence in these categories.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, General Admission has experienced a notable shift in its market position. While it maintained the top rank from October to December 2025, it was overtaken by Back Forty / Back 40 Cannabis in January 2026, which climbed to the number one spot. This change in rank coincides with a decline in General Admission's sales from December 2025 to January 2026, highlighting a potential challenge in sustaining its leading position. Meanwhile, Jeeter consistently held the third rank, and Claybourne Co. remained in the fourth position, indicating stable competition in the market. The sales trends suggest that while General Admission has been a dominant player, the brand may need to strategize to reclaim its top position amidst strong competition, particularly from Back Forty / Back 40 Cannabis.

Notable Products

In January 2026, the standout product from General Admission was the Tiger Blood Distillate Infused Pre-Roll 5-Pack (2.5g), maintaining its top rank for the fourth consecutive month with a sales figure of 28,591. The Cherry Watermelon Infused Pre-Roll 5-Pack (2.5g) climbed to the second position, surpassing its consistent third place from the previous months. The Tiger Blood Distillate Infused Pre-Roll 3-Pack (1.5g) slipped to third place from its previous second position. Notably, the Tiger Blood Chews 2-Pack (10mg) maintained its fourth rank since December 2025. The Tiger Blood Distillate Infused Pre-Roll (1g) re-entered the rankings at the fifth position after being absent in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.