Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

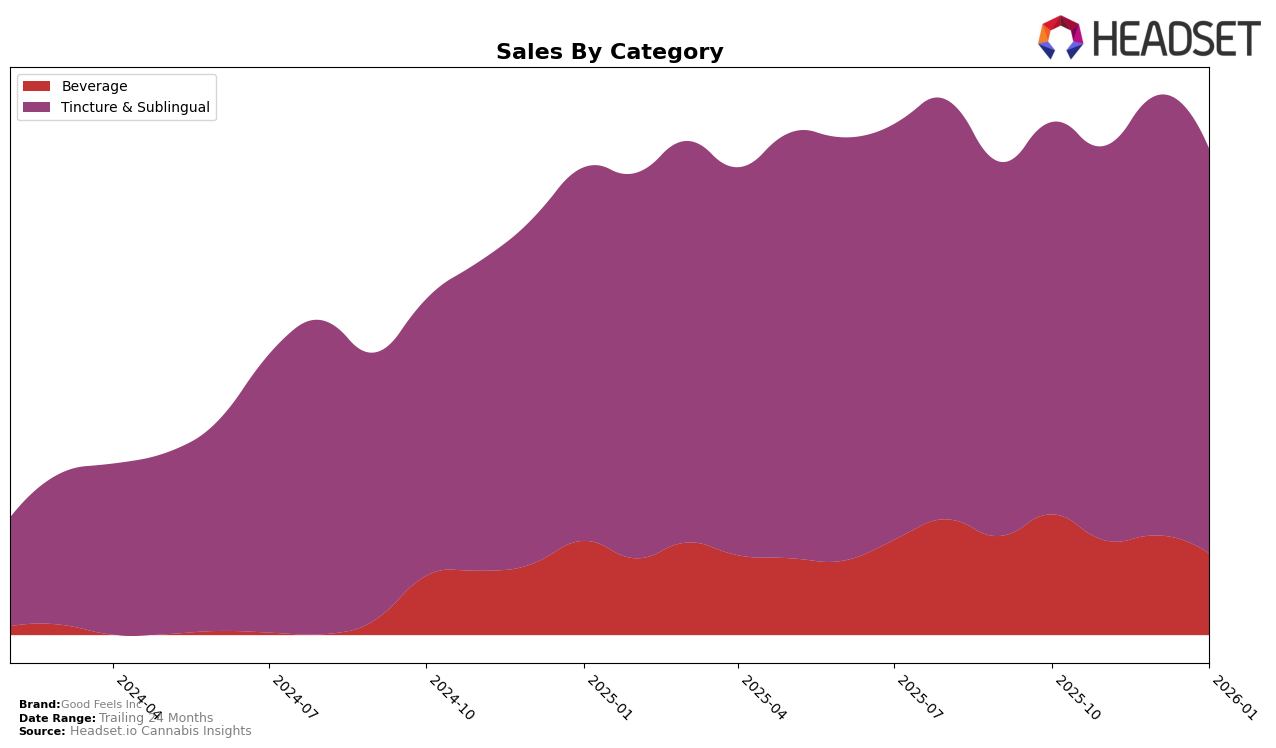

Good Feels Inc has demonstrated a strong performance in the Massachusetts market, particularly in the Tincture & Sublingual category where it consistently held the top position from October 2025 through January 2026. This unwavering dominance suggests a solid consumer base and effective market strategies in this category. Conversely, in the Beverage category, Good Feels Inc experienced a slight dip in December 2025, falling to the fourth position before regaining its third-place ranking in January 2026. This fluctuation indicates a competitive landscape in the Beverage category, where maintaining a top position requires agility and perhaps innovative product offerings.

While Good Feels Inc has shown significant strength in Massachusetts, the absence of ranking data for other states or provinces suggests that the brand has not yet cracked the top 30 in those markets. This could indicate either a strategic focus on Massachusetts or challenges in expanding their market presence beyond this state. The brand's continued success in the Tincture & Sublingual category, with sales peaking in December 2025, highlights the potential for growth if similar strategies are applied in other regions. However, without consistent top-tier rankings in other states, Good Feels Inc might need to reassess its approach to national or international expansion.

Competitive Landscape

In the Massachusetts Tincture & Sublingual category, Good Feels Inc has consistently maintained its top position from October 2025 to January 2026, showcasing its dominance in the market. Despite a slight dip in sales from December 2025 to January 2026, Good Feels Inc's sales figures remain significantly higher than its closest competitors. Treeworks, ranked second, has shown steady sales growth over the same period but still lags behind Good Feels Inc in terms of overall sales volume. Meanwhile, Levia holds the third rank consistently, with sales figures that are notably lower than both Treeworks and Good Feels Inc. This consistent ranking and sales performance highlight Good Feels Inc's strong market presence and customer loyalty, positioning it as the leader in this category.

Notable Products

In January 2026, the top-performing product for Good Feels Inc was Good Vibez X - Pink Lemonade Syrup Tincture, maintaining its number one rank from December 2025 with sales reaching 1978 units. Following closely was Good Vibez- Blue Raspberry Syrup Tincture, which dropped to the second position after leading in December 2025. Good Vibez- Unflavored Syrup Tincture held steady in the third position, continuing its upward trend from November 2025. Good Vibes - Watermelon Fast Acting Syrup Tincture claimed the fourth spot, consistent with its performance in November 2025. Finally, Good Vibez - Strawberry Syrup Tincture re-entered the rankings at fifth place, marking a stable presence since October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.