Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

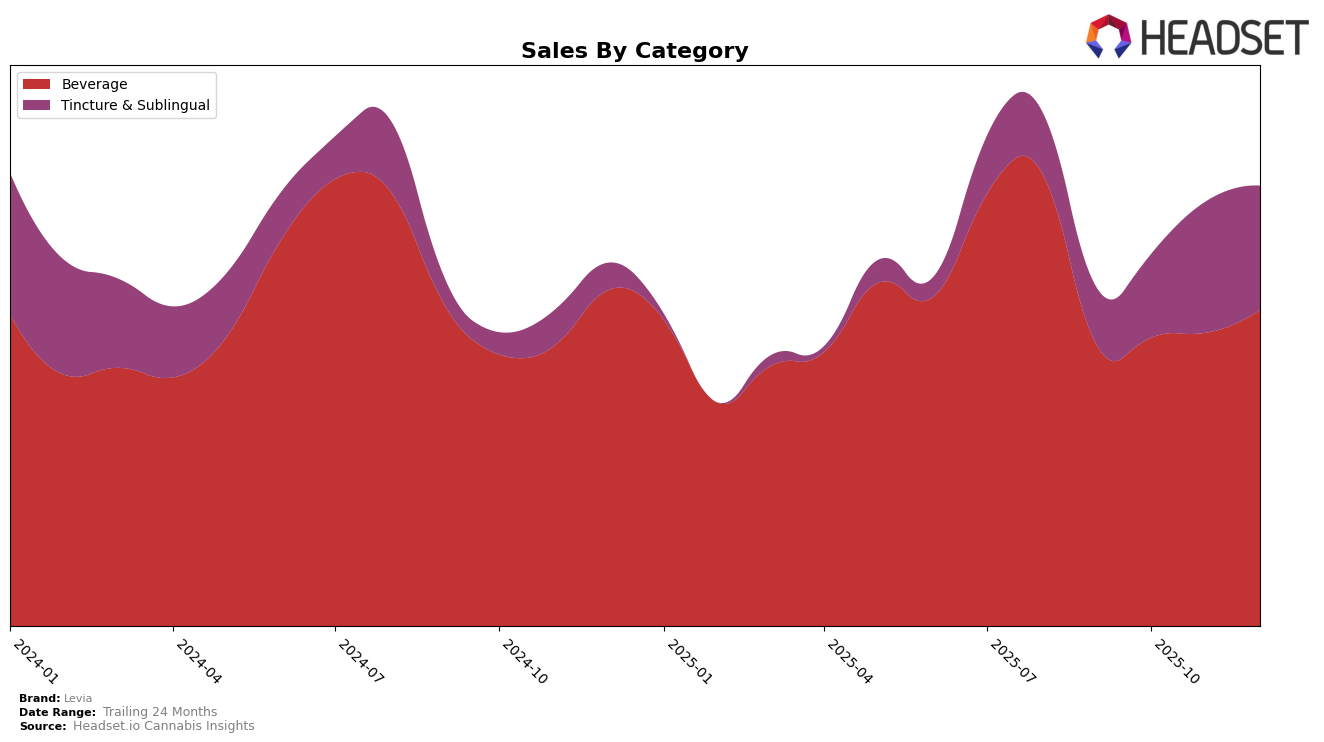

Levia has shown a strong performance in the Massachusetts market, particularly in the Beverage category. For three consecutive months, from September to November 2025, Levia maintained its position as the top brand in this category. However, in December 2025, it experienced a slight dip, moving to the second position. Despite this minor shift in ranking, the brand's sales figures continued to grow, indicating a robust consumer demand and a solid market presence. This consistent performance in the Beverage category underscores Levia's strong foothold in Massachusetts.

In the Tincture & Sublingual category within Massachusetts, Levia has held steady at the third position across all four months analyzed. This stability suggests a reliable consumer base and a competitive product offering in a category that can often see more fluctuation in rankings. Although the brand did not climb to the top ranks, maintaining a consistent third place is a testament to its ongoing appeal and effectiveness in this segment. The sales growth over the months further supports the brand's positive trajectory, indicating potential for future advancements in rank.

Competitive Landscape

In the Massachusetts beverage category, Levia has experienced a notable shift in its competitive landscape, particularly in the final quarter of 2025. Throughout September to November, Levia maintained its position as the top-ranked brand, showcasing consistent sales growth. However, in December, Levia's rank dropped to second place, overtaken by Hi5 Seltzer, which climbed to the top spot. This change indicates a competitive surge from Hi5 Seltzer, which saw a significant increase in sales, surpassing Levia's figures. Meanwhile, Good Feels Inc and Buzzy maintained their third and fourth positions, respectively, without threatening Levia's standing. The data suggests that while Levia remains a strong player, the brand faces increasing competition from Hi5 Seltzer, which could impact its market strategy moving forward.

Notable Products

In December 2025, the top-performing product for Levia was Dream - Indica Jam Berry Seltzer (5mg THC, 12oz) in the Beverage category, maintaining its number one rank consistently over the past four months with sales reaching 11,220 units. Achieve - Raspberry Lime Sativa Seltzer (5mg THC, 12oz) also held steady in the second position, showing an increase in sales to 8,095 units from the previous month. Celebrate - Hybrid Pride Lemon Lime Seltzer (5mg THC, 12oz) remained in third place, continuing its stable performance with a sales increase. Celebrate - Pomegranate Punch Seltzer (5mg THC, 12oz) ranked fourth, mirroring its consistent ranking with a notable sales boost. A new entry, Achieve- Kowloon Scorpion Bowl Seltzer (5mg THC, 12oz), entered the rankings at fifth place, indicating a successful launch in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.