Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

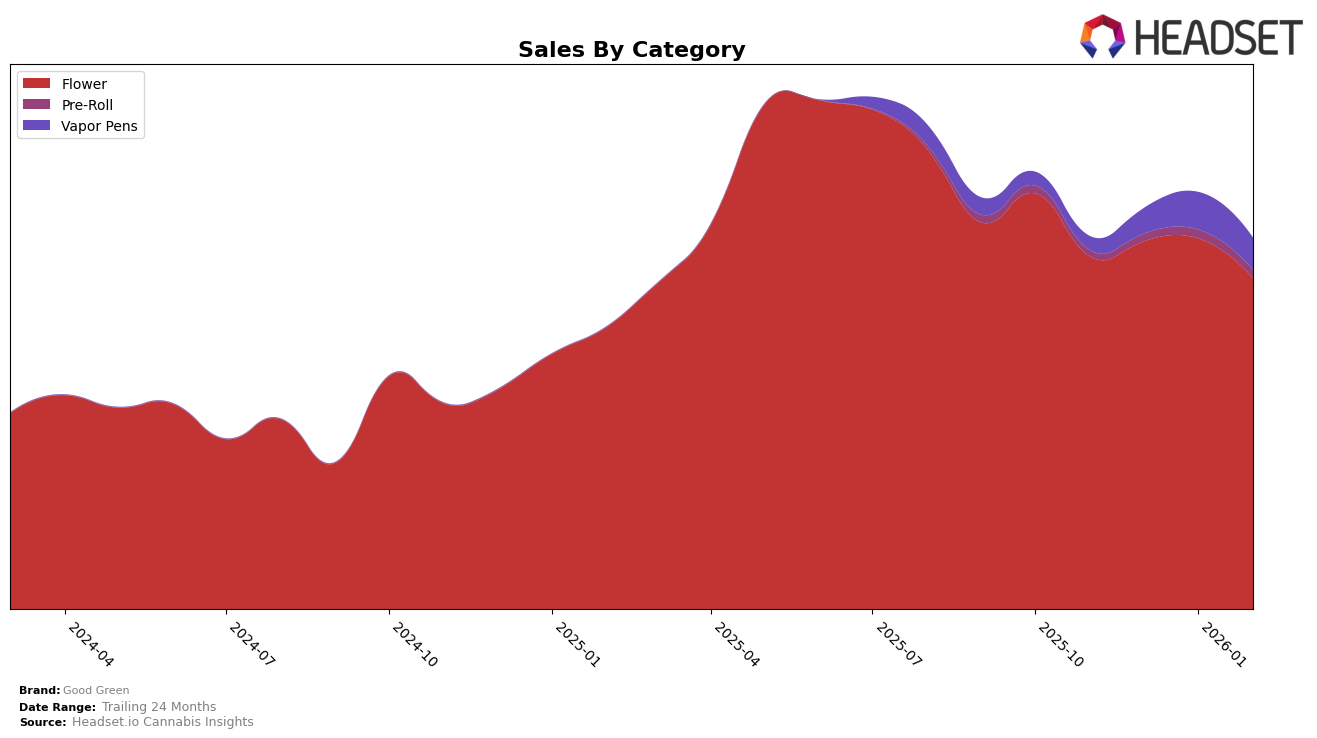

Good Green has demonstrated varied performance across different states and categories, highlighting both strengths and areas for improvement. In the Connecticut flower market, the brand made a significant entry in December 2025, ranking 14th, and maintained a similar position through to February 2026. This consistent ranking indicates a stable presence in the market, despite not appearing in the top 30 in November 2025, which suggests a positive growth trajectory. Meanwhile, in Illinois, Good Green has shown strong performance in the flower category, consistently ranking within the top 5 from November 2025 to February 2026. However, in the vapor pens category, while the brand improved its rank from 28th in December 2025 to 22nd by February 2026, it still has room to grow to match its flower category performance.

In Maryland, Good Green's ranking in the flower category dropped from 11th in November 2025 to 17th by February 2026, reflecting a decline in market position. This trend contrasts with their performance in New Jersey, where the brand improved from 22nd in November 2025 to 13th by February 2026, showcasing a positive upward trajectory. In Ohio, Good Green maintained a steady position at 16th in the flower category from December 2025 to February 2026, while in the vapor pens category, they made a notable leap from outside the top 30 in November 2025 to 17th by February 2026. This indicates a growing presence in Ohio's vapor pen market. In Nevada, Good Green experienced a slight decline, moving from 5th in November 2025 to 8th in February 2026 in the flower category, which could suggest increased competition or market challenges.

Competitive Landscape

In the competitive landscape of the Flower category in Illinois, Good Green has maintained a relatively stable position, ranking 4th in November and December 2025, slipping slightly to 5th in January and February 2026. This consistency suggests a strong brand presence, although it faces stiff competition from brands like Daze Off, which consistently held the 3rd position until February 2026, when it dropped to 6th. Meanwhile, Simply Herb showed a notable upward trend, moving from 7th in November and December 2025 to 3rd by February 2026, indicating a potential threat to Good Green's market share. Additionally, Grassroots demonstrated a significant leap from 9th to 4th place by February 2026, which could further pressure Good Green's ranking. Despite these shifts, Good Green's sales figures remained robust, although slightly lower than Simply Herb in February 2026, suggesting the need for strategic adjustments to maintain its competitive edge.

Notable Products

For February 2026, the top-performing product from Good Green was the Hybrid Pre-Roll 2-Pack (1g) in the Pre-Roll category, maintaining its first-place ranking from the previous month with sales of $5,821. The Indica Pre-Roll 2-Pack (1g) emerged as a strong contender, securing the second position, marking its debut in the rankings. The Cranberry Z Mixed Buds (3.5g) made a notable entry at third place, while Dulce de Uva Mixed Buds (14g) and Confidential Cherries Mixed Buds (3.5g) followed in fourth and fifth places, respectively. This month saw a shift in the top rankings, with new entries in the Flower category indicating a growing consumer interest in variety. Overall, the Pre-Roll products continue to dominate the top spots, reflecting consistent consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.