Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

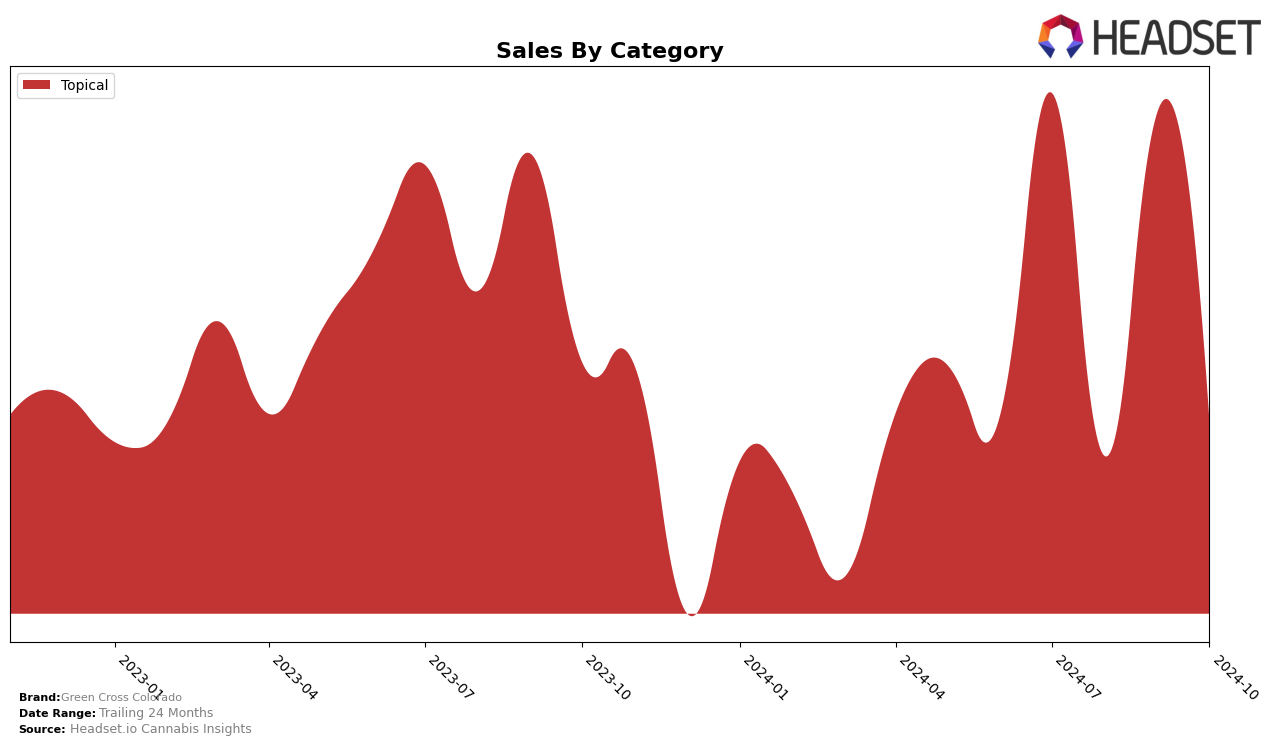

Green Cross Colorado has demonstrated a notable presence in the Colorado market, particularly in the topical category. In July 2024, the brand secured the 11th position in this category, reflecting a strong performance. However, in the subsequent months of August, September, and October 2024, the absence of a ranking indicates that Green Cross Colorado did not maintain its position within the top 30 brands. This drop suggests either increased competition or a decline in their market share within the state. The initial sales figure in July was $10,124, indicating a solid foothold that unfortunately did not sustain in the following months.

The brand's fluctuating performance in Colorado highlights the dynamic nature of the cannabis market, where maintaining a competitive edge requires constant innovation and adaptation. The lack of rankings in the later months could be attributed to several factors, including shifts in consumer preferences or strategic changes by competitors. Despite these challenges, Green Cross Colorado's initial ranking in July demonstrates potential for recovery and growth if strategic adjustments are made. Observing these movements provides valuable insights into the competitive landscape and the importance of consistent brand performance across categories.

Competitive Landscape

In the Colorado Topical category, Green Cross Colorado has faced significant competitive pressures, as evidenced by its absence from the top 20 rankings from August to October 2024. This marks a decline from its 11th place position in July 2024, suggesting a downward trend in market presence. Notably, ioVia maintained a steady presence within the top 10, albeit with a slight decline from 8th to 10th place over the same period, indicating a more resilient market position. Meanwhile, Nove Luxury Chocolate showed a positive trajectory, climbing from 10th in September to 9th in October, which might have contributed to the competitive pressure on Green Cross Colorado. Additionally, Aliviar was ranked 10th in July, further illustrating the competitive landscape that Green Cross Colorado is navigating. These dynamics highlight the need for strategic adjustments to regain market share and improve sales performance in this competitive topical market.

Notable Products

In October 2024, the top-performing product for Green Cross Colorado was CBD:THC 1:1 Wranglers Relief - Body Balm, maintaining its number one rank for four consecutive months. This topical product achieved a sales figure of 222 units in October, demonstrating consistent consumer demand. Notably, its sales peaked in July with 554 units, indicating a significant fluctuation over the months. Other products in the lineup experienced shifts in rankings, but none managed to surpass the consistent performance of the Body Balm. Overall, the product category of topicals remains a strong contender in Green Cross Colorado's portfolio.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.