Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

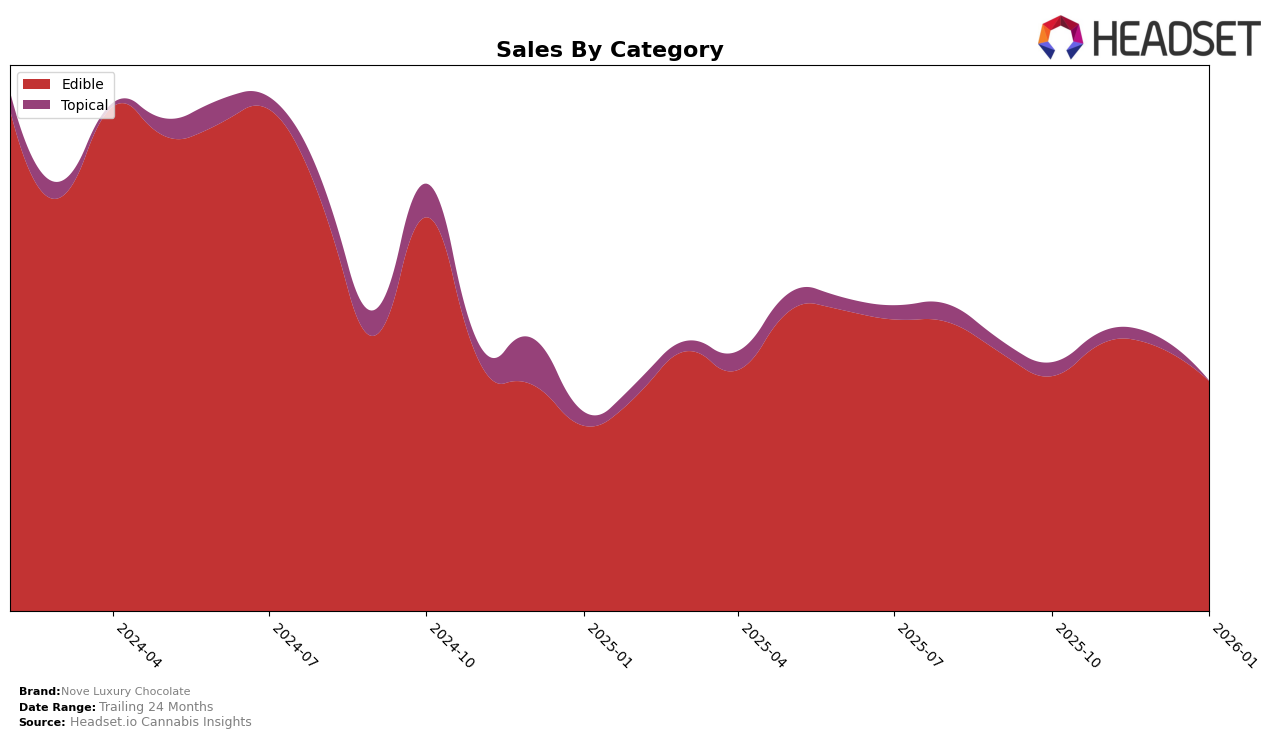

Nove Luxury Chocolate has shown a consistent performance in the Colorado market within the Edible category. Over the four-month period from October 2025 to January 2026, the brand maintained its presence within the top 20, with rankings fluctuating slightly but remaining stable overall. In October 2025, Nove was ranked 20th, improving to 18th in November, and then settling at 19th for both December and January. This stability in rankings indicates a strong foothold in the Colorado market, suggesting a loyal customer base and consistent demand for their products. However, the slight decrease in sales from December to January might be a point of concern, hinting at potential seasonal fluctuations or increased competition.

While Nove Luxury Chocolate has managed to maintain its position within the top 30 in Colorado, it's noteworthy that their presence is not mentioned in any other states or provinces for the Edible category. This absence from other markets could be interpreted in two ways: either the brand is focusing its efforts primarily on the Colorado market, or it is facing challenges in expanding its reach beyond this state. The lack of ranking in other regions might be an area for potential growth, but it also underscores the importance of solidifying their current market position before considering broader expansion strategies. This focused approach could be beneficial in maintaining brand quality and customer satisfaction within their established market.

Competitive Landscape

In the competitive landscape of the Colorado edible market, Nove Luxury Chocolate has shown a stable presence with a consistent rank of 19th in December 2025 and January 2026, despite a slight dip from 18th in November 2025. This stability is noteworthy when compared to competitors like Coda Signature, which saw a decline from 14th to 16th over the same period. Meanwhile, Candaze maintained a steady 17th rank, indicating a stronger foothold in the market. Billo showed an upward trend, moving from 26th to 20th, suggesting potential future competition for Nove Luxury Chocolate. Despite these dynamics, Nove Luxury Chocolate's sales remained relatively stable, although slightly lower than some competitors, indicating a need for strategic marketing efforts to enhance brand visibility and capture a larger market share.

Notable Products

In January 2026, the top-performing product for Nove Luxury Chocolate was the Glacier Mint Milk Chocolate 10-Pack (100mg), which climbed to the number one rank from second place in December 2025, with sales reaching 537 units. The Raspberry Bramble Dark Chocolate 10-Pack (100mg) maintained its position at rank two, demonstrating consistent popularity. The Honey Peanut Butter Milk Chocolate Bar (100mg) experienced a drop to third place from its previous top position in December. Island Coconut Dark Chocolate 10-Pack (100mg) secured the fourth spot, showing an upward trend from its absence in prior months. Meanwhile, Sea Salt Caramel Milk Chocolate (100mg) fell to fifth place, continuing a downward trend from its previous first-place ranking in October and November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.