Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

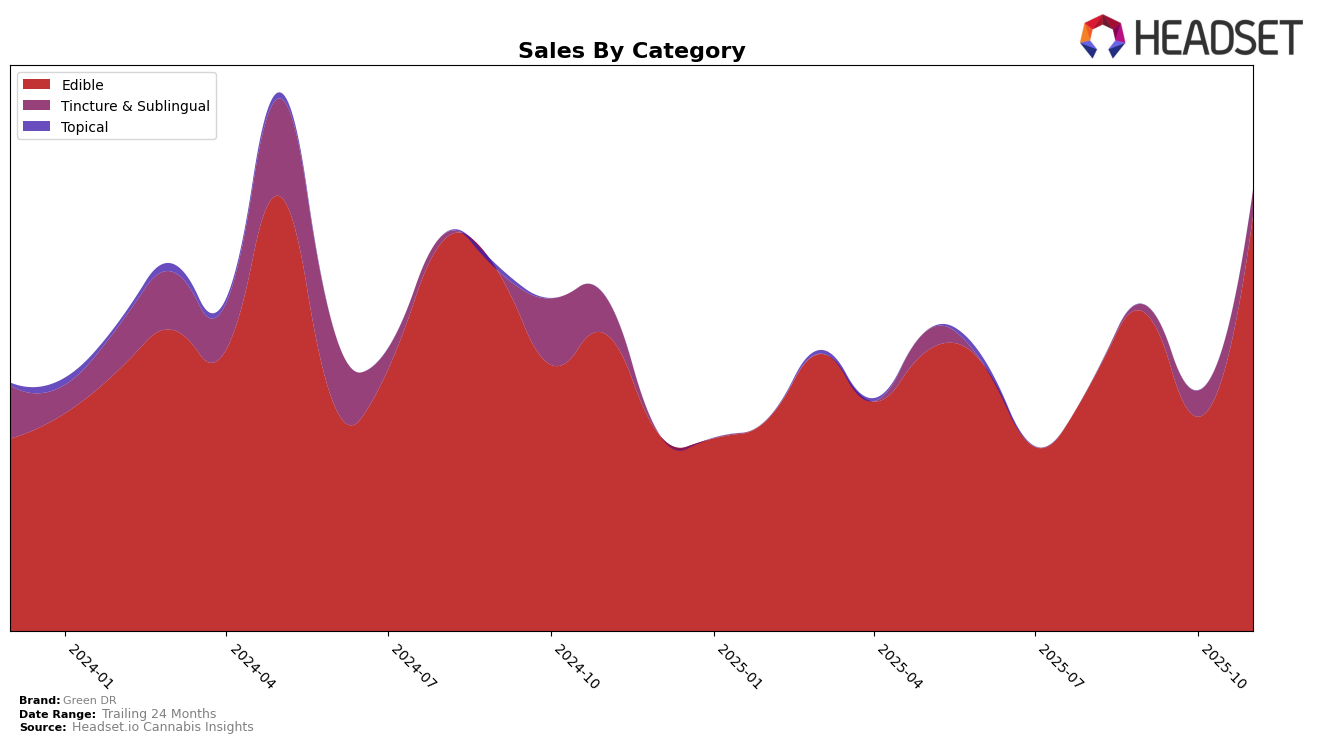

Green DR's performance in the Edible category in Michigan demonstrates a significant challenge as the brand did not make it into the top 30 rankings from August to November 2025. This absence from the rankings suggests that Green DR is struggling to capture market share in this category within the state. The lack of presence in the top tier could indicate either a highly competitive market or a need for strategic adjustments in product offerings or marketing tactics. Although specific sales figures for the months of August through October are not available, the November sales figure of $12,384 provides a glimpse into their market presence, albeit a limited one.

The absence of Green DR in the top 30 rankings across multiple months highlights a potential area of concern for the brand's strategic positioning and market penetration efforts in Michigan's Edible category. This trend suggests that the brand may need to reassess its approach to better compete with other brands that are capturing consumer interest and loyalty. While the data does not provide a complete picture of Green DR's overall performance, the lack of ranking indicates that there is a substantial opportunity for growth and improvement in this sector. The brand's performance trajectory will need careful monitoring to determine whether these trends are indicative of long-term challenges or temporary setbacks.

Competitive Landscape

In the Michigan edible market, Green DR has faced significant challenges in maintaining its competitive position, as evidenced by its absence from the top 20 rankings from August to November 2025. This indicates a need for strategic adjustments to regain market presence. In contrast, Hyman has shown a notable upward trajectory, climbing to the 81st position by November 2025, with sales increasing from September to November. Similarly, Vlasic Labs maintained a strong presence, although it experienced a dip in November. The consistent presence of Vlasic Labs and the upward movement of Hyman suggest that Green DR needs to innovate or enhance its marketing strategies to compete effectively in this dynamic market.

Notable Products

In November 2025, Green DR's top-performing product remains the CBD/CBN/CBG Trifecta Pain Relief Gummies 10-Pack, maintaining its number one rank for the fourth consecutive month with impressive sales of 272 units. The CBD/CBG/CBG Trifecta Pain Relief Gummies 30-Pack held steady at the second position, demonstrating consistent popularity. CBD Dog Treats 10-Pack climbed back to the third position after a brief dip to fourth in October. The CBD/CBN Sweet Dreams Gummies 50-Pack, which was not ranked in October, re-entered the rankings at fourth place. Meanwhile, the CBD Tincture maintained its fifth position, showing stable performance since September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.