Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

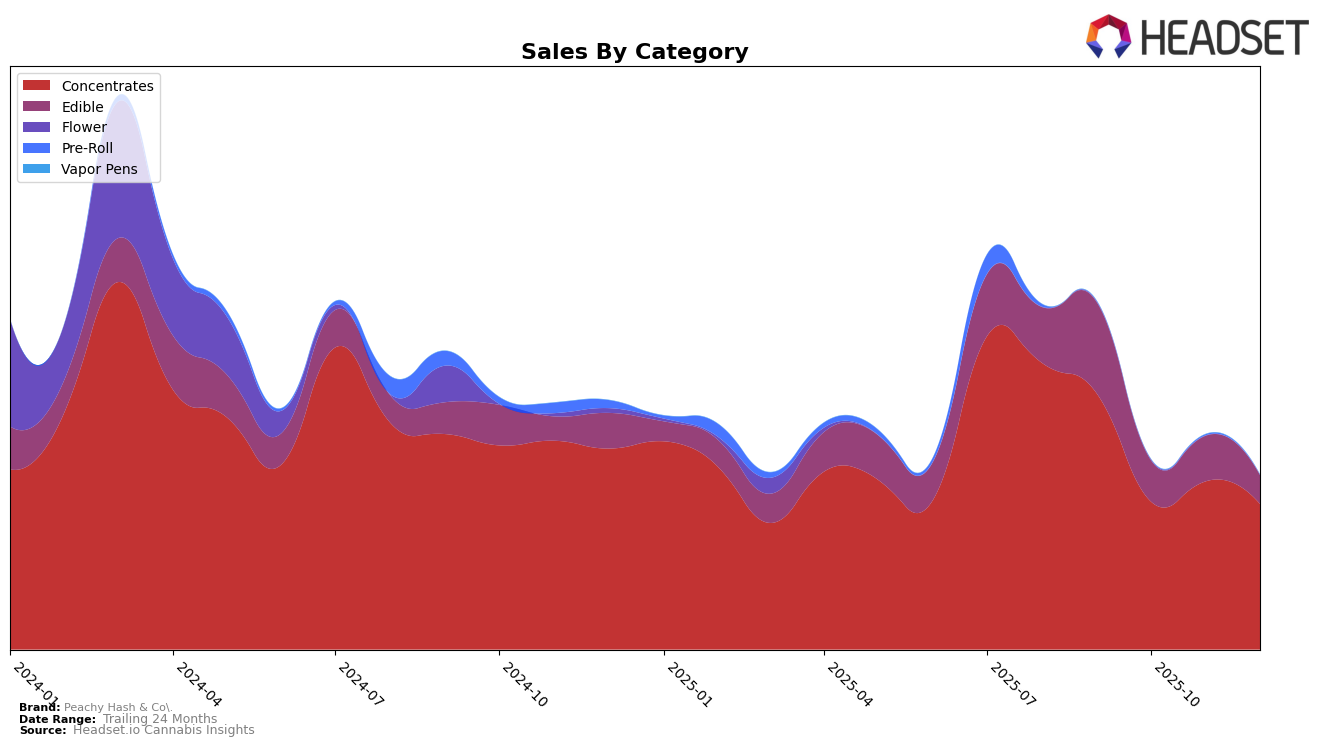

In the Michigan market, Peachy Hash & Co. has experienced notable fluctuations in its ranking across various categories. Specifically, within the Concentrates category, the brand saw a significant drop from a rank of 10 in September 2025 to 27 by December 2025. This decline indicates a potential challenge in maintaining market share, despite a brief improvement in November. Such volatility suggests that Peachy Hash & Co. may need to reassess its strategy or offerings in this category to regain its earlier standing. Meanwhile, the Edible category presents a more concerning scenario, as the brand failed to break into the top 30 in any month from September to December 2025, highlighting a potential area for growth or repositioning.

While the Concentrates category shows some resilience with a partial recovery in November, the overall trend for Peachy Hash & Co. in Michigan indicates challenges in sustaining its competitive edge. The sales figures reflect a downward trajectory, particularly evident in the Edible category, which saw a decrease in sales from October to December 2025. This trend underscores the importance of strategic adjustments to address market dynamics and consumer preferences. The absence of top rankings in Edibles suggests that Peachy Hash & Co. might benefit from innovation or marketing efforts to enhance its visibility and appeal in this segment.

Competitive Landscape

In the Michigan concentrates market, Peachy Hash & Co. has experienced notable fluctuations in its ranking and sales performance over the last quarter of 2025. Starting strong in September with a rank of 10, the brand saw a significant drop to 25 in October, followed by a slight recovery to 22 in November, and then a dip to 27 in December. This volatility contrasts with competitors like Bamn, which maintained a more stable presence, ranking consistently around 13 before dropping to 26 in December. Meanwhile, Peninsula Cannabis showed a positive trajectory, climbing from 39 in September to 29 by December, indicating a potential threat to Peachy Hash & Co.’s market share. Another competitor, Distro 10, demonstrated a similar pattern of recovery, ending December with a rank of 25, suggesting competitive pressure. Despite these challenges, Peachy Hash & Co. maintained relatively strong sales figures, particularly in November, which could be leveraged to regain a higher rank in the coming months.

Notable Products

In December 2025, the top-performing product for Peachy Hash & Co. was the Blue Raspberry Live Hash Rosin Gummies 20-Pack (200mg), maintaining its number one rank from the previous month with sales of 1022 units. The Cherry Live Rosin Gummies 20-Pack (200mg) followed closely, ranked second, slipping from its previous top position in October. Citrus Berry Live Rosin Gummies 20-Pack (200mg) consistently held the third position for two consecutive months. Strawberry Live Rosin Gummies 20-Pack (200mg) remained in fourth place, showing a decline in sales over the months. A new entry, Hash Burger Live Rosin (1g), debuted at fifth place in December, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.