Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

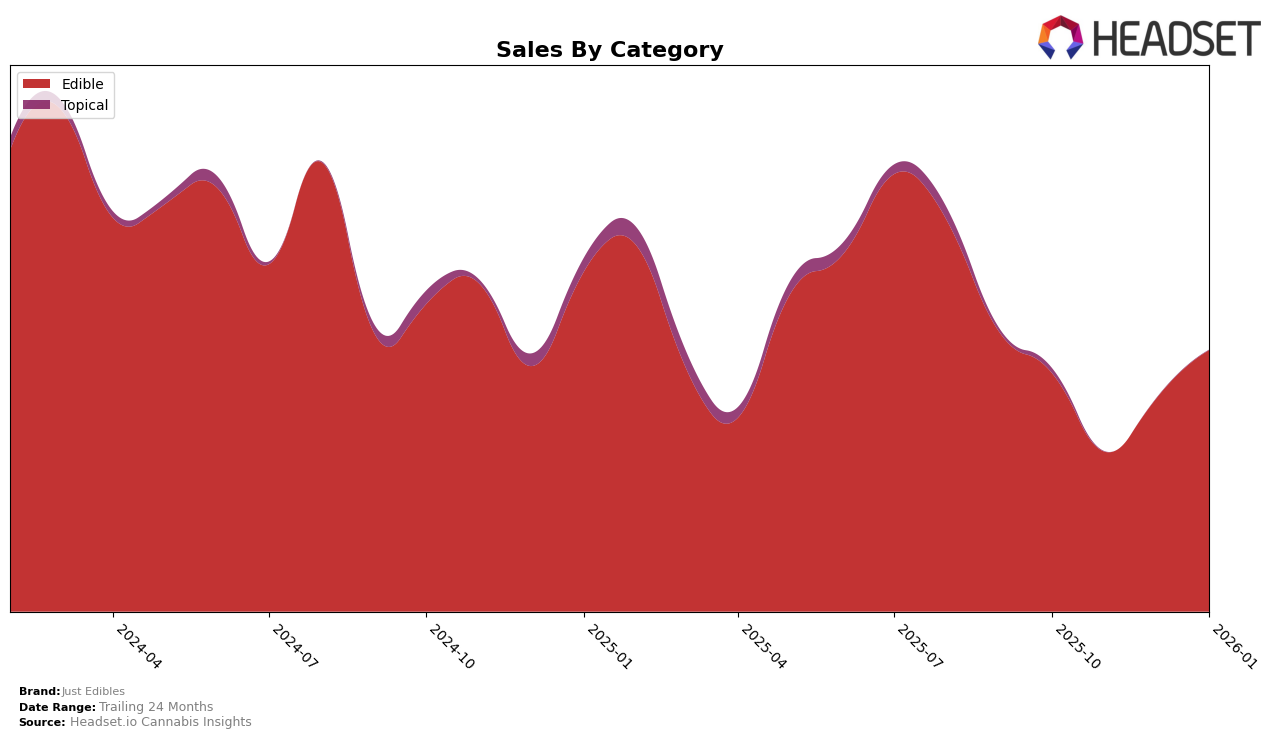

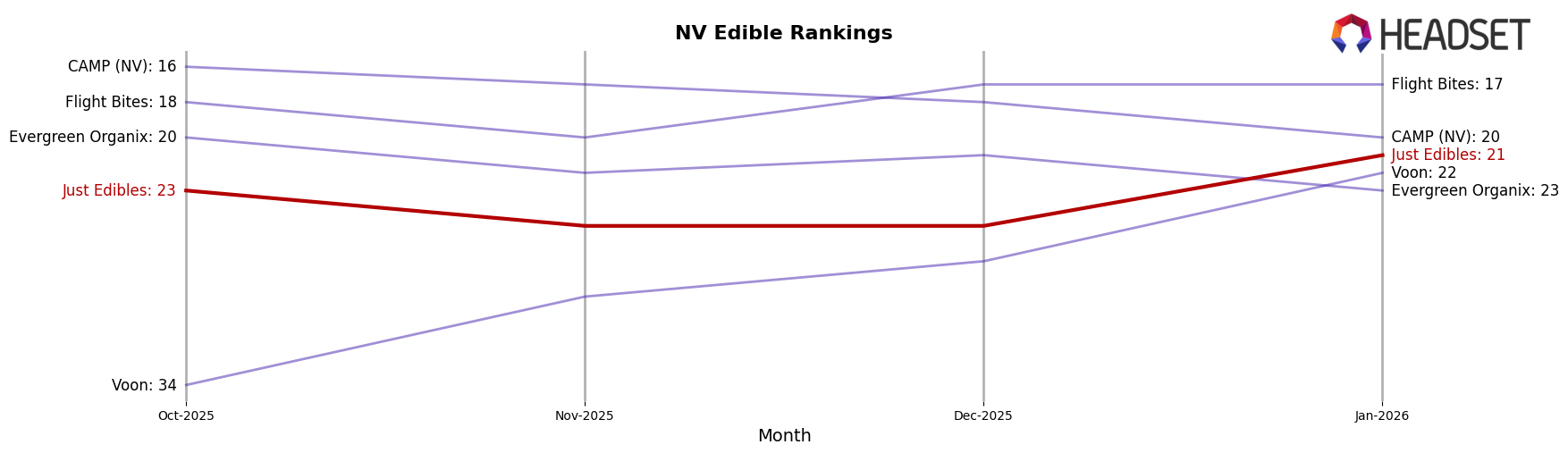

Just Edibles has shown a varied performance across different states and categories over the past few months. In the Edible category within Nevada, the brand has experienced fluctuations in its rankings. Starting at the 23rd position in October 2025, Just Edibles experienced a slight dip to 25th in both November and December, before making a recovery to 21st place by January 2026. This upward movement in January indicates a positive trend, suggesting that the brand may be gaining traction or responding effectively to market demands. Despite these fluctuations, their sales figures in Nevada rose from $30,879 in December to $37,920 in January, reflecting a robust start to the new year.

In other states and categories, the absence of Just Edibles from the top 30 rankings could be either a strategic focus on specific markets or a challenge in gaining a foothold. While the data for other states is not provided here, the ability to maintain or improve rankings in Nevada's Edible category suggests that Just Edibles might be leveraging certain competitive advantages or consumer preferences unique to that market. Observing their performance in Nevada could provide insights into potential strategies they might employ in other regions moving forward. For a more comprehensive understanding, one might consider examining additional data across different states and categories to see if similar trends are present.

Competitive Landscape

In the Nevada edibles market, Just Edibles experienced a notable fluctuation in its competitive positioning from October 2025 to January 2026. Initially ranked 23rd in October, Just Edibles saw a dip in November and December, ranking 25th, before rebounding to 21st in January. This recovery coincided with a significant increase in sales, suggesting a positive response to potential strategic adjustments. In contrast, Evergreen Organix consistently hovered around the 20th position but experienced a decline in sales by January. Meanwhile, CAMP (NV) maintained a stronger market presence, although its rank slipped slightly from 16th to 20th, accompanied by a sales drop in January. Flight Bites remained a formidable competitor, consistently ranking in the top 20 with robust sales figures, while Voon made a significant leap from 34th to 22nd, indicating a rapidly improving market position. These dynamics highlight the competitive pressures Just Edibles faces, emphasizing the importance of strategic innovation to maintain and improve its market rank and sales trajectory.

Notable Products

In January 2026, the top-performing product for Just Edibles was the Sour Quad-Dro Belts Rosin Gummies 20-Pack (100mg), leading the sales with a notable figure of 567 units sold. Following closely was the Graham Cracker Peanut Butter Cookie Sandwich 10-Pack (100mg), securing the second position with impressive sales. The Birthday Cake Cookie Cream Sandwich 10-Pack (100mg) ranked third, maintaining a consistent presence among the top sellers. The Blazeberry Sour Long Belt 2-Pack (100mg) retained its third position from November, indicating stable consumer preference. Lastly, the Cheese Crackers 20-Pack (100mg) rounded out the top four, demonstrating a strong debut in the rankings for January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.