Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Gron / Grön has demonstrated a significant presence in the Arizona edibles market, maintaining a consistent third-place ranking from November 2025 through January 2026, and improving to second place by February 2026. This upward movement is indicative of their growing popularity and market penetration in the state. In contrast, their performance in Alberta has seen some fluctuations, with a drop from fourth place in November 2025 to being unranked by February 2026, suggesting potential challenges or increased competition in the region. Similarly, in Nevada, Gron / Grön was ranked fourth in November 2025 but did not maintain a top 30 position in the subsequent months, highlighting a potential area of concern or shifting market dynamics.

In terms of market dominance, Gron / Grön has maintained a stronghold in both Missouri and New Jersey, securing the top spot in the edibles category from November 2025 to February 2026. This consistent performance underscores their strong brand presence and consumer loyalty in these states. On the other hand, their performance in British Columbia has been noteworthy, with a tight race for the top spot, alternating between first and second place over the months. Meanwhile, in Ontario, Gron / Grön held a steady second-place ranking, although the sales figures indicate a slight decline in February 2026, which may warrant attention to sustain their competitive edge.

Competitive Landscape

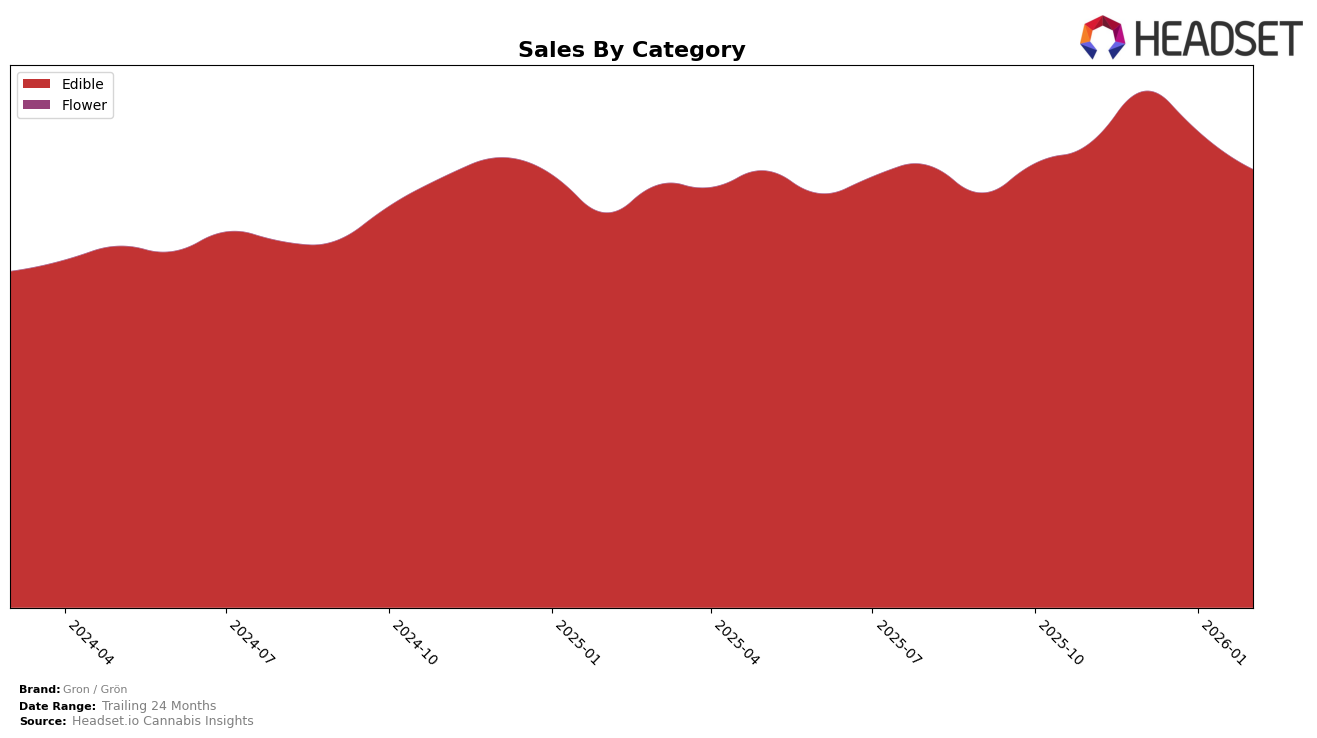

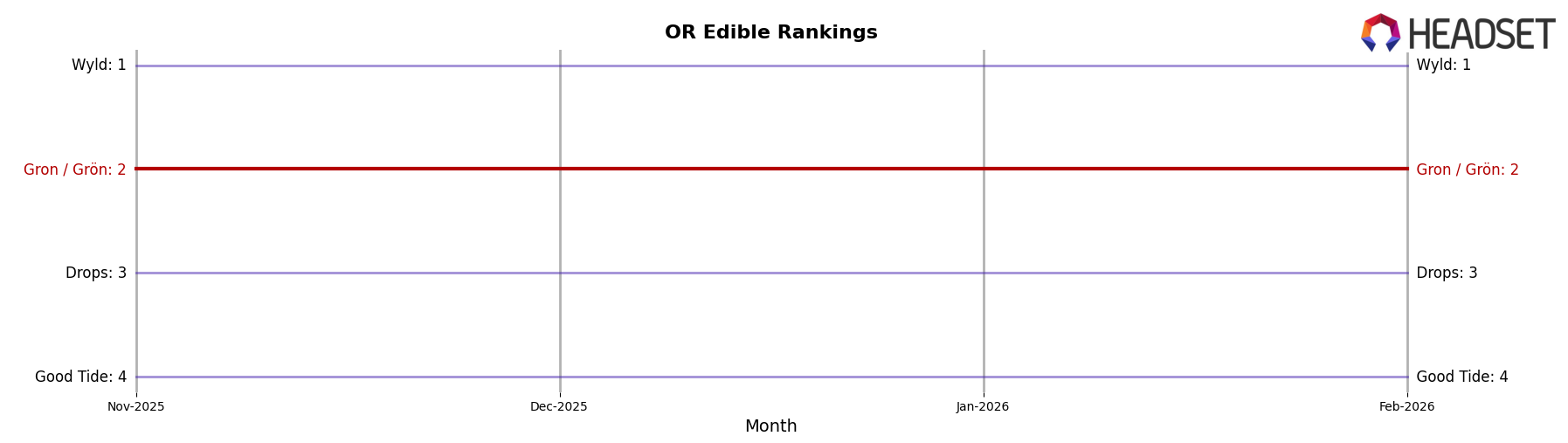

In the Oregon edible market, Grön has consistently maintained its position as the second-ranked brand from November 2025 through February 2026. Despite a steady rank, Grön's sales have experienced a slight downward trend, decreasing from November's figures to February's. This trend is notable when compared to Wyld, the leading brand, which also saw a sales decline but maintained a higher sales volume overall. Meanwhile, Drops and Good Tide have consistently held the third and fourth ranks, respectively, with sales figures significantly lower than Grön's. The stability in Grön's ranking amidst these fluctuations suggests a strong brand presence, but the downward sales trend indicates potential challenges in maintaining market share against competitors like Wyld, which continues to lead the category.

Notable Products

In February 2026, the top-performing product for Gron / Grön was the Pearls - CBG/THC 3:1 Blue Razzleberry Gummies 5-Pack, which regained its top position after falling to second place in January, with sales of 130,533. The CBD/CBN/THC 1:1:1 Blackberry Lemonade Pearls Gummies 5-Pack remained consistent, holding the second rank, despite a slight dip in sales. The CBN/THC 4:1 Strawberry Melon Pearls Gummies 5-Pack maintained its third position across the months, showing stable performance. The CBD/THC 4:1 Pomegranate Pearls Gummies 5-Pack and the CBD/CBN/THC 1:1:1 Sleepy Blackberry Lemonade Sugar Coated Pearl Gummies 10-Pack also retained their ranks, indicating steady demand. Overall, the top products for Gron / Grön in February continued to dominate the Edible category with slight fluctuations in sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.