Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

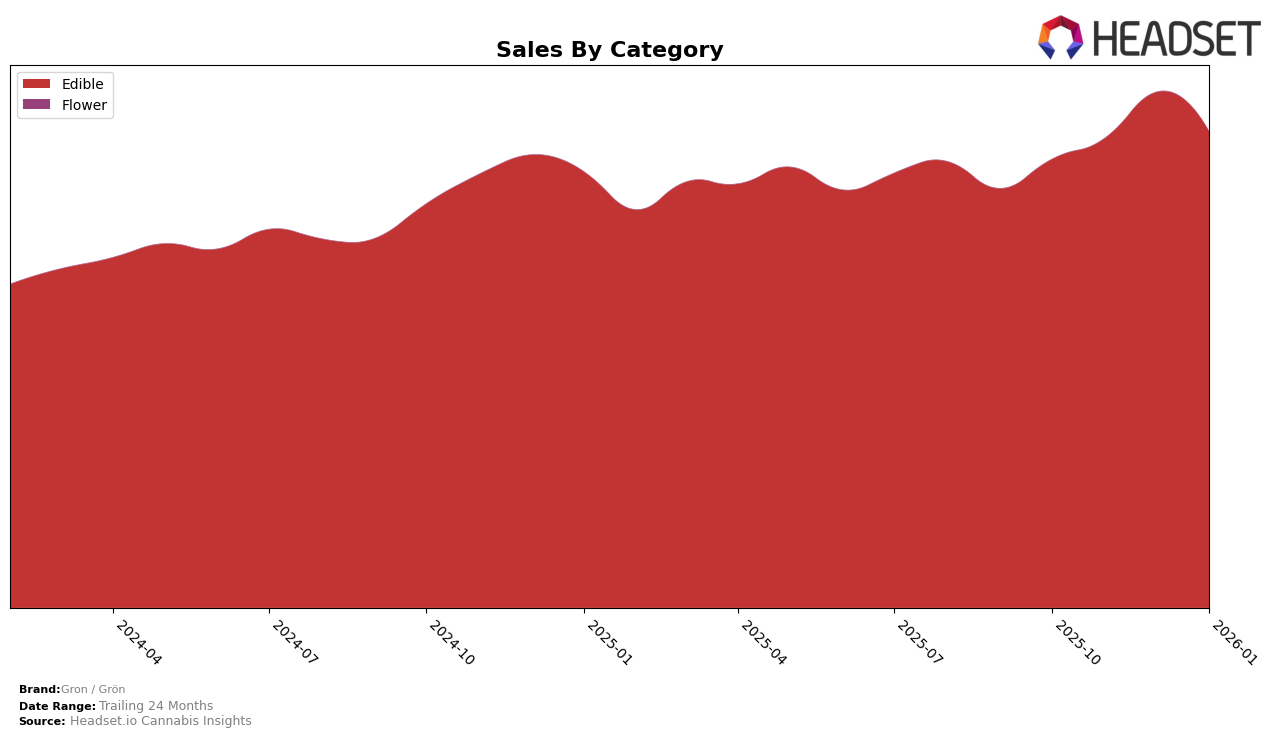

Gron / Grön has demonstrated a strong presence in the Edible category across various states and provinces, with notable performances in Missouri and New Jersey where they consistently held the number one spot from October 2025 to January 2026. In Alberta, the brand maintained a stable position at rank 4, except for a brief dip to rank 5 in December. Meanwhile, in Arizona, Gron / Grön retained a solid third place across the same period, showcasing their consistency in the market. However, in Nevada, the brand was in the top four for October and November, but it fell out of the top 30 in December and January, indicating potential challenges in maintaining market share in that region.

In British Columbia, Gron / Grön emerged as the top brand starting from November 2025, and continued to hold this position through January 2026, despite not being ranked in October, which suggests a significant upward trajectory. Similarly, in Ohio, the brand showed resilience by climbing from rank 5 in October to rank 2 in November, although it fluctuated slightly in subsequent months. Illinois saw Gron / Grön improve from rank 5 in October to a consistent rank 4 afterward, indicating steady growth. In contrast, the brand's performance in New York remained stable at rank 3, except for a brief dip to rank 4 in November, reflecting a strong foothold in the market. The brand's consistent rank 2 position in Ontario and Oregon further underscores their robust positioning in these regions.

Competitive Landscape

In the Oregon edible market, Grön consistently holds the second rank from October 2025 to January 2026, showcasing a stable position in a competitive landscape. The brand's consistent ranking is indicative of its strong market presence and customer loyalty. However, Grön faces significant competition from Wyld, which maintains the top spot throughout the same period, highlighting a gap in market leadership. Despite this, Grön's sales figures remain robust, with only a slight dip in January 2026, suggesting resilience in its sales strategy. Meanwhile, Drops and Good Tide consistently rank third and fourth, respectively, indicating a clear hierarchy in the market. This competitive environment underscores the importance for Grön to innovate and potentially expand its product offerings to challenge Wyld's dominance and further solidify its market position.

Notable Products

In January 2026, the top-performing product for Gron / Grön was the CBD/CBN/THC 1:1:1 Blackberry Lemonade Pearls Gummies 5-Pack, which ascended to the number one rank after maintaining the second position for the preceding three months, with sales reaching 152,712. The Pearls - CBG/THC 3:1 Blue Razzleberry Gummies 5-Pack, previously holding the top rank, moved to the second position. The CBN/THC 4:1 Strawberry Melon Pearls Gummies 5-Pack consistently held the third position throughout the analyzed months. The CBD/THC 4:1 Pomegranate Pearls Gummies 5-Pack remained stable at the fourth rank, while the CBD/CBN/THC 1:1:1 Sleepy Blackberry Lemonade Sugar Coated Pearl Gummies 10-Pack stayed at the fifth rank. Overall, the rankings for Gron / Grön products showed slight shifts, indicating a strong and consistent performance across their top edibles.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.