Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

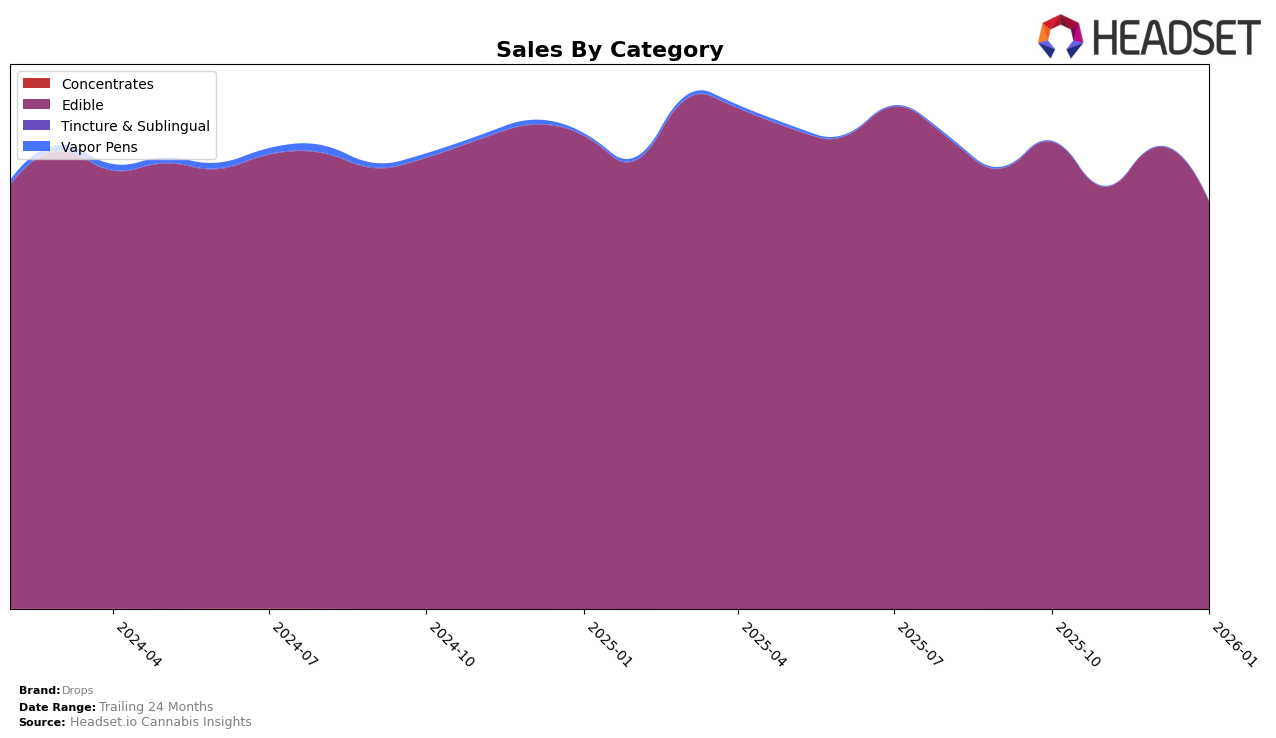

In the California market, Drops experienced some fluctuations in its rankings within the Edible category. Starting in October 2025, Drops was ranked 8th, but by January 2026, it had slipped to 12th place. This decline in ranking is accompanied by a noticeable drop in sales from approximately $984,043 in October 2025 to $661,970 in January 2026. This trend suggests that the brand may be facing increased competition or other market challenges in California. Conversely, in Oregon, Drops maintained a consistent 3rd place ranking throughout the same period, indicating strong brand loyalty or effective market strategies in this state.

In Washington, Drops held a steady position at 10th place in the Edible category from October 2025 to January 2026. This consistent ranking suggests stability in their market presence, though there is room for growth if they aim to climb higher in the rankings. The sales figures in Washington reflect a relatively stable performance, with minor fluctuations over the months. Interestingly, despite the challenges in California, Drops appears to have maintained a stronghold in both Oregon and Washington, highlighting regional differences in consumer preferences or brand strategies. However, it is worth noting that Drops did not appear in the top 30 rankings in any other states or provinces during this period, which could be seen as a potential area for expansion or improvement.

Competitive Landscape

In the Oregon edible market, Drops consistently held the third rank from October 2025 to January 2026, indicating a stable position amidst strong competition. Despite this consistency, Drops faces significant competition from leading brands like Wyld and Gron / Grön, which maintained the first and second ranks respectively during the same period. Wyld, in particular, has shown robust sales figures, consistently outperforming Drops, which suggests that while Drops is a strong contender, it may need to innovate or adjust its strategy to close the gap with the top two brands. Meanwhile, Good Tide and Mule Extracts consistently ranked below Drops, indicating that Drops has a solid foothold in the middle of the market. This stable ranking suggests that while Drops is not currently threatening the top two positions, it is also not in immediate danger of losing its spot to lower-ranked competitors.

Notable Products

In January 2026, the top-performing product from Drops was the CBN/CBD/THC 1:1:1 Black Currant Deep Relaxation Rosin Gummies 20-Pack, maintaining its number one rank from the previous months with sales reaching 19,039. The CBD/THC 2:1 Blackberry Soothing Solventless Rosin Jellies 20-Pack rose to second place, showing a consistent improvement from fifth in October 2025. The CBD/THC 2:1 Blackberry Jellies 2-Pack held the third position, a slight drop from its previous second-place ranking in December 2025. Active - Lemon Jelly (100mg) moved up to fourth place from fifth in December 2025, while Chill - Watermelon Rosin Gummies 20-Pack entered the rankings at fifth place. This shift in rankings indicates a dynamic competitive landscape within Drops' edible category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.