Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

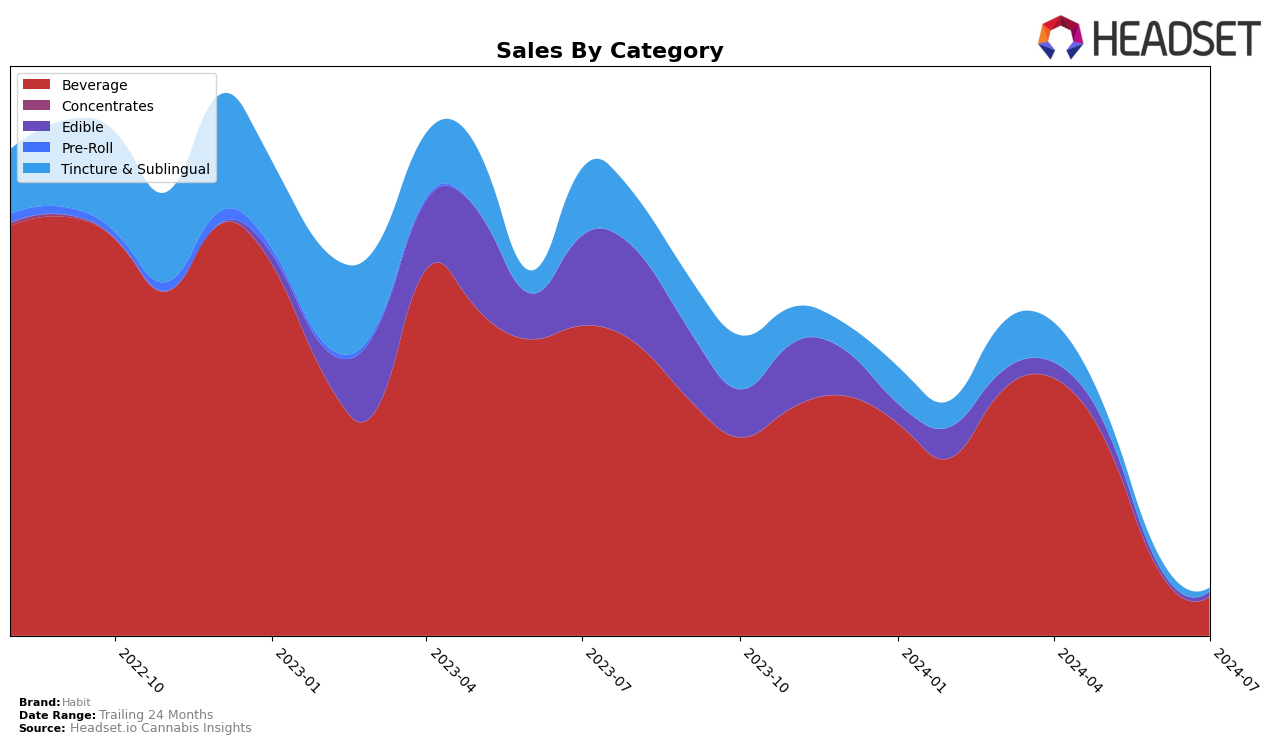

Habit has shown a dynamic performance across various categories and states, particularly within California. In the Beverage category, Habit maintained a steady rank of 11th place in both April and May of 2024 but experienced a decline to 18th and 21st places in June and July, respectively. This downward movement indicates a potential challenge in maintaining its market position amidst growing competition or changing consumer preferences. Conversely, in the Tincture & Sublingual category, Habit was ranked 16th in April but fell to 25th in May and did not make it into the top 30 in subsequent months. This suggests that Habit may need to reassess its strategy in this category to regain its footing.

The sales figures reflect these ranking changes, with a significant drop in the Beverage category from $167,600 in April to just $25,090 by July. This sharp decline could be indicative of seasonal trends, supply chain issues, or shifts in consumer demand. The Tincture & Sublingual category also saw a notable decrease in sales from $25,645 in April to $10,440 in May, with no rankings in June and July, highlighting a potential area for improvement. Overall, while Habit has had some strong months, the brand faces challenges in maintaining its market presence across these categories in California.

Competitive Landscape

In the competitive landscape of the California cannabis beverage market, Habit has experienced notable fluctuations in its ranking and sales over recent months. Starting from a strong position at rank 11 in both April and May 2024, Habit saw a decline to rank 18 in June and further dropped to rank 21 by July. This downward trend in ranking is mirrored by a significant decrease in sales, from $167,600 in April to just $25,090 in July. In contrast, competitors like Kikoko and Drink Loud have shown more stable or improving performances. Kikoko maintained a presence in the top 20 throughout the period, even improving slightly from rank 20 in June to rank 19 in July. Meanwhile, Drink Loud climbed from rank 27 in April to rank 20 in July, indicating a positive growth trajectory. The data suggests that Habit may need to reassess its market strategies to regain its competitive edge and reverse the current downward trend.

Notable Products

In July 2024, the top-performing product for Habit was Mango Sleepy Time Live Shot (100mg THC, 60ml, 2oz) with notable sales of 286 units. Following closely was Watermelon Lemonade Live Resin Shot (100mg THC, 2oz) in the second position. Electric Grape Sparkling Soda (100mg) held the third spot, moving down from fourth place in June. Lazy Peach Sparkling Craft Brew Soda (100mg) secured the fourth rank. Orange Water Soluble Syrup (1000mg THC, 2oz) dropped from second place in June to fourth in July, indicating a significant shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.