Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

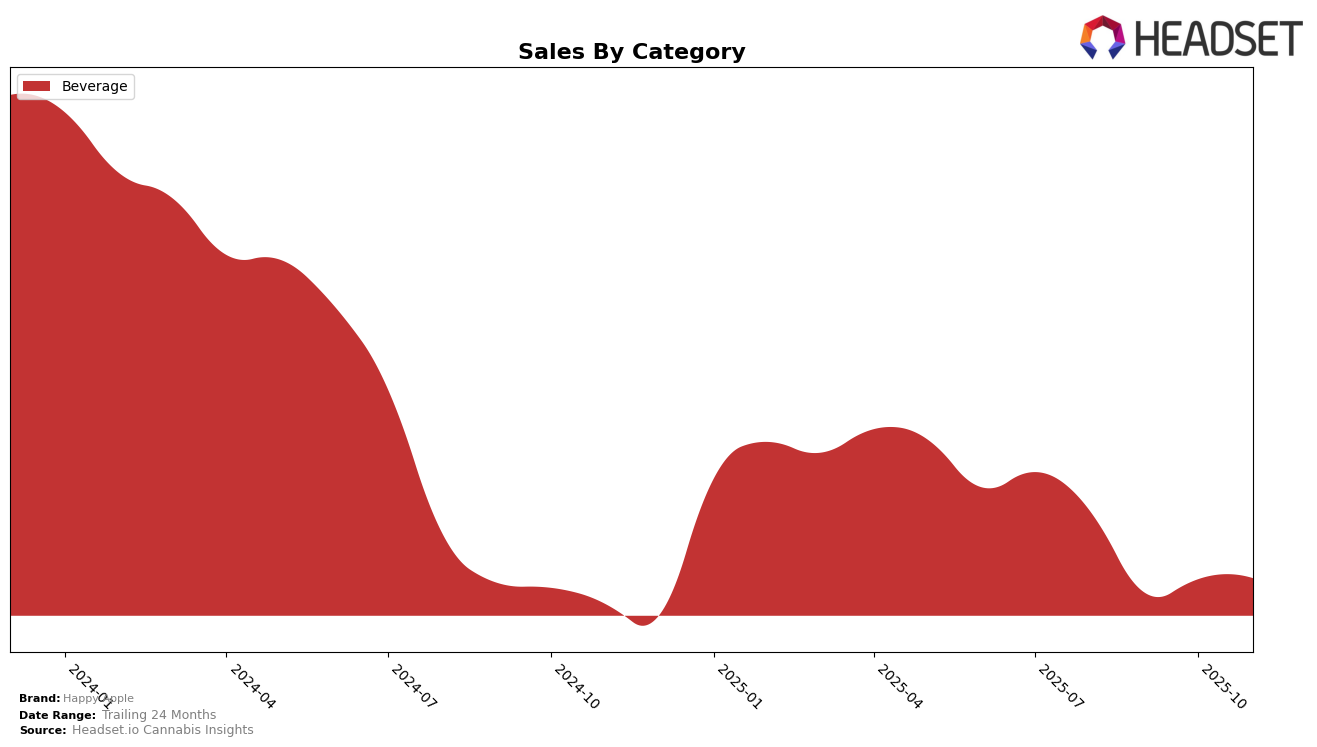

Happy Apple, a notable name in the cannabis beverage category, has shown a fluctuating presence across different states. In Washington, Happy Apple managed to secure the 18th rank in August 2025 within the beverage category, with sales reaching 10,274 units. However, the subsequent months saw the brand slipping out of the top 30 rankings, indicating a potential decline in market presence or competition intensifying in the beverage segment. This drop in ranking could suggest challenges in maintaining consumer interest or the emergence of stronger competitors in the Washington market.

Across other states, Happy Apple's absence from the top 30 rankings in recent months may highlight areas where the brand could focus on improving its market strategy or product offerings. The lack of rankings in states beyond Washington suggests that the brand might not have a strong foothold in those regions or that the competition is significantly fierce. This could be a strategic opportunity for Happy Apple to reassess its market entry strategies and explore avenues for growth in untapped regions. Observing these trends can provide insights into the brand's overall performance and potential areas for expansion.

Competitive Landscape

In the Washington beverage category, Happy Apple experienced a notable shift in its market presence from August to November 2025. Initially ranked 18th in August, Happy Apple's absence from the top 20 in subsequent months suggests a decline in its competitive standing. Meanwhile, Swell Edibles maintained a consistent 19th rank throughout this period, demonstrating steady growth in sales, which increased from August to November. Cormorant showed a fluctuating performance, dropping from 15th in August to 20th by November, with a corresponding decline in sales. Additionally, Sipsy entered the rankings in September at 20th, indicating emerging competition. These dynamics highlight the competitive pressures Happy Apple faces in retaining its market position amidst evolving consumer preferences and competitor strategies.

Notable Products

In November 2025, the top-performing product for Happy Apple was the Apple Cider Shot (100mg THC, 6.7oz, 200ml), maintaining its leading position for three consecutive months with sales of 261 units. The Infused Apple Cider (100mg) secured the second spot, climbing from third place in October 2025 with notable sales growth to 204 units. The CBD/THC 1:1 Apple Cider Shot (100mg CBD, 100mg THC, 6.7oz) ranked third, showing a slight decrease in sales compared to the previous month. The CBD/THC 1:1 Apple Sparkling Drink (100mg CBD, 100mg THC, 12oz) entered the rankings at fourth place, indicating a positive reception in the market. The Apple Cider Sparking Drink (10mg THC, 12oz) fell to fifth place, continuing its downward trend from the top position in August 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.