Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

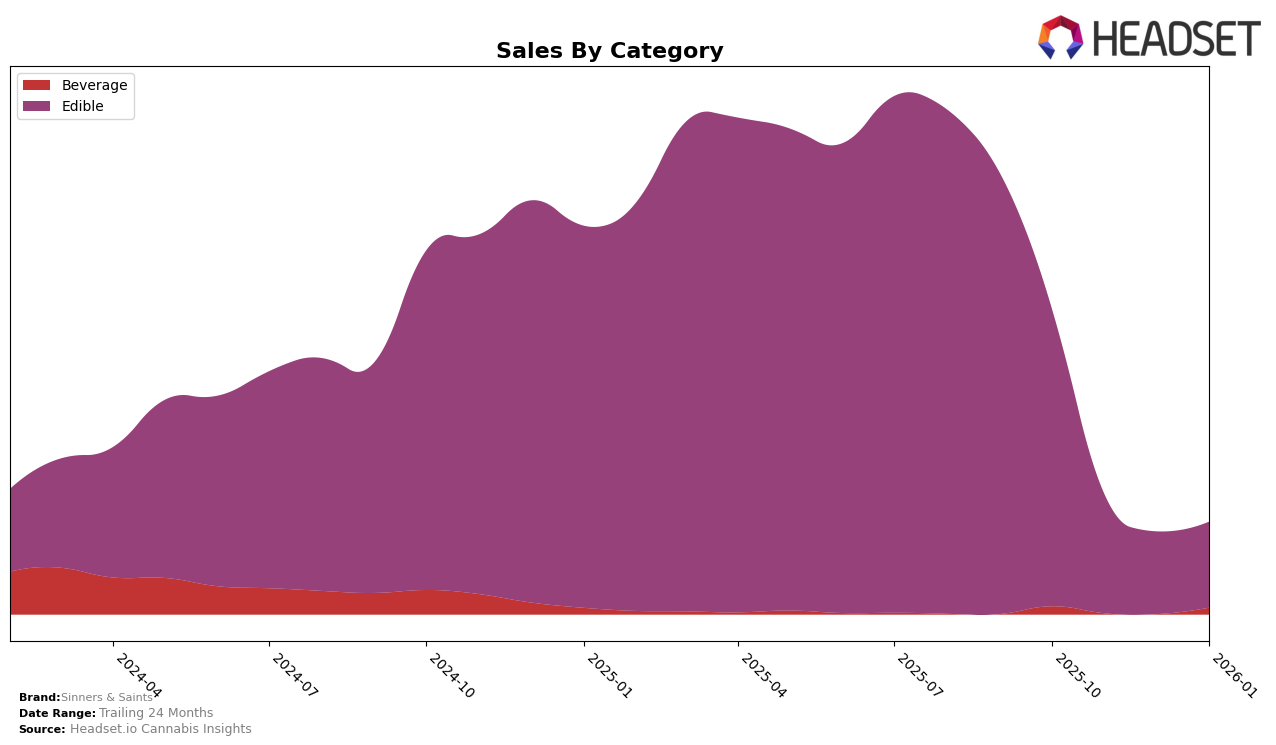

Sinners & Saints has demonstrated fluctuating performance in the Edible category across different states, with notable movements in Washington. In October 2025, the brand held the 18th position, indicating a strong presence in the market. However, by December 2025, they fell out of the top 30, only to re-enter at the 30th spot by January 2026. This movement suggests a volatile market presence, potentially due to shifts in consumer preferences or competitive pressures. The drop from October to November was significant, with sales plummeting from over $111,000 to just above $44,000, highlighting a critical period of decline that the brand needs to address.

Despite these challenges, the return to the 30th position in January 2026 in Washington suggests some recovery or strategic adjustments by Sinners & Saints. The brand's ability to re-enter the rankings indicates resilience and potential for growth if they can stabilize their performance. However, the absence from the top 30 in December 2025 could be seen as a warning sign, urging the brand to analyze market conditions and consumer trends more closely. The fluctuating rankings underscore the importance of consistent market engagement and strategic planning to maintain a competitive edge in the dynamic cannabis industry.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Washington, Sinners & Saints has experienced notable fluctuations in its ranking over the past few months. Starting from a strong position at 18th in October 2025, the brand saw a decline to 27th in November and further slipped to 31st in December before slightly recovering to 30th in January 2026. This downward trend in rank coincides with a significant drop in sales from October to November, although sales have stabilized somewhat in the following months. In contrast, competitors like Agro Couture and Goodies have shown a gradual improvement in their rankings, with Agro Couture moving from 31st to 29th and Goodies climbing from 33rd to 28th by January 2026. These shifts suggest that Sinners & Saints faces increasing competition, particularly from brands that are gaining traction in the market, highlighting the need for strategic adjustments to regain its competitive edge.

Notable Products

In January 2026, the top-performing product from Sinners & Saints was the CBN/CBD/THC 2:2:1 Blue Raspberry Gummies 10-Pack, maintaining its first-place ranking from the previous two months with sales reaching 976 units. The CBD/CBC/CBG/THC 1:1:1:1 Mango Passionfruit Gummies 10-Pack held steady in the second position, although its sales declined to 390 units. The CBN/CBD/THC 2:2:1 Sour Berry Pomegranate Gummies 10-Pack improved its standing to third place, showing a slight recovery in sales. The CBG/THC 2:1 Sour Cherry Gummies 10-Pack slipped to fourth place, while the CBD/CBC/CBG/THC 1:1:1:1 Strawberry Kiwi Gummies 10-Pack remained in fifth place, continuing its downward trend. Overall, the rankings reflect slight shifts in consumer preferences within the edible category for Sinners & Saints.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.