Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

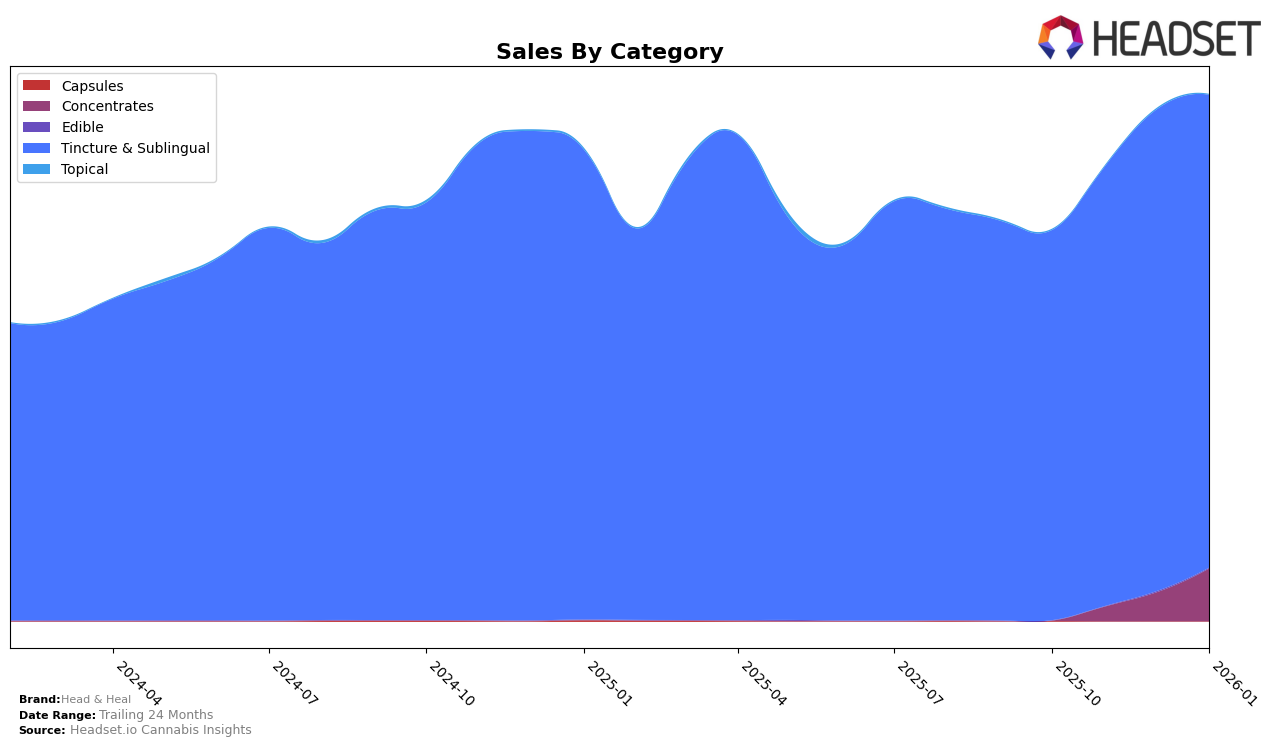

In the New York market, Head & Heal has shown significant progress in the Concentrates category. Notably, the brand did not feature in the top 30 rankings for October 2025, but by January 2026, it had climbed to 24th place. This upward trajectory suggests a growing acceptance and popularity of their products in this category. The sales figures corroborate this trend, with a notable increase from $10,647 in October 2025 to $39,031 in January 2026. Such a leap in both rank and sales volume indicates a positive market response and improved brand positioning over the months.

In contrast, Head & Heal has maintained a consistent performance in the Tincture & Sublingual category in New York. The brand has consistently held the 2nd position from October 2025 through January 2026, indicating a strong and stable market presence. While the sales figures have shown some fluctuations, the brand's ability to retain its high ranking suggests a loyal customer base and consistent demand. This stability in the Tincture & Sublingual category, coupled with the growth seen in Concentrates, paints a picture of a brand that is both resilient and expanding its market reach.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in New York, Head & Heal consistently holds the second rank from October 2025 to January 2026. Despite maintaining its position, Head & Heal faces stiff competition from Ayrloom, which dominates the market as the top-ranked brand with significantly higher sales figures. Head & Heal's sales show a steady upward trend, peaking in December 2025, but still remain less than half of Ayrloom's sales. Meanwhile, Mfny (Marijuana Farms New York) and Veterans Choice Creations (VCC) consistently rank third and fourth, respectively, with sales figures significantly lower than those of Head & Heal. This competitive positioning indicates that while Head & Heal is a strong player in the market, there is a substantial gap to bridge to challenge the leading brand, Ayrloom, in terms of sales volume.

Notable Products

In January 2026, the Max Strength THC Tincture (1000mg THC, 30ml) maintained its position as the top-performing product for Head & Heal, with sales reaching 1924 units. Following closely, the CBD/THC/CBN 2:1:2 Sleep Tincture (600mg CBD, 300mg THC, 600mg CBN, 30ml) held steady in second place, demonstrating consistent demand. The CBD/THC 2:1 Relief Tincture (600mg CBD, 300mg THC, 30ml) also retained its third-place ranking, although its sales dipped slightly compared to December 2025. Notably, the Hybrid RSO Dablicator (1g) climbed to fourth place, surpassing the CBG/THC 4:1 Focus Tincture (600mg CBG, 150mg THC, 30ml, 1oz), which dropped to fifth. The rankings show stability at the top, with some shifts in the lower ranks indicating changing consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.