Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

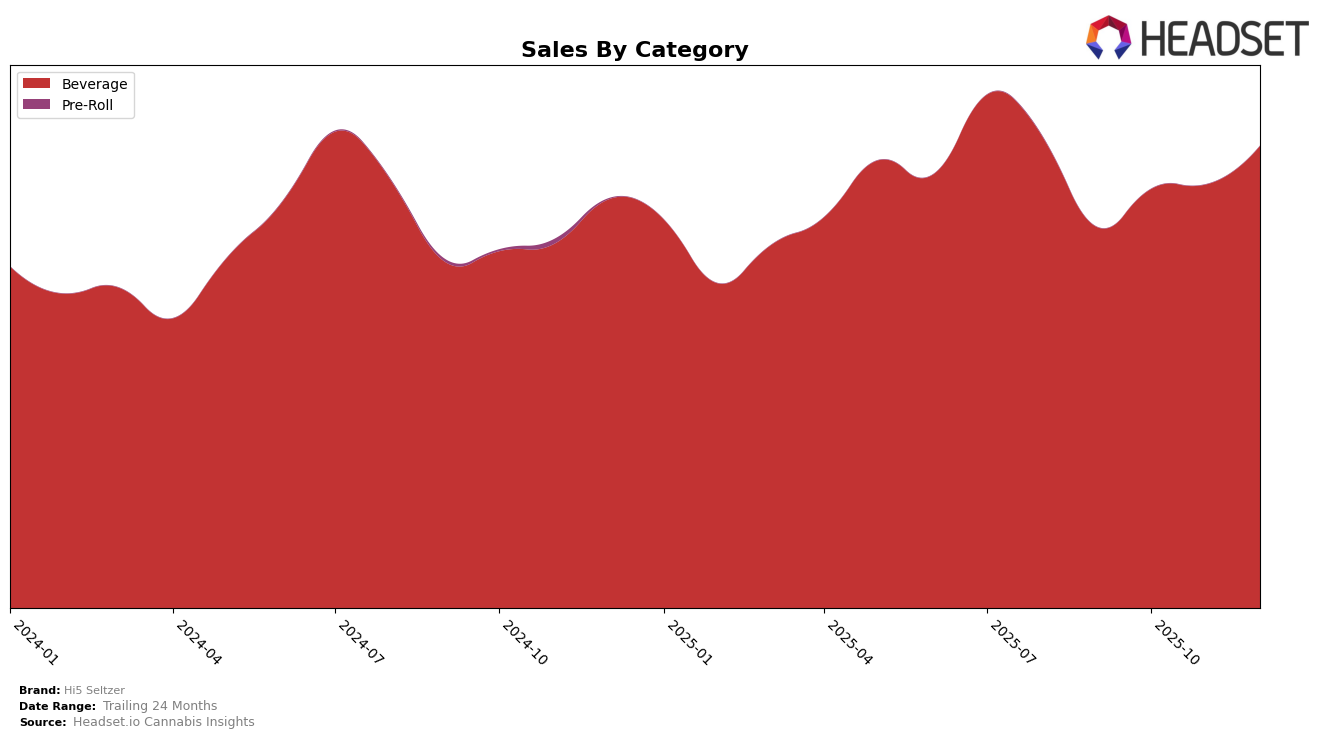

Hi5 Seltzer has demonstrated a strong performance in the Beverage category within Massachusetts. Over the last four months of 2025, the brand consistently maintained a top-tier position, ranking second from September to November and climbing to the top spot in December. This upward movement in December indicates a positive reception and growing popularity among consumers in the state. Notably, the brand's sales figures showed a steady increase each month, with a significant jump from November to December, suggesting successful marketing strategies or seasonal demand factors at play.

Despite the impressive performance in Massachusetts, Hi5 Seltzer's absence from the top 30 rankings in other states or provinces raises questions about its market penetration and brand recognition beyond this region. This could imply either a focus on strengthening its presence in Massachusetts or challenges in expanding its footprint across other markets. The brand's ability to maintain its leading position in Massachusetts while potentially exploring new markets could be crucial for its long-term growth and success. Observing how Hi5 Seltzer navigates these dynamics in the coming months will be key to understanding its broader market strategy.

Competitive Landscape

In the Massachusetts beverage category, Hi5 Seltzer has shown a notable upward trajectory in the rankings, culminating in a rise from the consistent second position from September to November 2025 to claiming the top spot in December 2025. This ascent can be attributed to a steady increase in sales, which saw a significant boost in December. The primary competitor, Levia, maintained the leading position for three consecutive months but experienced a slight decline in December, allowing Hi5 Seltzer to overtake it. Meanwhile, Good Feels Inc remained stable in third place throughout this period, indicating a less dynamic market presence compared to the top two brands. This shift in rankings highlights Hi5 Seltzer's growing appeal and market penetration, suggesting a positive trend for future sales performance in the region.

Notable Products

In December 2025, the top-performing product from Hi5 Seltzer was Black Cherry Infused Seltzer 4-Pack (20mg THC, 12oz), which climbed back to the number one spot with impressive sales of 2301 units. Peach Mango Infused Seltzer (5mg) dropped to second place, despite being the top seller in the previous two months. Cranberry Lime Infused Seltzer 4-Pack (20mg THC, 355ml) made a notable appearance at third place, showing a significant improvement from October when it ranked fourth. Watermelon Infused Seltzer (5mg) secured the fourth position, maintaining a consistent performance over the months. Lime Infused Seltzer 4-Pack (20mg) rounded out the top five, marking its debut in the rankings this month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.