Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

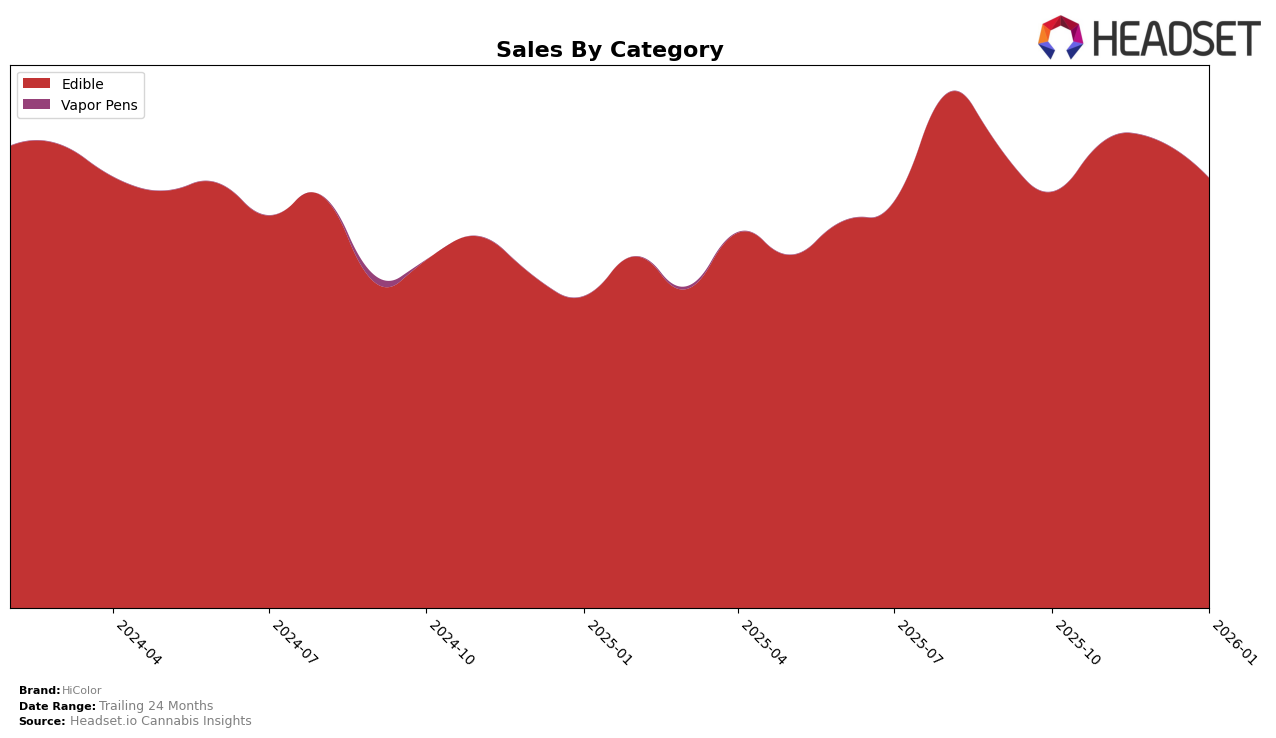

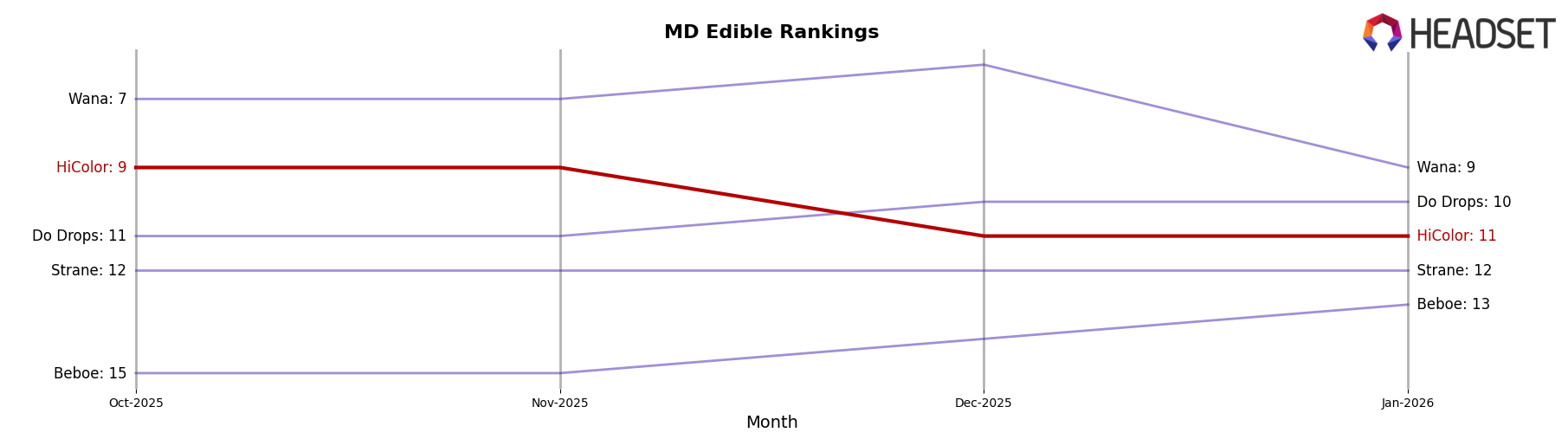

In the state of Maryland, HiColor has maintained a steady presence in the Edible category, consistently ranking at 9th place in both October and November 2025. However, there was a slight dip in December 2025 and January 2026, where the brand ranked 11th. Despite this minor decline in ranking, HiColor's sales in Maryland showed a notable increase in November 2025, indicating a strong market performance before the subsequent decline in January 2026. This suggests that while the brand is well-established in Maryland, there may be competitive pressures impacting its ranking stability.

In contrast, HiColor's performance in New York reveals a more dynamic trend. Initially, the brand was not in the top 30 in October 2025, ranking 44th, and even slipped to 50th in December 2025. However, a significant improvement was observed in January 2026 when HiColor climbed to 37th place. This upward movement in the rankings coincided with a substantial increase in sales for the same month, suggesting a positive reception and possibly successful marketing strategies or product launches in New York. The brand's journey in New York reflects a growing presence, although it still faces challenges in breaking into the top tier of the Edible category.

Competitive Landscape

In the Maryland edible cannabis market, HiColor has experienced some fluctuations in its competitive standing over the past few months. Starting in October 2025, HiColor was ranked 9th, maintaining this position through November before slipping to 11th in December and January 2026. This decline in rank is notable given that competitors like Wana improved their position from 7th to 6th before dropping to 9th, while Do Drops consistently held the 10th spot. Despite the rank drop, HiColor's sales remained relatively stable, indicating a potential resilience in customer loyalty or market presence. However, the consistent performance of Strane and the upward trend of Beboe, which improved from 15th to 13th, suggest increasing competition that may require strategic adjustments from HiColor to regain and maintain a higher rank.

Notable Products

In January 2026, Cherry RSO Gummies 10-Pack (100mg) maintained its top position from December, leading HiColor's sales with 3390 units sold. The Blueberry RSO Gummy Gummies 10-Pack (100mg) rose to second place, consistently climbing the ranks from third in December. CBN/THC 1:1 Blackberry Dream Gummies 10-Pack (100mg CBN, 100mg THC) experienced a drop from second to third place compared to the previous month. Pineberry RSO Gummy Cubes 10-Pack (100mg) remained stable in fourth place, showing consistent performance over the past months. Notably, Oxnard Strawberry Gummy Cubes 10-Pack (100mg) entered the rankings at fifth place, indicating a new contender in HiColor's lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.