Feb-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

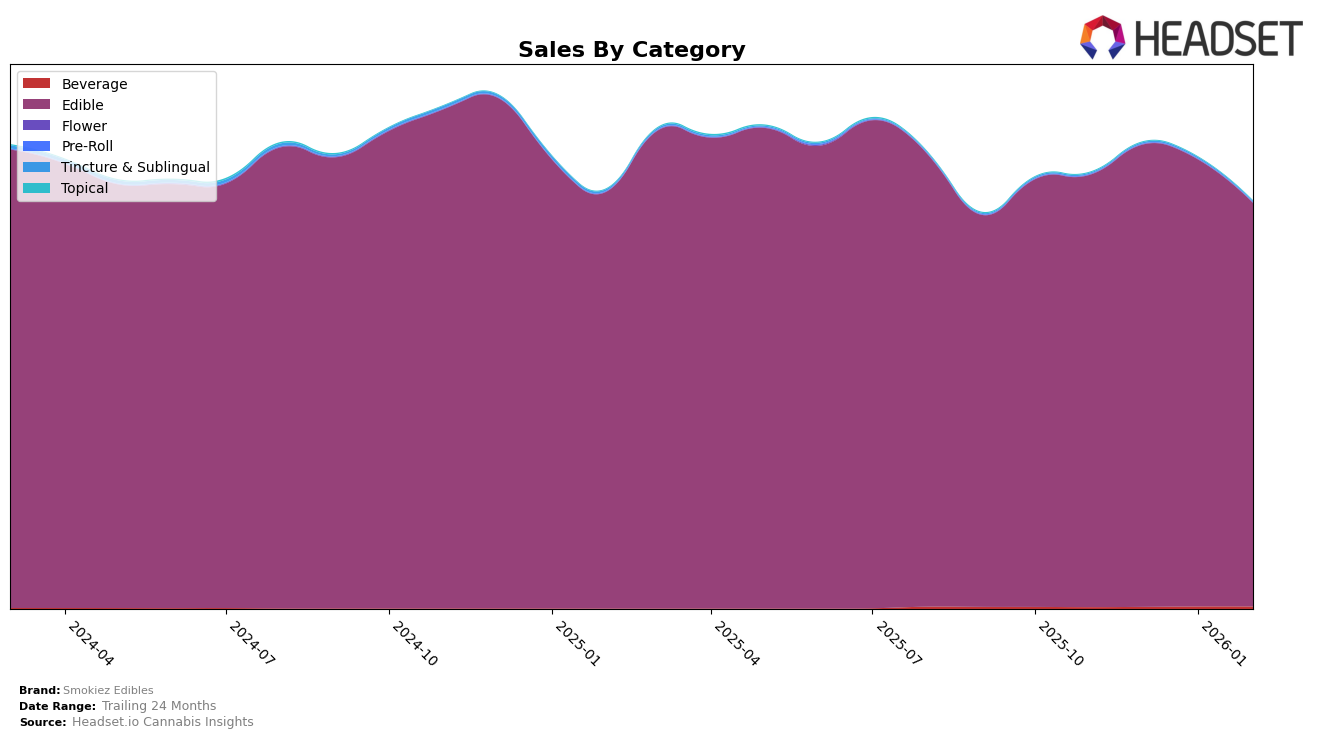

Smokiez Edibles has shown varied performance across different states, demonstrating both stability and fluctuation in their rankings. In Arizona, the brand maintained a consistent position around the 5th and 6th spots, with a notable sales increase from November 2025 to February 2026. Similarly, in Missouri, Smokiez Edibles held a steady 4th position, though sales saw a slight decline over the months. Meanwhile, in Michigan, the brand struggled to stay within the top 30, ranking 42nd in November 2025 and dropping out of the top rankings in December 2025 and February 2026, indicating challenges in maintaining a foothold in this market.

In Illinois, Smokiez Edibles experienced a drop in rankings from 18th in December 2025 to 21st by February 2026, alongside a decrease in sales, suggesting a potential area for improvement. Conversely, in Colorado, the brand improved slightly, moving from 12th to 11th place by February 2026, with sales showing a gradual upward trend. New York presented a similar scenario, where the brand's ranking slipped from 11th to 13th, yet sales remained relatively stable. These movements highlight the brand's varying market dynamics and the competitive landscape they face in different regions.

Competitive Landscape

In the competitive landscape of the Missouri edible cannabis market, Smokiez Edibles consistently held the 4th rank from November 2025 to February 2026, indicating a stable position amidst fluctuating sales figures. Despite a downward trend in sales over these months, Smokiez Edibles maintained its rank, suggesting a loyal customer base or effective market strategies. In contrast, Wyld consistently outperformed Smokiez Edibles, holding the 3rd rank with higher sales figures, while Good Day Farm dominated the 2nd position with a noticeable sales lead. Meanwhile, Illicit / Illicit Gardens and Good Taste showed some rank volatility, indicating potential opportunities for Smokiez Edibles to capitalize on any market shifts. This competitive analysis highlights the importance for Smokiez Edibles to innovate and possibly expand its product offerings to challenge its higher-ranked competitors and boost its sales trajectory.

Notable Products

In February 2026, the top-performing product for Smokiez Edibles was the Sour Watermelon Live Resin Gummies 10-Pack (100mg), reclaiming the number one spot with sales of 24,301 units. Following closely was the Sativa Sour Peach Fruit Chews 10-Pack (100mg), which held the second position, a slight drop from its first-place ranking in January 2026. The Hybrid Sweet Watermelon Gummies 10-Pack (100mg) maintained its third-place position, consistent with its January ranking. The Indica Sour Blue Raspberry Fruit Chews 10-Pack (100mg) remained steady at fourth place, mirroring its January performance. Lastly, the Indica Sweet Blue Raspberry Fruit Chews 10-Pack (100mg) consistently held the fifth position across the months, showing stable sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.