Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

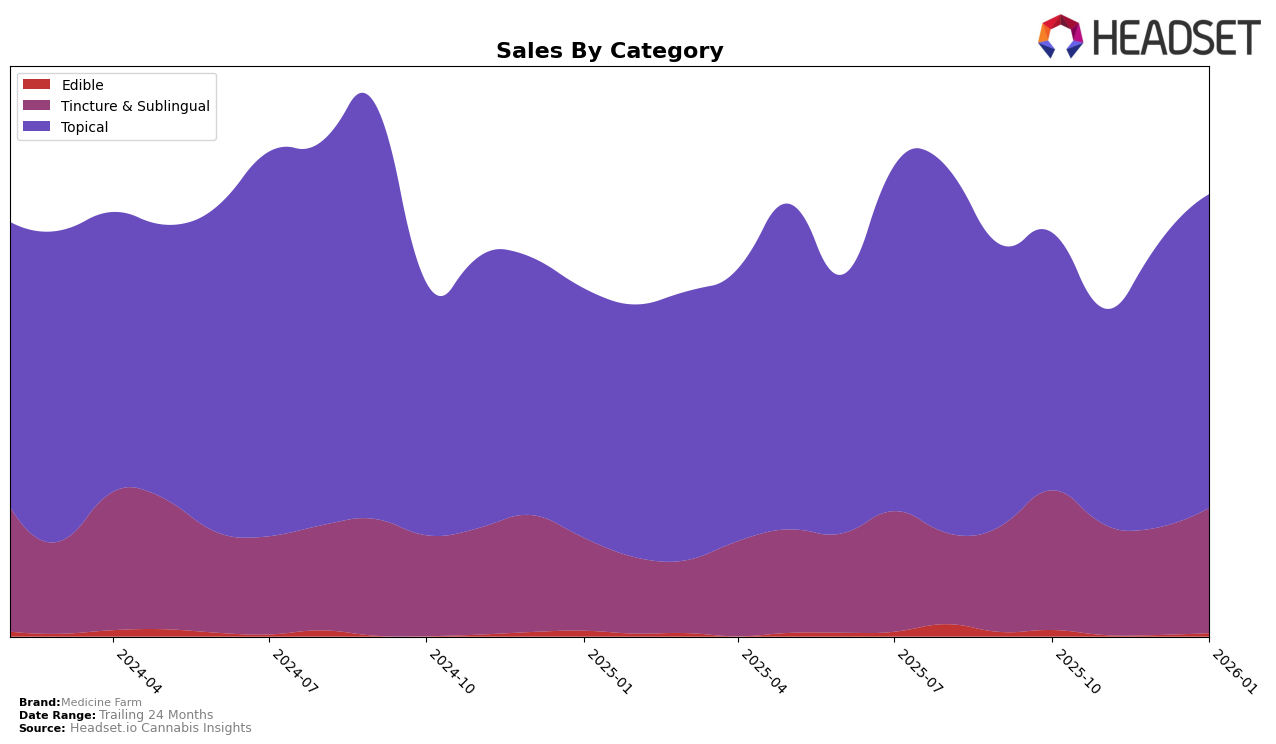

Medicine Farm has shown a mixed performance across its product categories in Oregon. In the Tincture & Sublingual category, the brand experienced a slight decline in rankings from October to December 2025, moving from 5th to 8th place, before slightly improving to 7th in January 2026. Despite this fluctuation in rankings, the sales figures indicate a recovery in January 2026, suggesting a potential rebound. However, it's important to note that Medicine Farm did not manage to break into the top 5 during this period, which could be seen as a challenge in maintaining competitive positioning within this category.

Conversely, Medicine Farm has maintained a strong and consistent presence in the Topical category in Oregon, consistently holding the 2nd rank from October 2025 through January 2026. This stability in ranking is complemented by a positive trend in sales, with a notable increase in January 2026. This suggests that Medicine Farm's products in the Topical category are well-received and have a steady consumer base. The consistency in this category highlights a solid market strategy and potentially a strong brand loyalty among consumers. However, the brand's inability to capture the top spot may indicate room for growth and improvement.

Competitive Landscape

In the Oregon Topical cannabis market, Medicine Farm consistently maintained its position as the second-ranked brand from October 2025 to January 2026. Despite this stability, Medicine Farm faces stiff competition from High Desert Pure, which has consistently held the top rank with significantly higher sales figures. Medicine Farm's sales showed a positive trend, particularly with a notable increase in January 2026, suggesting a potential for growth. Meanwhile, Synergy Skin Worx fluctuated in rank, dropping from third to fifth before recovering to fourth, indicating a less stable market presence. Physic Cannabis Therapy emerged in the rankings in January 2026, debuting at fourth place, which could signal new competition. Medicine Farm's consistent ranking amidst these dynamics highlights its resilience and potential for leveraging its stable market position to capture more market share.

Notable Products

In January 2026, Medicine Farm's top-performing product was the CBD/THC 1:1 Mini Phoenix Blend Salve (125mg CBD, 125mg THC, 0.25oz) in the Topical category, maintaining its number one rank from November 2025 and achieving sales of 360 units. The CBD/THC 1:1 Phoenix Blend Salve (1000mg CBD, 1000mg THC, 2oz) ranked second, consistent with its performance in December 2025. The CBD/THC/CBN 2:3:1 Lunar Elixir Tincture (600mg CBD, 900mg THC, 300mg CBN, 30ml, 1oz) rose to third place, showing a notable increase from its fourth position in the previous two months. A newcomer, Extra Strength Dragons Blend Balm (65mg THC, 0.25oz), entered the rankings at fourth place. Phoenix Blend Balm (1000mg THC, 2oz) dropped to fifth, indicating a decrease in sales compared to its higher rankings in prior months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.