Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

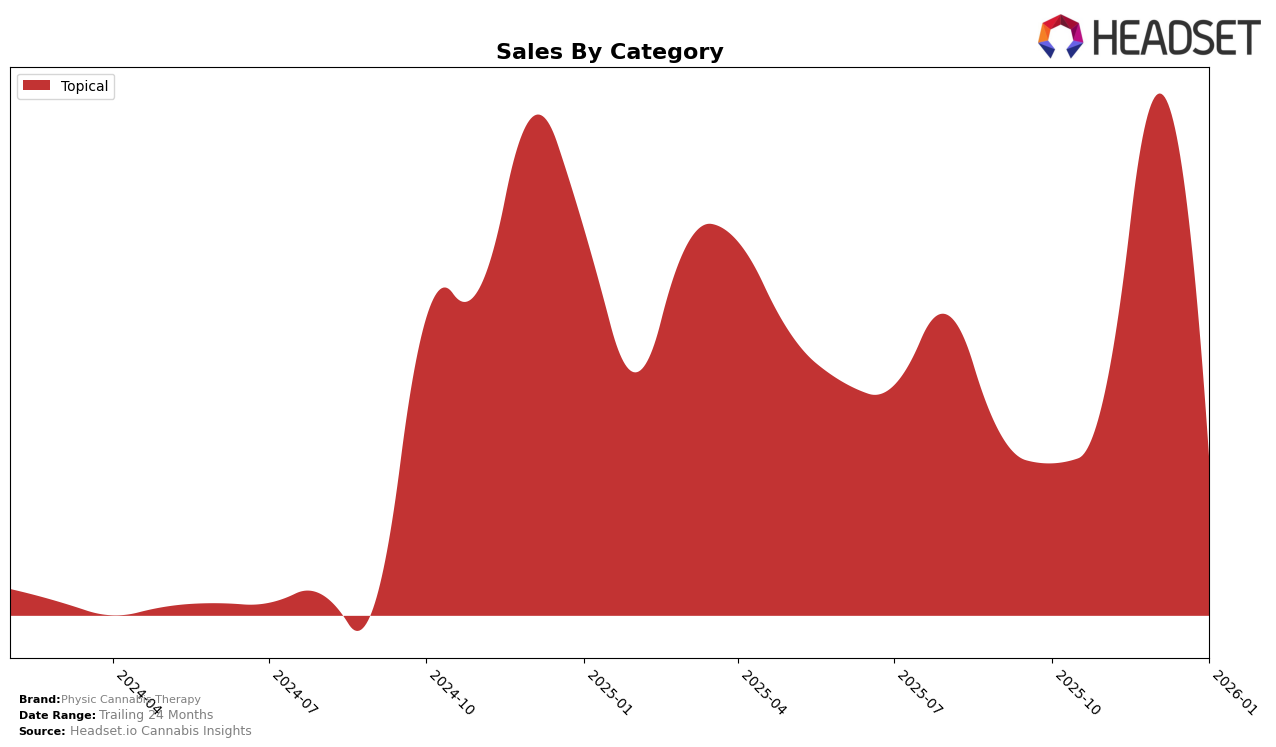

Physic Cannabis Therapy has shown a notable performance in the Topical category within Oregon. In January 2026, they achieved a significant milestone by entering the top 5 brands, securing the 4th position. This is a remarkable achievement considering the absence of their ranking in the top 30 in the previous months. Such a leap indicates a positive reception of their products in the market and suggests an upward trend in consumer demand for their offerings. However, the lack of ranking in October, November, and December 2025 raises questions about their market presence during those months, which could be attributed to either a strategic market entry or a sudden increase in consumer interest.

It is important to note that Physic Cannabis Therapy's performance in other states or categories is not readily available, which suggests that their current market focus might be heavily centered on Oregon's Topical category. The absence of data from other states or categories could imply that they are either not present or not performing within the top 30 in those areas. This information is crucial for understanding the brand's market strategy and geographical focus. The January 2026 sales figures, while not explicitly detailed here, suggest a successful entry into the market, hinting at potential growth opportunities if similar strategies are employed in other states or categories.

Competitive Landscape

In the Oregon Topical cannabis market, Physic Cannabis Therapy has shown a notable entry by securing the 4th rank in January 2026, despite not being in the top 20 in the preceding months. This upward movement suggests a significant increase in market presence and consumer interest. In comparison, Medicine Farm consistently held the 2nd rank throughout the same period, indicating a stable and strong market position. Meanwhile, Synergy Skin Worx experienced fluctuations, dropping from 3rd to 5th before recovering to 4th, suggesting some volatility in their sales performance. Angel (OR) also showed inconsistency, appearing in the rankings only in October and December. The rise of Physic Cannabis Therapy into the top ranks highlights a potential shift in consumer preferences or successful marketing strategies that could challenge the established positions of its competitors in the Oregon Topical market.

Notable Products

In January 2026, the top-performing product from Physic Cannabis Therapy was Wood Balm (500mg THC, 1.8 oz) in the Topical category, maintaining its first-place rank from the previous two months with sales of 81 units. Field Balm (128mg CBD 460mg THC, 1.8 oz) held steady in the second position, consistent with its ranking in the preceding months, despite a decrease in sales compared to December. Notably, CBD:THC 1:3 Wood Balms Away (150mg CBD, 450mg THC, 0.18oz) was not ranked in January 2026, following its third-place position in December 2025. This indicates a narrowing focus on the top two products, which have consistently dominated the sales rankings. Overall, the rankings for January 2026 reflect a stable preference for these leading topical products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.