Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

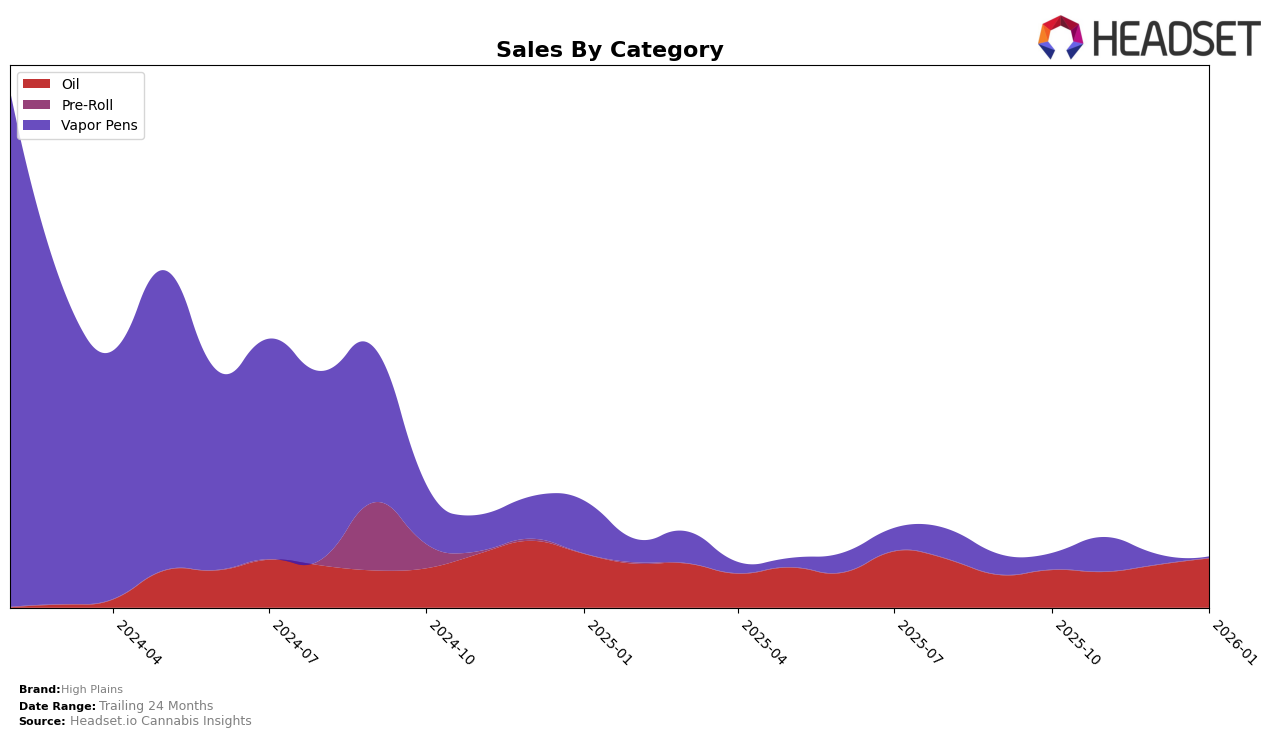

High Plains has shown a notable performance in the Ontario market, particularly in the Oil category. While they were not ranked in the top 30 brands from October to December 2025, they made a significant leap in January 2026, securing the 16th position. This upward movement indicates a strong growth trajectory and suggests that High Plains has potentially refined its strategy or product offering to resonate more effectively with consumers in this region. The absence from the top 30 in the previous months could be seen as a challenge, but the January ranking highlights a positive shift in market presence.

Across other states and categories, High Plains' performance remains less apparent due to the lack of top 30 rankings. This could imply either a strategic focus on specific markets like Ontario or challenges in penetrating other regions or categories. The data suggests that the brand has potential in the Oil category, but its absence in other rankings might indicate areas for growth or realignment. The sales figures from January 2026 in Ontario, however, do reflect a promising increase, hinting at a possible upward trend that could extend to other categories or states if strategies are effectively adapted.

Competitive Landscape

In the competitive landscape of the Oil category in Ontario, High Plains has shown a notable entry into the top 20 rankings by January 2026, securing the 16th position. This marks a significant milestone for High Plains, as it was absent from the top 20 in the preceding months. In comparison, Solei maintained a steady presence, fluctuating slightly from 17th to 15th place before dropping out of the top 20 in January. Meanwhile, Five Founders demonstrated consistent performance, improving its rank from 16th in October to 14th by January, while LoFi Cannabis experienced more volatility, peaking at 11th in November before falling to 15th in January. The entry of High Plains into the rankings suggests a positive trend in its market presence and sales momentum, potentially driven by strategic marketing efforts or product differentiation in a competitive market.

Notable Products

For January 2026, the top-performing product from High Plains is Indica THC Oil Drops (35ml) in the Oil category, maintaining its first-place rank consistently since October 2025 with notable sales of 334 units. Blueberry Chemdawg Live Rosin Cartridge (1g) in the Vapor Pens category has held steady in the second position for the past two months, despite a significant drop in sales from November 2025. Cotton Cannon Distillate Cartridge (1g) has consistently ranked third until December 2025 but did not appear in the rankings for January 2026. This shift suggests a potential change in consumer preference or inventory availability. Overall, Indica THC Oil Drops remain a strong leader in sales performance for High Plains.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.