Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

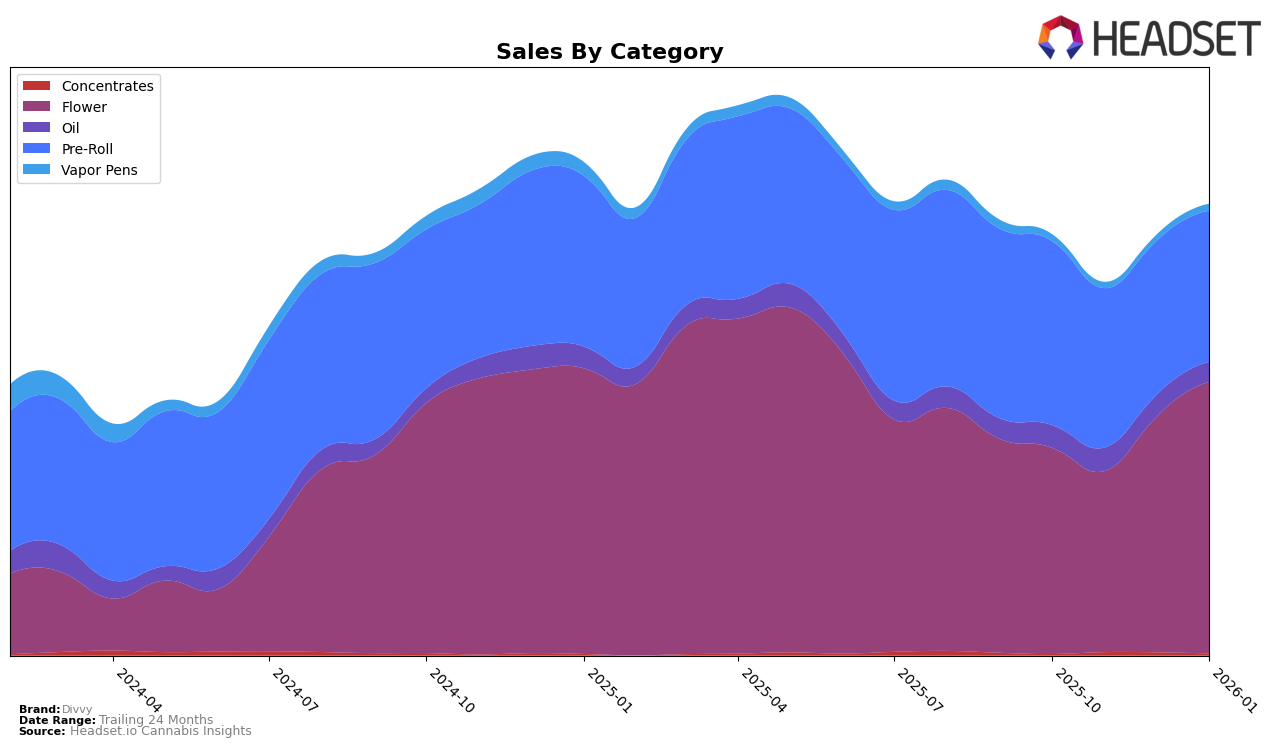

In Alberta, Divvy has shown a notable upward trend in the Flower category, moving from the 19th position in October 2025 to 9th by January 2026. This improvement is reflected in their sales, which saw a significant increase from approximately 325,033 in October to 611,685 by January. However, in the Pre-Roll category, Divvy did not make it into the top 30 rankings, indicating room for growth or a strategic shift in focus. Meanwhile, their Oil category performance has remained relatively stable, consistently ranking within the top 10, suggesting a strong foothold in this segment.

In Ontario, Divvy experienced a decline in the Flower category, dropping from 33rd place in October to 44th by January 2026. This downward trajectory is accompanied by a decrease in sales, suggesting challenges in maintaining market share. The Oil category also saw fluctuations, with Divvy absent from the top 30 rankings in November and January, which could indicate volatility or competitive pressures. Notably, in Saskatchewan, Divvy made a strong entry into the Flower category, achieving the 8th position in December 2025, although slipping slightly to 9th by the following month. This suggests a promising potential for growth in this province, particularly with their recent entry into the Pre-Roll category, debuting at 14th in January 2026.

Competitive Landscape

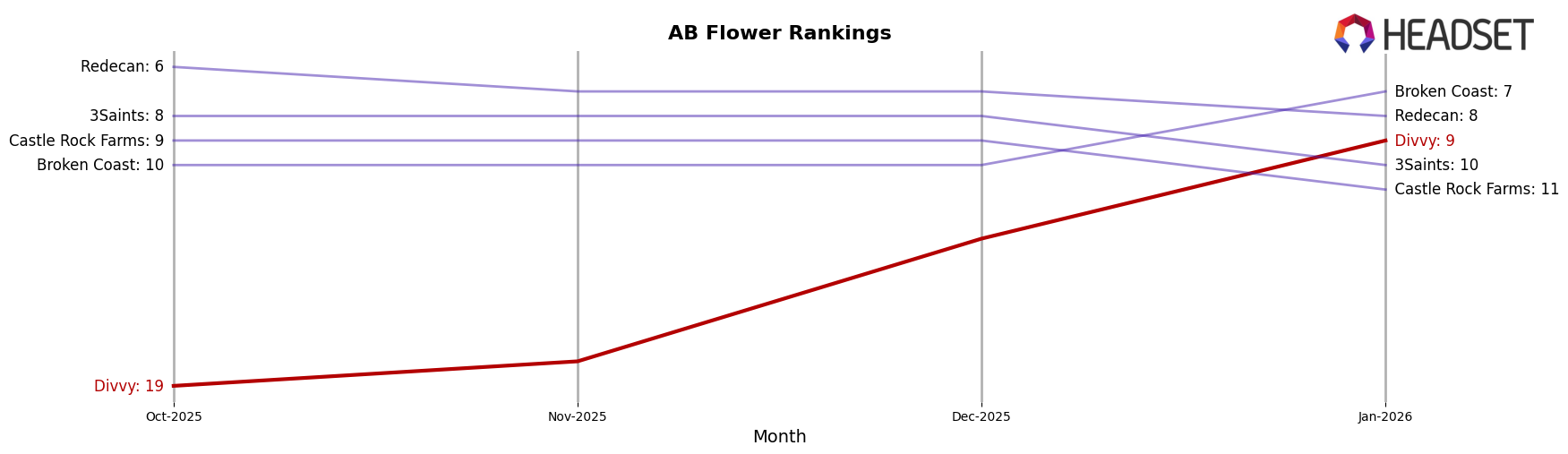

In the competitive landscape of the flower category in Alberta, Divvy has demonstrated a notable upward trajectory in brand ranking from October 2025 to January 2026. Starting at the 19th position in October, Divvy climbed to 9th by January, indicating a significant improvement in market presence. This upward movement is particularly impressive given the competitive pressure from established brands such as Redecan, which experienced a decline from 6th to 8th place, and 3Saints, which dropped from 8th to 10th. Meanwhile, Broken Coast improved its ranking from 10th to 7th, showcasing strong sales momentum. Divvy's sales growth, particularly the jump in January, suggests a successful strategy in capturing market share from competitors like Castle Rock Farms, which fell from 9th to 11th. This data highlights Divvy's potential to continue its ascent in the Alberta flower market, emphasizing the importance of strategic positioning and market adaptation.

Notable Products

In January 2026, the top-performing product for Divvy was Roll Up Sativa Pre-Roll (0.5g) in the Pre-Roll category, maintaining its number one rank from December 2025 with sales of 9,926 units. Roll Up Indica Pre-Roll (1g) rose to the second position, improving from its third-place ranking in December. Roll Up Sativa Pre-Roll (1g) retained its third-place position, consistent with the previous month. Roll Up Indica Pre-Roll (0.5g) experienced a drop, moving from second place in December to fourth in January. Notably, Blueberry (7g) emerged as a new entrant in the rankings, securing the fifth spot in the Flower category for January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.