Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

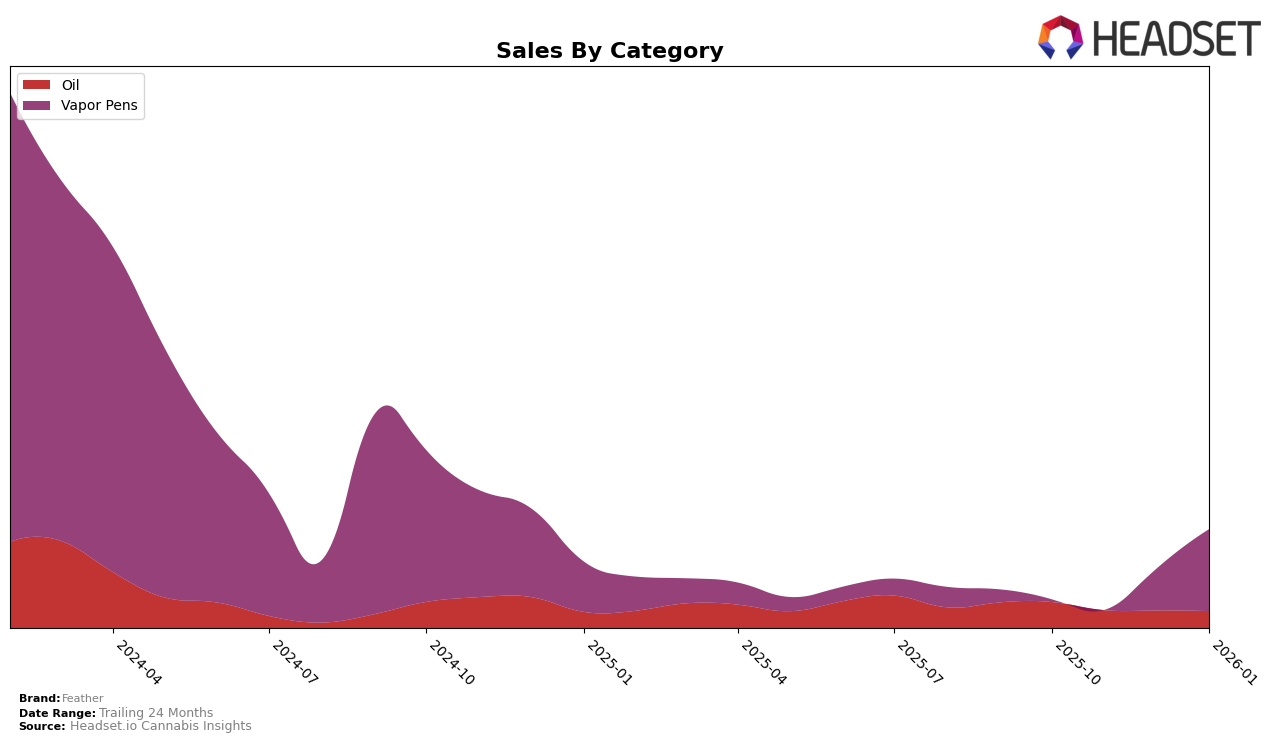

Feather's performance in the Vapor Pens category in British Columbia has shown a notable upward trend over the recent months. Despite not ranking in the top 30 brands in October and November 2025, Feather made significant strides by December 2025, reaching the 68th position. By January 2026, the brand further improved its standing to 54th place. This upward trajectory indicates a growing consumer interest in Feather's offerings within this category, suggesting effective market penetration strategies or increasing brand recognition among consumers in British Columbia.

The sales figures for Feather in British Columbia's Vapor Pens category reflect this positive movement, with sales jumping from 14,715 in December 2025 to 27,730 in January 2026. This significant increase in sales aligns with Feather's improved rankings, highlighting a successful period of growth. However, the brand's absence from the top 30 rankings in the earlier months suggests initial challenges in capturing the market. The recent progress could be attributed to strategic adjustments or new product introductions that resonated well with the local consumer base, although further details would be required to fully understand the underlying factors contributing to this performance.

Competitive Landscape

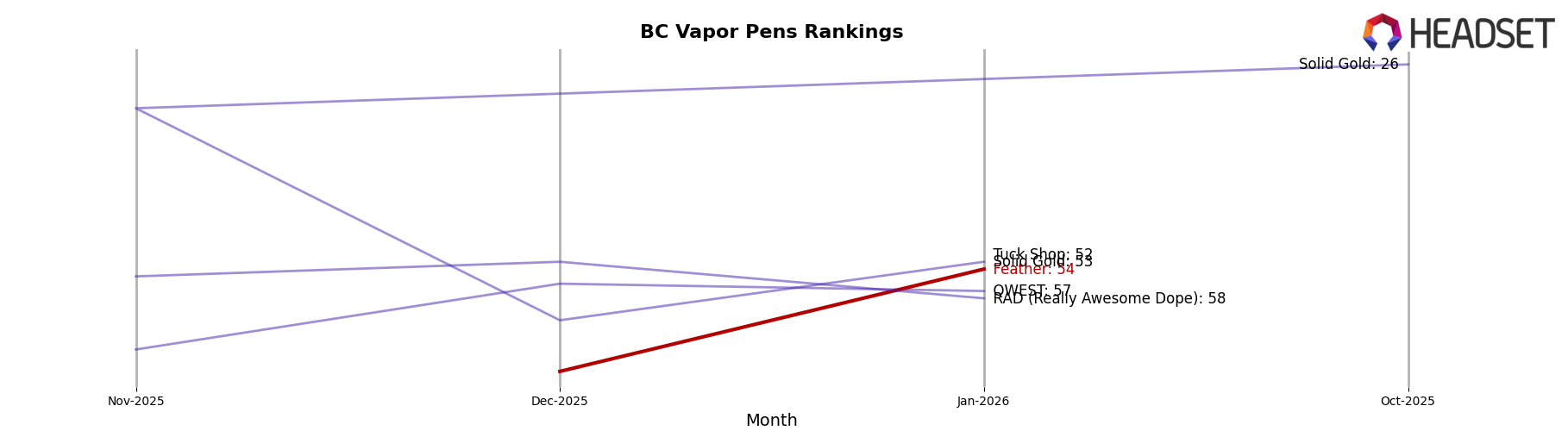

In the competitive landscape of vapor pens in British Columbia, Feather has shown a notable upward trajectory in recent months. After not ranking in the top 20 from October to December 2025, Feather made a significant leap to rank 54th in January 2026. This improvement in rank coincides with a substantial increase in sales from December to January, indicating a positive reception in the market. In contrast, QWEST experienced a decline, dropping out of the top 20 by January 2026, while RAD (Really Awesome Dope) maintained a relatively stable position, fluctuating slightly but remaining within the top 60. Meanwhile, Solid Gold saw a dramatic drop from 26th in October to 61st in December, before recovering to 53rd in January. These shifts highlight Feather's potential to capture more market share as competitors face volatility, making it a brand to watch in the coming months.

Notable Products

In January 2026, Feather's top-performing product was the Blue Mystic Haze Distillate Cartridge in the Vapor Pens category, maintaining its first-place rank from December with sales of 484 units. The Hawaiian Smash Distillate Cartridge also performed strongly, securing the second rank in its debut month. The THC Dose Control Spray, part of the Oil category, dropped to third place from its second-place position in December, with sales reaching 148 units. The Juicy Rouge Distillate Cartridge entered the rankings at fourth place. Meanwhile, the Orange Citrus THC Rapid Spray saw a slight improvement, moving from third to fifth place, despite a modest increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.