Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

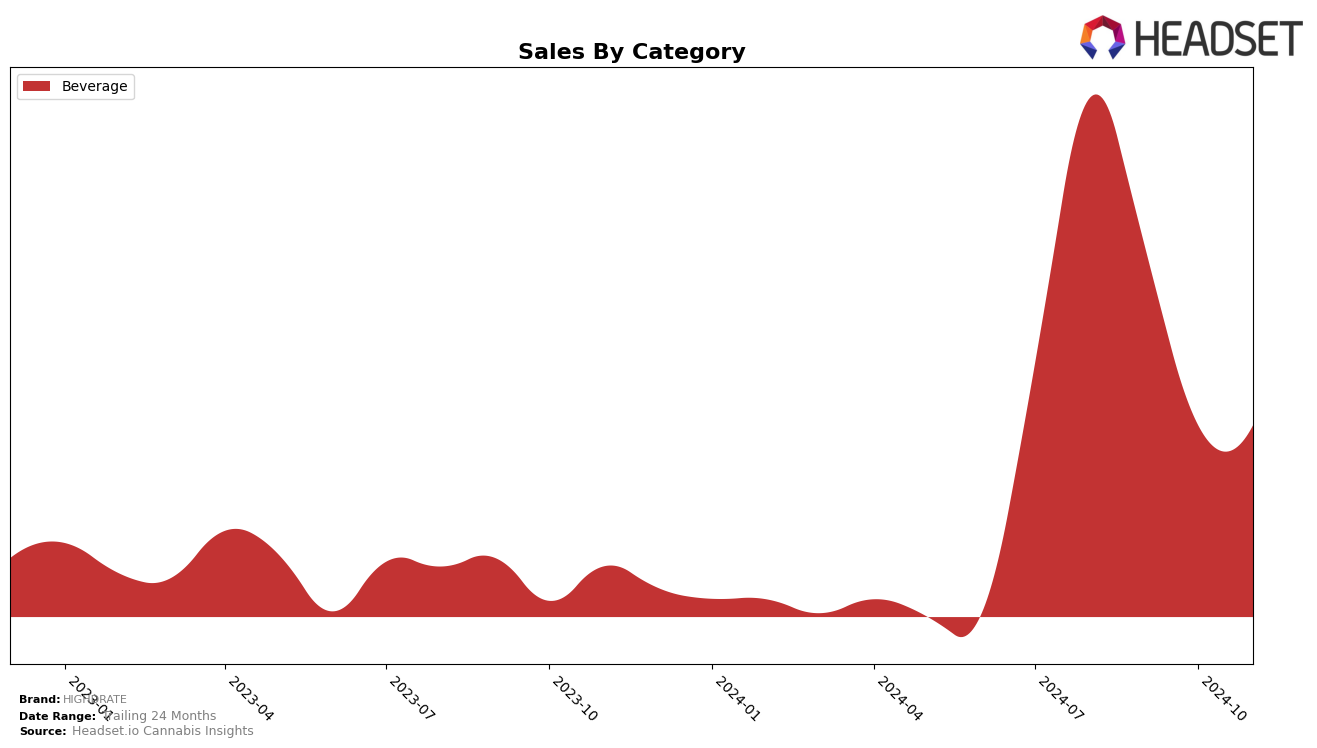

In the realm of cannabis beverages, HIGHDRATE has been making noticeable strides, particularly in the province of British Columbia. In August 2024, HIGHDRATE secured the 20th position in the beverage category, reflecting a solid presence in the market. However, the absence of ranking data for subsequent months suggests that the brand did not maintain its position within the top 30, indicating potential challenges or shifts in consumer preferences. This fluctuation in rankings could be attributed to various factors, including market saturation, competition, or changes in consumer demand. The initial ranking in August highlights a promising entry, but the lack of continued presence in the top 30 calls for strategic reassessment to regain momentum.

Despite the ranking volatility in British Columbia, the August sales figure of 10,471 units underscores a noteworthy demand for HIGHDRATE's offerings at that time. This performance suggests that there was a significant consumer interest, which the brand could potentially capitalize on with targeted marketing efforts or product innovation. The absence of sales data for the following months makes it challenging to determine the brand's trajectory accurately, but it does highlight the importance of consistent market engagement to maintain and grow brand visibility. Understanding these dynamics can be crucial for stakeholders looking to navigate the competitive landscape of the cannabis beverage market effectively.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, HIGHDRATE faced significant challenges in maintaining its market presence. As of August 2024, HIGHDRATE was ranked 20th, but it subsequently fell out of the top 20 in the following months, indicating a potential decline in market influence and sales. In contrast, Ace Valley consistently held a stronger position, ranking between 15th and 17th from August to November 2024, which suggests a more stable sales performance. Similarly, Second Nature showed resilience by maintaining a rank close to the top 20 throughout the same period. The absence of HIGHDRATE from the top 20 in the latter months highlights the competitive pressure from these brands, emphasizing the need for strategic adjustments to regain market share and improve sales performance.

Notable Products

In November 2024, Wildberry Lavender Soda (100mg THC, 355ml, 12oz) maintained its position as the top-performing product for HIGHDRATE, with sales figures reaching 362 units. Watermelon THC Syrup (100mg) followed closely, holding steady at the second rank, showing consistent performance since September. Notably, the Sugar-Free Purple Punch Wildberry Lavender Live Rosin (10mg THC, 12oz) was not ranked in November, having last appeared in the rankings in October. The rankings for the top two products have remained unchanged since August, indicating a strong consumer preference for these beverages. This stability suggests that the leading products have established a loyal customer base, contributing to sustained sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.