Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

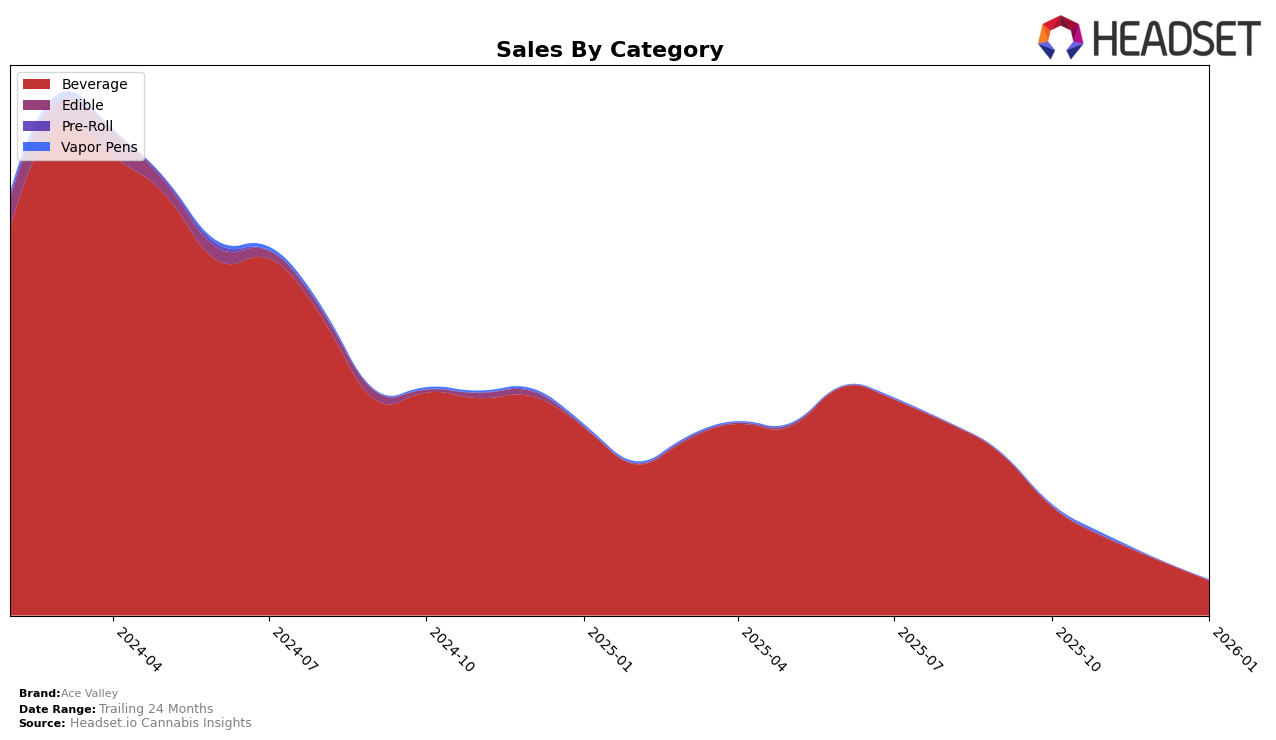

In the province of Alberta, Ace Valley has shown a notable presence in the Beverage category. As of October 2025, the brand was ranked 17th, which indicates a competitive position in the market. However, the absence of rankings in the subsequent months through January 2026 suggests that Ace Valley did not maintain a top 30 position in Alberta's Beverage category. This decline in visibility could be a point of concern for the brand, as it may imply a loss of market share or increased competition in the region. The October sales figure of 10,829 units highlights a starting point for evaluating their market impact, but without further data, it is challenging to assess the trend's direction.

The lack of rankings for Ace Valley in the Beverage category beyond October 2025 in Alberta may reflect a need for strategic adjustments to regain or enhance its market position. While the initial 17th rank indicates a solid entry point, sustaining and improving this rank is crucial for long-term success. The absence of data for November and December 2025, as well as January 2026, could suggest that the brand has either faced increased competition or perhaps has shifted focus to other categories or markets. Without more detailed insights, it is difficult to pinpoint the exact cause, but this trend should be closely monitored for future strategic planning.

Competitive Landscape

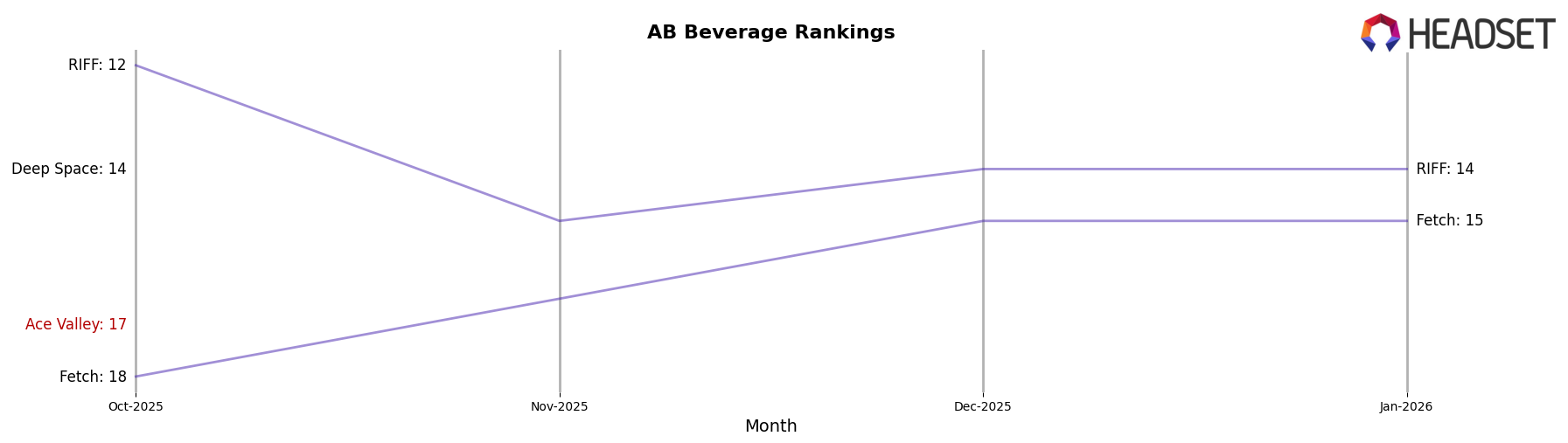

In the competitive landscape of the beverage category in Alberta, Ace Valley has faced significant challenges in maintaining its market position. As of October 2025, Ace Valley was ranked 17th, but it did not appear in the top 20 rankings for the subsequent months, indicating a decline in its competitive standing. In contrast, RIFF maintained a consistent presence within the top 20, albeit with a slight drop from 12th to 14th place by January 2026. Meanwhile, Deep Space also appeared in October 2025 but did not sustain its ranking in the following months. Fetch showed a notable recovery by reappearing in the rankings at 15th place in December 2025 and January 2026. These dynamics suggest that while Ace Valley has struggled to maintain its competitive edge, other brands like RIFF and Fetch have managed to stabilize or improve their positions, potentially capturing market share that Ace Valley has lost.

Notable Products

In January 2026, the top-performing product for Ace Valley was the CBD/THC 2:1 Aranciata Rossa Sparkler, maintaining its rank as the number one product from December 2025 with sales of 402 units. The CBD/THC 2:1 Sugar Free Agave Lime Sparkler held its position as the second-best seller, consistent with its December ranking. The CBD/CBG Blueberry Acai Sparkling Water remained steady in the third position across the last four months, indicating stable demand. The CBD Passion Fruit Guava Sparkling Water also retained its fourth position, showing no change in ranking since October 2025. Notably, the CBD/THC 4:1 Grapefruit Gummies, which appeared in the rankings in November 2025, did not feature in January 2026, suggesting a potential discontinuation or drop in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.