Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

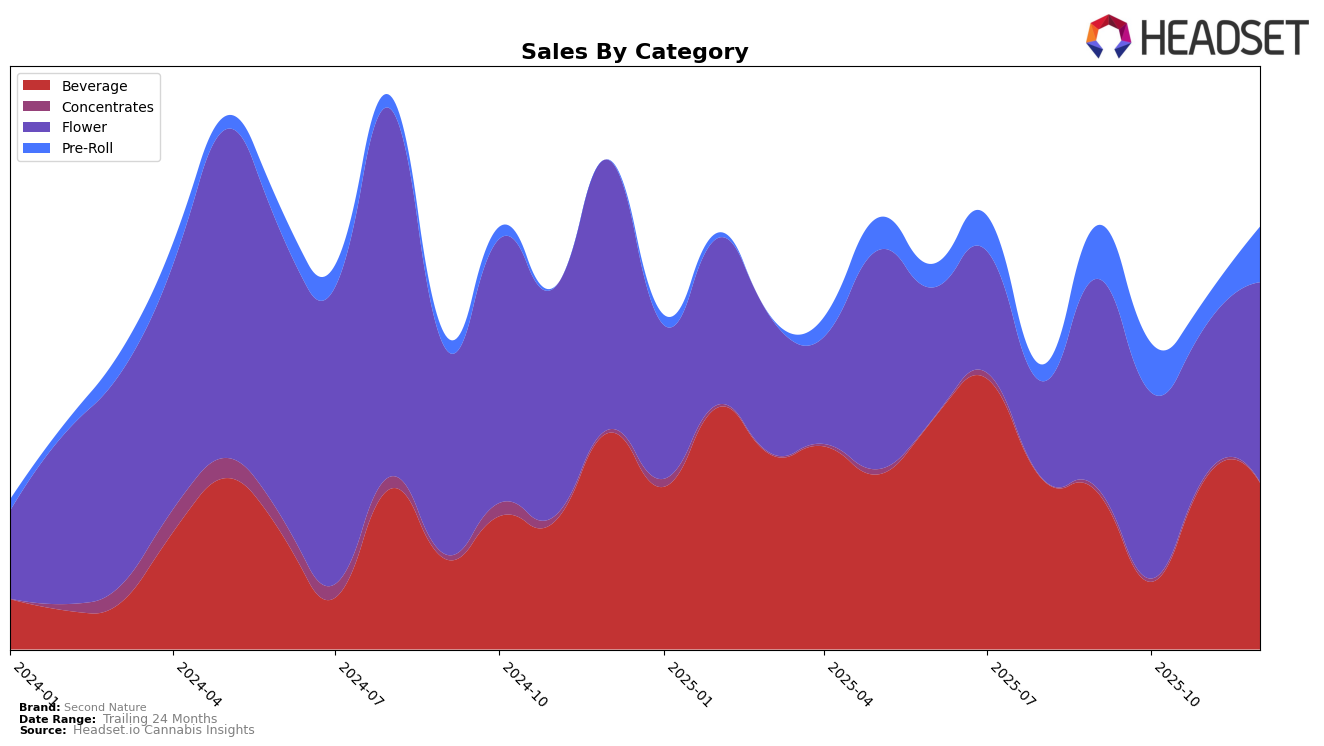

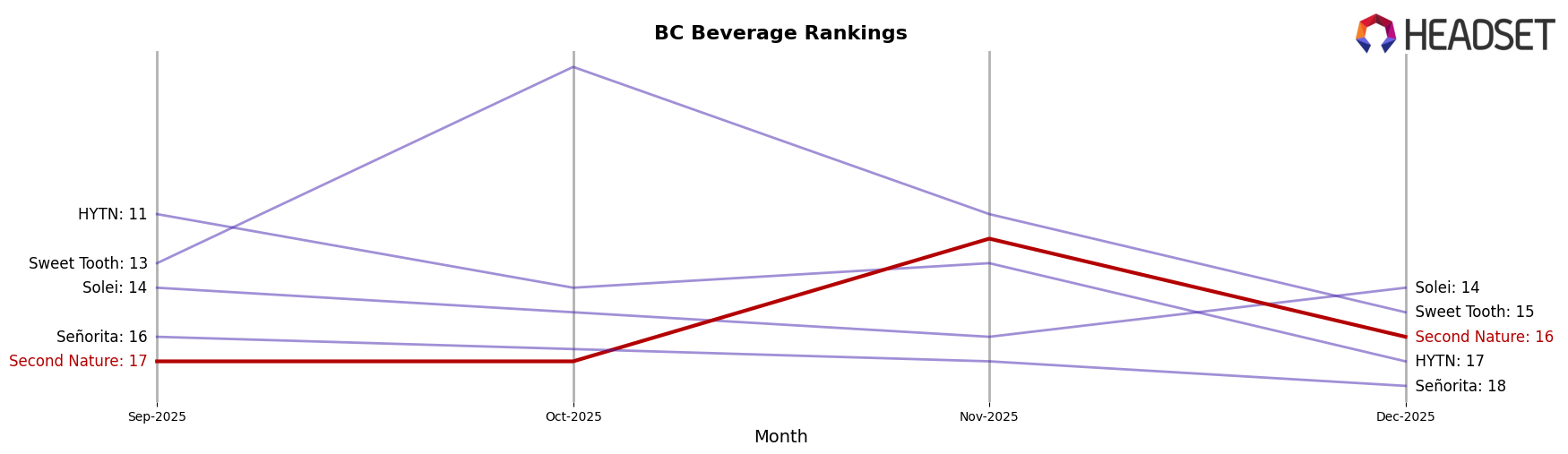

Second Nature has shown a dynamic performance across various categories and regions, with notable movements in the beverage category in British Columbia. In September 2025, Second Nature held the 17th position in the beverage category, maintaining this rank into October. However, by November, the brand climbed to the 12th position, demonstrating a significant improvement in market presence. Despite this upward trend, December saw a slight dip back to the 16th position. This fluctuation suggests a competitive market environment and highlights the challenges of maintaining a top position. The brand's ability to climb the ranks in November indicates a successful strategy or product offering that resonated with consumers during that period.

Interestingly, the sales figures for Second Nature reveal a pattern of recovery and growth. After a decline in sales from September to October, the brand experienced a resurgence in November, with sales figures reaching approximately 25,835. This rebound suggests a strong consumer response, possibly driven by seasonal demand or effective marketing campaigns. However, the slight drop in rank in December, despite maintaining a similar sales level, could indicate increased competition or market saturation. The absence of ranking data for other states or categories implies that Second Nature has yet to make a significant impact beyond British Columbia's beverage category, presenting both a challenge and an opportunity for market expansion.

Competitive Landscape

In the competitive landscape of the beverage category in British Columbia, Second Nature has shown a dynamic shift in rankings over the last few months of 2025. Starting at 17th place in September, Second Nature climbed to 12th in November, before settling at 16th in December. This fluctuation indicates a responsive market strategy, as the brand managed to surpass competitors like Señorita, which was absent from the top 20 in October and ended December at 18th. Despite this progress, Second Nature faces stiff competition from brands like Sweet Tooth, which maintained a higher rank, peaking at 5th in October. Additionally, Solei and HYTN have shown resilience, with Solei consistently ranking around 14th and HYTN experiencing a drop to 17th in December, closely trailing Second Nature. These insights suggest that while Second Nature is making strides, it must continue to innovate and adapt to maintain and improve its market position amidst strong competitors.

Notable Products

In December 2025, the top-performing product for Second Nature was the Senorita - Mango Mexican Agave Lime Margarita Drink (10mg THC, 12oz) in the Beverage category, maintaining its consistent first-place ranking from previous months, with sales of 3224 units. The Cake Pre-Roll (1g) emerged as the second top product, marking its debut in the rankings. The Cake (3.5g) in the Flower category dropped to third place after being second in November 2025. Orangasm (3.5g) made its appearance in fourth place, while the Bottomless Mimosa Pre-Roll (1g) secured the fifth position. This month saw a notable entry of pre-roll products in the top rankings, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.