Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

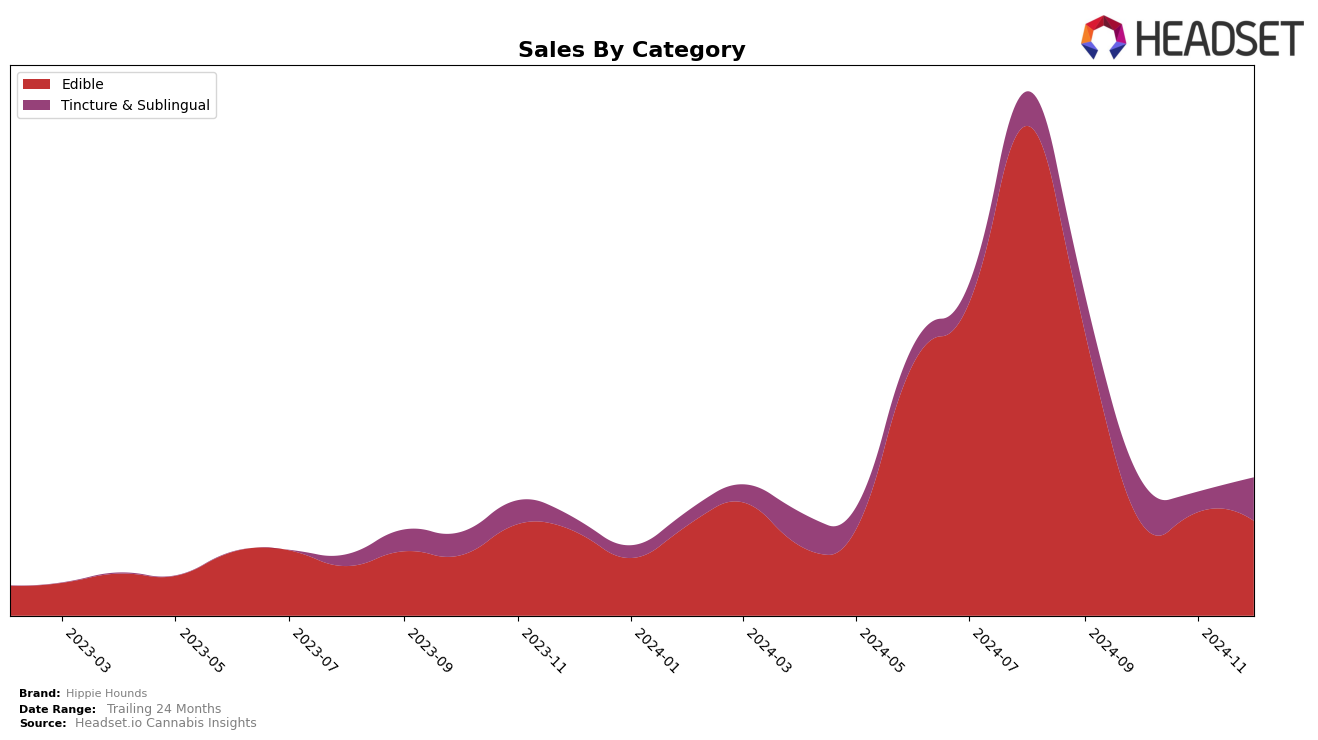

Hippie Hounds has shown a notable presence in the cannabis market, particularly within the edible category in Missouri. In September 2024, the brand was ranked 50th in this category, with sales reaching $12,263. However, the absence of rankings in the following months suggests that Hippie Hounds did not maintain a position within the top 30 edible brands in Missouri. This decline may indicate challenges in sustaining market competition or shifts in consumer preferences, which could have impacted their standing.

The performance of Hippie Hounds across other states and categories remains an area of interest, especially considering the competitive nature of the cannabis industry. The lack of data for subsequent months in Missouri might reflect broader trends affecting their market strategy or product appeal. It is essential for stakeholders to monitor these dynamics to understand the brand's trajectory and potential areas for growth or improvement. Observing how Hippie Hounds adapts to these challenges could provide valuable insights into their resilience and strategic planning in a rapidly evolving market.

Competitive Landscape

In the competitive landscape of the Missouri edible cannabis market, Hippie Hounds has shown a notable presence, although it faces significant competition. In September 2024, Hippie Hounds held the 50th rank, which indicates a strong entry but suggests room for growth when compared to other brands. For instance, Bhang was ranked 52nd in September 2024, indicating a slightly lower position than Hippie Hounds. However, The Standard emerged as a formidable competitor by November 2024, securing the 35th rank, which highlights a substantial lead over Hippie Hounds. This suggests that while Hippie Hounds maintains a competitive edge over some brands, it needs to strategize effectively to climb higher in the rankings and increase its market share, especially as other brands like The Standard demonstrate significant upward momentum in sales and ranking.

Notable Products

In December 2024, the top-performing product for Hippie Hounds was the CBD Pet Treats 30-Pack (150mg CBD) in the Edible category, maintaining its number one rank from November with sales of 106 units. CBD Hemp infused Pet Treats (10mg CBD) climbed to the second position, up from third in November, with a notable increase in sales. The CBD K9 Treats 30-Pack (300mg CBD) experienced a drop to third place from second in November, showing a significant decrease in sales compared to earlier months. The CBD/CBG 1:1 Anxious Formula CBD Dog Pet Tincture (1000mg CBD, 1000mg CBG) debuted in the rankings at fourth place, indicating growing interest in tincture products. Meanwhile, the CBD Feline Full Spectrum Pet Tincture (125mg CBD) held steady at fifth place, showing a modest increase in sales from November.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.