Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

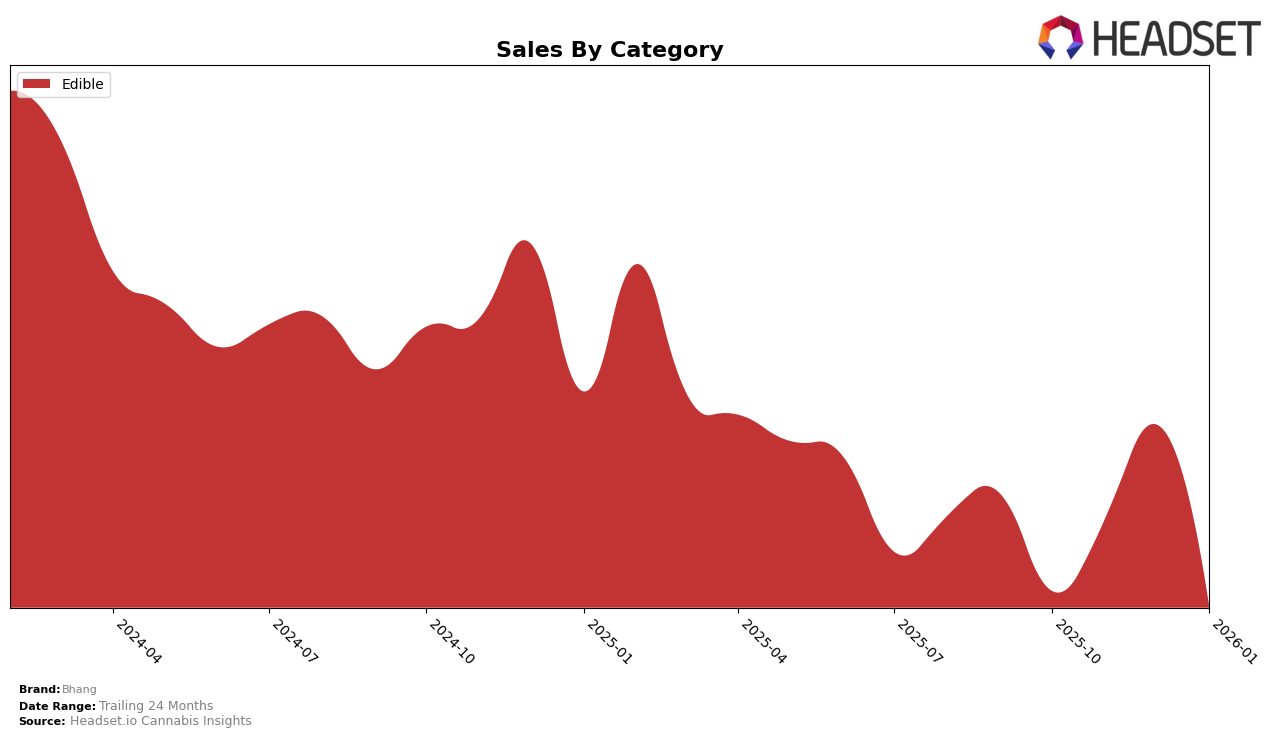

Bhang has shown a consistent presence in the Canadian market, particularly in the Edible category. In British Columbia, the brand maintained a steady ranking, fluctuating slightly from 12th in October 2025 to 15th in December 2025, before climbing back to 13th by January 2026. This indicates a stable performance in the province, with only minor shifts in ranking. The sales figures reflect this stability, with a slight dip in December followed by a modest recovery in January. The consistency in rankings suggests that Bhang has a reliable consumer base in British Columbia, though the brand has not broken into the top 10, which could be an area for potential growth.

In Ontario, Bhang has maintained a more stable ranking, holding the 11th position in October and December 2025, and only dropping to 12th in November 2025 and January 2026. This steadiness in the rankings is accompanied by a notable peak in sales during December, suggesting a successful holiday period for the brand in this province. However, the decline in January sales could indicate seasonal fluctuations or increased competition. The consistent presence in the top rankings across months highlights Bhang's strong market position in Ontario, yet the brand's inability to crack the top 10 suggests there is still room for improvement to capture a larger market share.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Ontario, Bhang consistently holds a mid-tier position, ranking 11th in both October and December 2025, and slightly dropping to 12th in November 2025 and January 2026. This stability in ranking, despite fluctuations in sales, suggests a steady consumer base. However, Bhang faces stiff competition from brands like Foray and Chowie Wowie, which have maintained slightly higher ranks, with Foray consistently outperforming Bhang in sales. Notably, HighXotic showed a significant improvement, climbing from 13th to 10th place by January 2026, indicating a potential threat to Bhang's market position. Meanwhile, Emprise Canada remains a lower-tier competitor, yet its upward trend in sales could signal future challenges. These dynamics underscore the importance for Bhang to innovate and enhance its market strategies to maintain and potentially improve its standing in the Ontario edibles market.

Notable Products

In January 2026, Bhang's top-performing product was the THC Milk Chocolate Bar 4-Pack (10mg) in the Edible category, maintaining its position as the best-seller since October 2025 with sales of 13,812 units. Following closely, the THC Dark Chocolate Bar 4-Pack (10mg) also retained its consistent second-place ranking. The CBD/THC 1:1 Caramel Dark Chocolate Bar (10mg CBD, 10mg THC) continued to hold the third spot, showing stable performance across the months. The Cookies and Cream White Chocolate Bar (10mg) and THC Milk Chocolate (10mg) maintained their fourth and fifth positions, respectively, indicating a stable product preference among consumers. Overall, Bhang's top products have shown remarkable consistency in their rankings, with no changes observed in their positions from the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.