Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

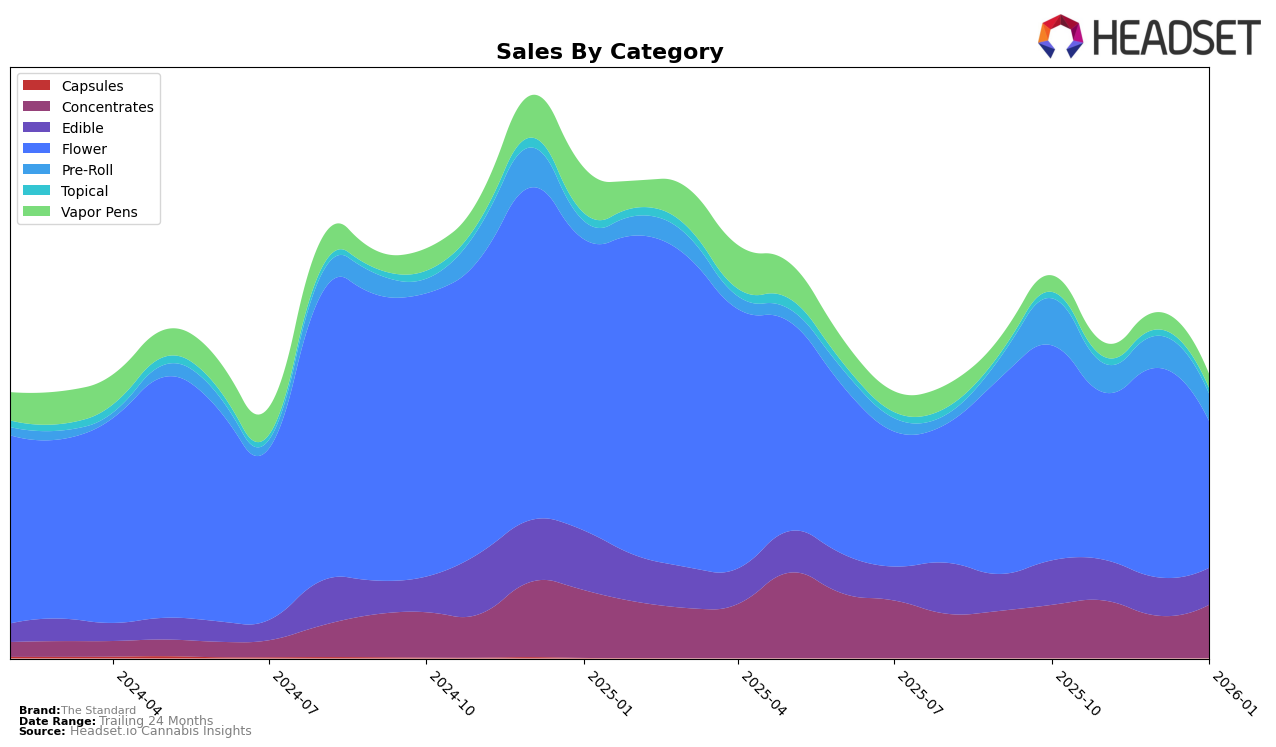

The Standard has shown varied performance across different cannabis categories and states. In Missouri, the brand has made notable progress in the Concentrates category, improving its rank from 26th in October 2025 to 21st by January 2026, indicating a positive growth trend. Meanwhile, in the Edible category, The Standard has struggled to break into the top 30, with rankings fluctuating between 35th and 38th over the same period. The Flower category experienced a decline, moving from 33rd to 37th, suggesting potential challenges in maintaining market share. Interestingly, the Pre-Roll category saw The Standard drop out of the top 30 in December, only to reappear at 59th in January, highlighting an area with room for improvement.

In Ohio, The Standard has been more consistent in its performance, particularly in the Concentrates and Pre-Roll categories. The brand maintained a strong position in Concentrates, ranking 8th in both October and January, despite a slight drop to 11th in December. The Pre-Roll segment showed some volatility but remained within the top 20, ranking as high as 7th in October. However, the Vapor Pens category has been a challenge, with The Standard consistently ranked around the 48th position, indicating a need for strategic adjustments. The Flower category also saw a downward trend, with rankings slipping from 24th to 27th over the period, which may suggest increased competition or shifting consumer preferences.

Competitive Landscape

In the competitive landscape of the Ohio flower category, The Standard has experienced notable fluctuations in rank and sales over the past few months. While The Standard maintained a strong position in October 2025 with a rank of 24, it saw a slight dip to 27 by January 2026. Despite this, The Standard's sales figures remained competitive, although slightly lower than Ohio Clean Leaf, which started with higher sales in October 2025. Meanwhile, Common Citizen and Galenas showed consistent performance with ranks hovering around the mid-20s, indicating stable competition. Interestingly, Standard Farms saw a significant improvement in rank from 41 in November and December 2025 to 28 in January 2026, suggesting a potential upward trend that could impact The Standard's market share if sustained. These dynamics highlight the importance for The Standard to strategize effectively to maintain its competitive edge in Ohio's flower market.

Notable Products

In January 2026, The Standard's top-performing product was Tangie D Pre-Roll (0.5g) in the Pre-Roll category, maintaining its number one rank from December 2025 with sales of 2804 units. Following closely, Papaya Jelly Donuts Pre-Roll (0.5g) debuted at the second position in the same category with notable sales figures. Dirty Taxi (3.5g) in the Flower category held steady at the third rank, showing consistent performance since December 2025. Purple Cherry Cookies Infused Pre-Roll (1g) entered the rankings at fourth place, while Caramel Cake Infused Pre-Roll (1g) dropped from second to fifth place since December. Overall, the Pre-Roll category dominated the top rankings for The Standard in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.