Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

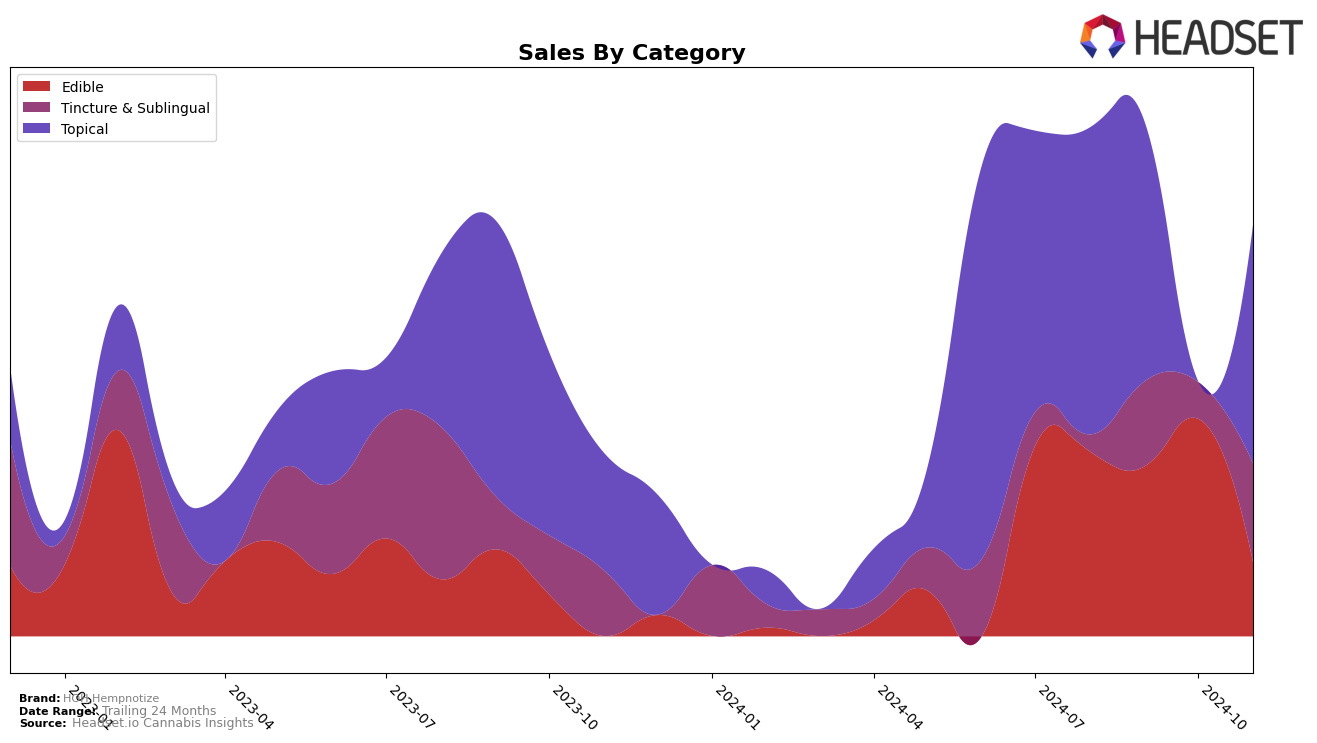

HOH Hempnotize has shown a promising presence in the Topical category within the state of Michigan. In August 2024, the brand secured the 8th position in the Topical category rankings, indicating a strong market position. However, it's worth noting that in subsequent months, the brand did not maintain its top 30 status, which suggests a significant drop in visibility or sales performance in the state. This decline could be attributed to increased competition or shifts in consumer preferences. Despite the absence from the rankings in later months, the brand's initial position in August reflects a capacity to resonate with the market when conditions are favorable.

The data from Michigan highlights a critical performance trend for HOH Hempnotize, particularly in the Topical category. The brand's sales in August amounted to $10,614, which indicates a solid foothold during that period. However, the lack of ranking in the following months raises questions about the brand's ability to sustain its market position. This could potentially point to a need for strategic adjustments to recapture market share or explore new opportunities in other states or categories. The fluctuation in rankings serves as an important indicator for stakeholders to assess the brand's market strategies and potential areas for growth or improvement.

Competitive Landscape

In the competitive landscape of the Michigan topical cannabis market, HOH Hempnotize has faced notable shifts in its ranking and sales performance. As of August 2024, HOH Hempnotize was ranked 8th, but it did not maintain a top 20 position in the subsequent months, indicating a potential decline in market presence. In comparison, Michigan Organic Rub showed a strong upward trajectory, moving from 9th in August to 6th in September, although it fell slightly to 7th in October before dropping out of the top 20 by November. Meanwhile, Primitiv emerged as a significant competitor, entering the rankings at 7th in November. Made By A Farmer also displayed a positive trend, improving from 10th in August to 8th in September. The absence of HOH Hempnotize from the rankings after August suggests that while competitors are gaining traction, HOH Hempnotize may need to reassess its strategies to regain its competitive edge in the Michigan market.

Notable Products

In November 2024, the top-performing product from HOH Hempnotize was the CBD Intensive Relief Cream (2000mg CBD, 2oz) in the Topical category, maintaining its first-place ranking from previous months with sales of 137 units. The CBD Gummies 30-Pack (1500mg CBD) in the Edible category, which held the top spot in October, dropped to second place. Notably, the CBD Honey Crisp Apple Tincture (2000mg CBD, 30ml) made a significant climb in the Tincture & Sublingual category, moving up to second place from third in October. The CBD Natural Flavor Full Spectrum Tincture (2000mg CBD) also improved its ranking, tying for the second position in November. The CBD Gummies 30-Pack (750mg CBD) did not rank in November, indicating a decline from its position in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.