Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

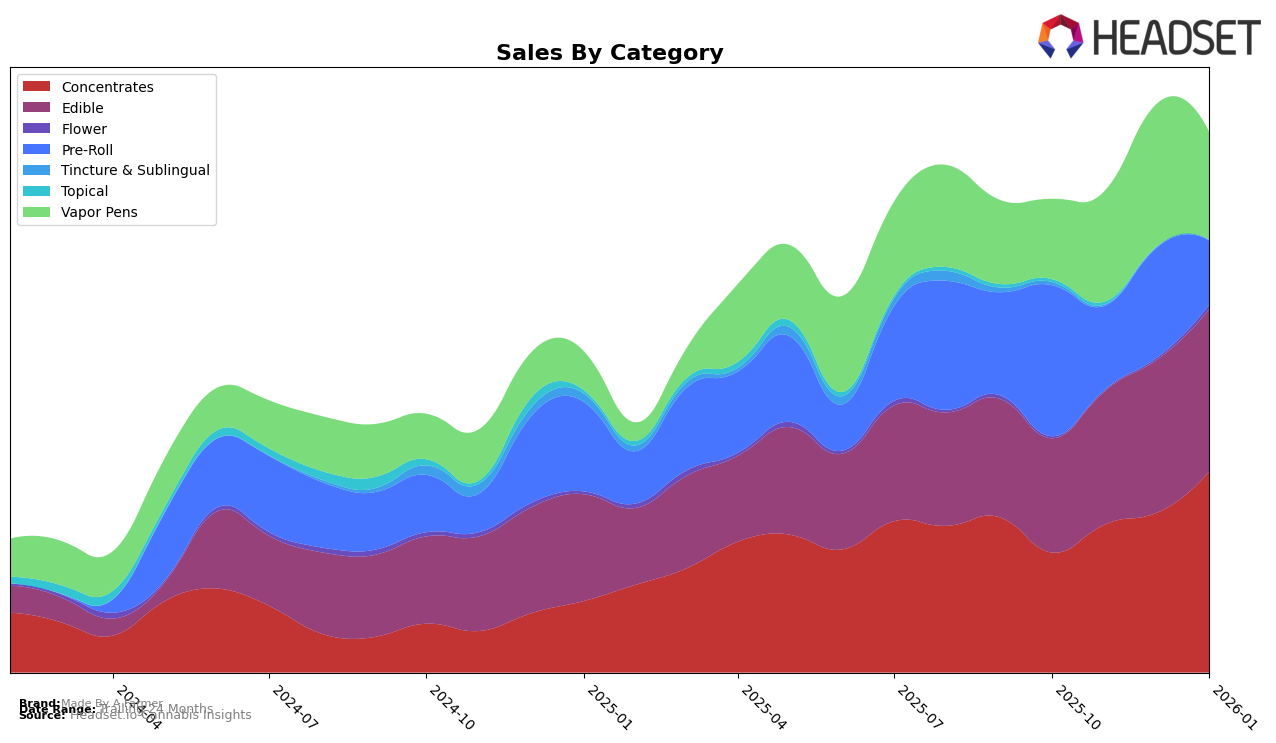

Made By A Farmer has shown notable progress in the Michigan cannabis market, particularly within the Concentrates category. Over the span of several months, the brand improved its rank from 33rd in October 2025 to an impressive 18th by January 2026. This upward trajectory is complemented by a steady increase in sales, indicating a growing consumer preference for the brand's concentrate products. On the other hand, the Pre-Roll category presents a more challenging picture. While the brand was ranked 73rd in October 2025, it fell out of the top 30 in subsequent months, suggesting a need for strategic adjustments to regain competitive positioning in this category.

In the Edible category, Made By A Farmer has been making consistent strides, moving from 51st in October 2025 to 36th by January 2026 in Michigan. This improvement in ranking, coupled with a rise in sales, highlights a growing acceptance and demand for their edible products. However, the Vapor Pens category presents a mixed performance. Despite an initial positive movement from 82nd in October 2025 to 63rd in December 2025, the brand saw a slight decline to 71st by January 2026. This fluctuation suggests potential volatility in consumer preferences or competitive pressures that may require attention to maintain momentum in this segment.

Competitive Landscape

In the competitive landscape of concentrates in Michigan, Made By A Farmer has shown a promising upward trajectory in rank and sales, particularly from October 2025 to January 2026. Starting at rank 33 in October, it climbed to 18 by January, indicating a significant improvement in market presence. This positive trend is noteworthy when compared to competitors like Common Citizen, which fluctuated but remained within the top 20, and Apex Solventless (MI), which maintained a steady position close to Made By A Farmer. Meanwhile, Afternoon Delite experienced a dramatic rise from rank 91 in December to 17 in January, suggesting a potential threat. Additionally, Homiez made a remarkable leap from rank 94 in November to 16 in January, indicating a surge in popularity. Despite these competitive pressures, Made By A Farmer's consistent sales growth, culminating in a peak in January, underscores its strengthening foothold in the Michigan concentrates market.

Notable Products

In January 2026, the top-performing product from Made By A Farmer was the Green Apple Fast Acting Gummies 10-Pack (200mg) in the Edible category, securing the number one rank with sales of 2911 units. Following closely in second place were the CBD/THC 1:1 Strawberry Kiwi Full Spectrum Nano Vegan Full Spectrum Gummies 10-Pack (200mg CBD, 200mg THC), which had previously topped the rankings in December 2025. The Frozen Dessert Live Hash Rosin (1g) made a notable entry in the Concentrates category, achieving the third rank. The Peach Full Spectrum Nano Gummies 10-Pack (200mg) climbed from fifth in December 2025 to fourth in January 2026. Blueberry Fast Acting Gummies 10-Pack (200mg) rounded out the top five, marking its first appearance in the rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.