Jul-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

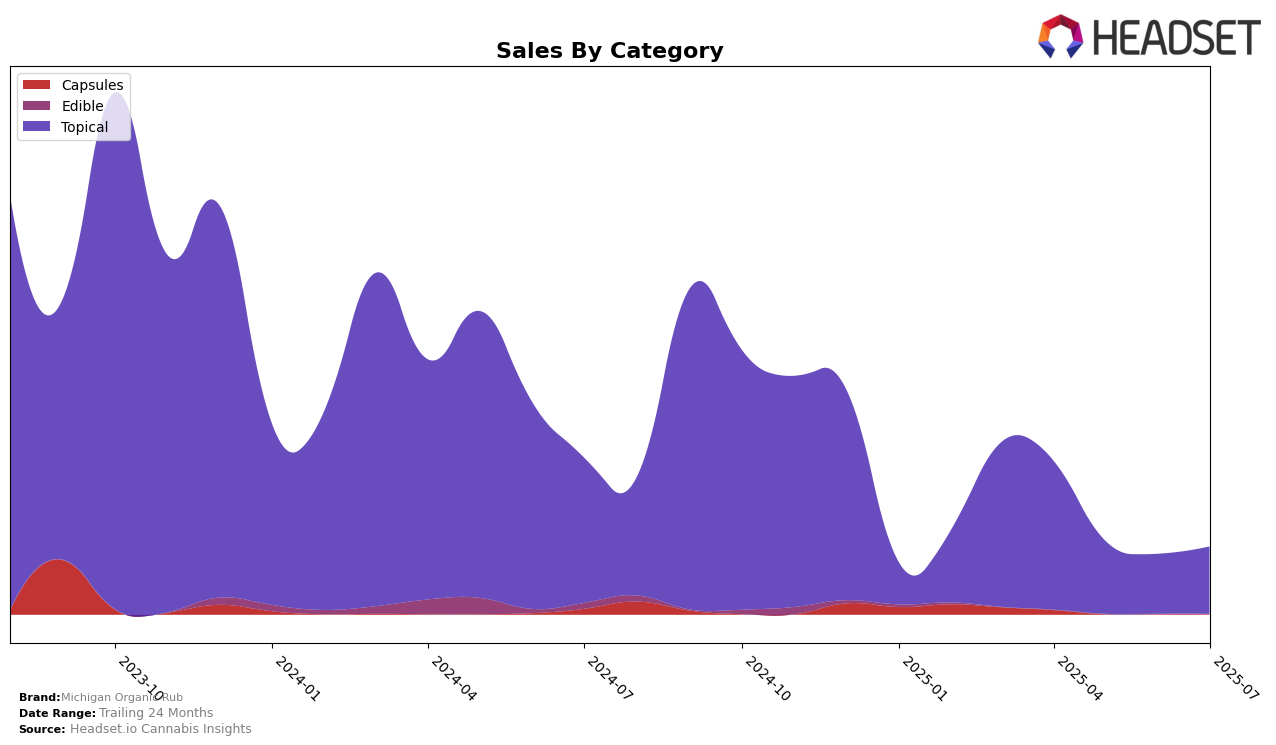

In the state of Michigan, Michigan Organic Rub has demonstrated a promising start in the topical category. In April 2025, the brand secured the 5th position, showcasing its strong presence and demand in the market. However, the subsequent months of May, June, and July saw the brand missing from the top 30 rankings, indicating a potential decline in market presence or increased competition. This drop in ranking could be a point of concern for stakeholders, as maintaining visibility in the top rankings is crucial for sustained growth and market leadership.

Despite the fluctuation in rankings, the brand's initial sales performance in April was noteworthy, with sales reaching a significant figure. This suggests that there was a strong initial consumer interest and acceptance. However, the absence of rankings in the following months might suggest challenges such as market saturation or the emergence of new competitors. The brand's ability to navigate these challenges and regain its position in the top rankings will be crucial in determining its long-term success and market strategy in Michigan.

Competitive Landscape

In the competitive landscape of the Michigan Topical cannabis market, Michigan Organic Rub experienced a notable presence in April 2025, securing the 5th rank. However, the absence of subsequent rankings suggests a decline in its market position, potentially falling out of the top 20 in the following months. In contrast, Neno's Naturals demonstrated a strong performance, consistently maintaining a top 6 position and even climbing to 5th place by June and July 2025, indicating a robust sales trajectory. Meanwhile, Northern Connections showed a fluctuating rank, peaking at 5th in May before dropping to 7th in June. The emergence of Escape Artists and Bossy in the rankings further intensifies the competition, with both brands securing the 6th position at different times. These dynamics highlight the competitive pressures Michigan Organic Rub faces, emphasizing the need for strategic adjustments to regain and sustain its market share.

Notable Products

In July 2025, the top-performing product from Michigan Organic Rub was the CBD:THC 1:1 Muscle Cooling Rub (300mg CBD, 300mg THC), which ascended to the first rank with notable sales of 57 units, a significant leap from its fourth position in June. The Lemon Extra Relief Balm (750mg THC, 3oz) also saw impressive performance, climbing to second place from an unranked position in June, indicating a surge in consumer interest. The Extra Releaf Lavender Woods Roll On (1000mg) experienced a drop to third place from its consistent first position in the preceding months, reflecting a shift in consumer preferences. Meanwhile, the Lavender Woods Balm (750mg THC, 3oz) entered the rankings at fourth place, marking its debut in the top positions. The Tangafruit Extra Relief Salve (750mg THC, 3oz) maintained a steady presence in the rankings, holding the fourth position for two consecutive months, suggesting stable demand.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.